The June European Central Bank (ECB) meeting provides a useful opportunity to review the solid ground upon which European fixed income sits. Unlike the UK, which has had problems squeezing out residual inflation and high wages, and the US where there is a debate about the inflationary impact of tariffs, the ECB now has a benign inflationary backdrop.

A strong euro and recent weak energy prices help cement this outlook. Reflecting this, in its own release today, the ECB revised down headline inflation by 0.3% for 2025 and 2026 to 2% and 1.6% respectively, with core inflation expectations unchanged at 1.9% for both 2026 and 2027. Having cut rates from the 4% peak to 2% at today’s meeting, further cuts will be data and tariff-war dependent. In their scenarios, the ECB note that any further escalation of trade tensions will be disinflationary and growth negative.

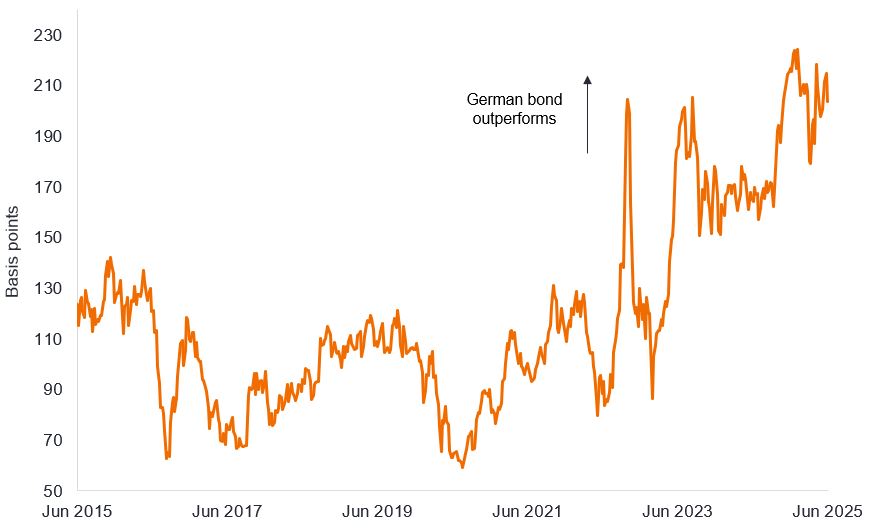

As a result, European fixed income has been a defensive duration allocation relative to other markets. 10-year German bonds have recovered all their brief but dramatic underperformance versus 10-year US Treasuries resulting from the German fiscal expansion announced on 5 March 2025 and have not suffered from the recent technical angst (concerns about supply levels) of other markets (UK, US & Japan). Meanwhile German bonds have continued their structural outperformance versus UK government bonds, which has been evident for the last five years.

UK 10-year government bond yield minus German equivalent

Source: Bloomberg, UK Government 10-year bond yield minus Germany 10 year bond yield. Basis point (bp) equals 1/100 of a percentage point, 1bp = 0.01%. Past performance does not predict future returns.

The Eurozone stands as the sole large developed economy poised to achieve a core inflation rate of 2% or below within the next year. Headline inflation is already at 1.9% year-on-year. Data in recent days underscores this trend: in May the seasonally-adjusted core measure actually printed negative at -0.12% month-on month. This was the first negative monthly print in four years. Q2 core inflation is now running at 2% on an annualised basis and the year-on-year measure is at 2.3%. Significant progress has been made as supply shocks have abated, energy prices have come down, demand is subdued, and wages have normalised.

Wages play a critical role in shaping the inflation outlook, especially in Europe where the Phillips curve coefficient is more pronounced compared to other regions. Current forward-looking indicators, including the Indeed wage tracker, the ECB wage tracker, and the ECB telephone survey, all project that wage increases will remain under 3% by year’s end. This aligns with expectations for core inflation to stay at or below 2%. Notably, negotiated wages have recently dropped to just 2.4% in the first quarter of 2025, further signalling potential downward risks to inflation.

IMPORTANT INFORMATION

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

There is no guarantee that past trends will continue or forecasts will be realised

10-year bond: A bond that is set to mature (repay the principal value) in 10 years.

Disinflation: A fall in the rate of inflation.

Duration: A measure of the sensitivity of a bond’s price to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa. Bond prices rise when their yields fall and vice versa.

Forward-looking indicator: A metric that anticipates future developments or changes. Please note that while they may provide some insight into what might happen, they are not always accurate and are not definitive predictions.

Inflation: The rate at which prices of goods and services are rising in the economy. Core Inflation are price indices that exclude volatile items, typically food and energy.

Phillips curve: The Phillips Curve plots inflation against unemployment to indicate the inverse relationship between inflation and unemployment. Higher inflation is associated with lower unemployment and vice versa.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For a bond, at its most simple, this is calculated as the coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- Some bonds (callable bonds) allow their issuers the right to repay capital early or to extend the maturity. Issuers may exercise these rights when favourable to them and as a result the value of the Fund may be impacted.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- CoCos can fall sharply in value if the financial strength of an issuer weakens and a predetermined trigger event causes the bonds to be converted into shares/units of the issuer or to be partly or wholly written off.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- When interest rates rise (or fall), the prices of different bonds will be affected differently. In particular, bond prices generally fall when interest rates rise or are expected to rise. This is especially true for bonds with a higher sensitivity to interest rate changes. A material portion of the fund may be invested in such bonds (or bond derivatives), so rising interest rates may have a negative impact on fund returns.