Israel’s strike on key nuclear and military targets in Iran has put upward pressure on global oil prices and lifted energy stocks, while sending broader equity indices lower on worries about the implications of geopolitical risks in the Middle East. Iran is a major oil producer and sits at a strategic location on the Strait of Hormuz, where millions of barrels of crude are shipped per day. As such, Brent crude and West Texas Intermediate (WTI), the gauge for U.S. oil prices, surged as much as 13% in pre-trading hours after the attack.

Upside risk to oil prices grows

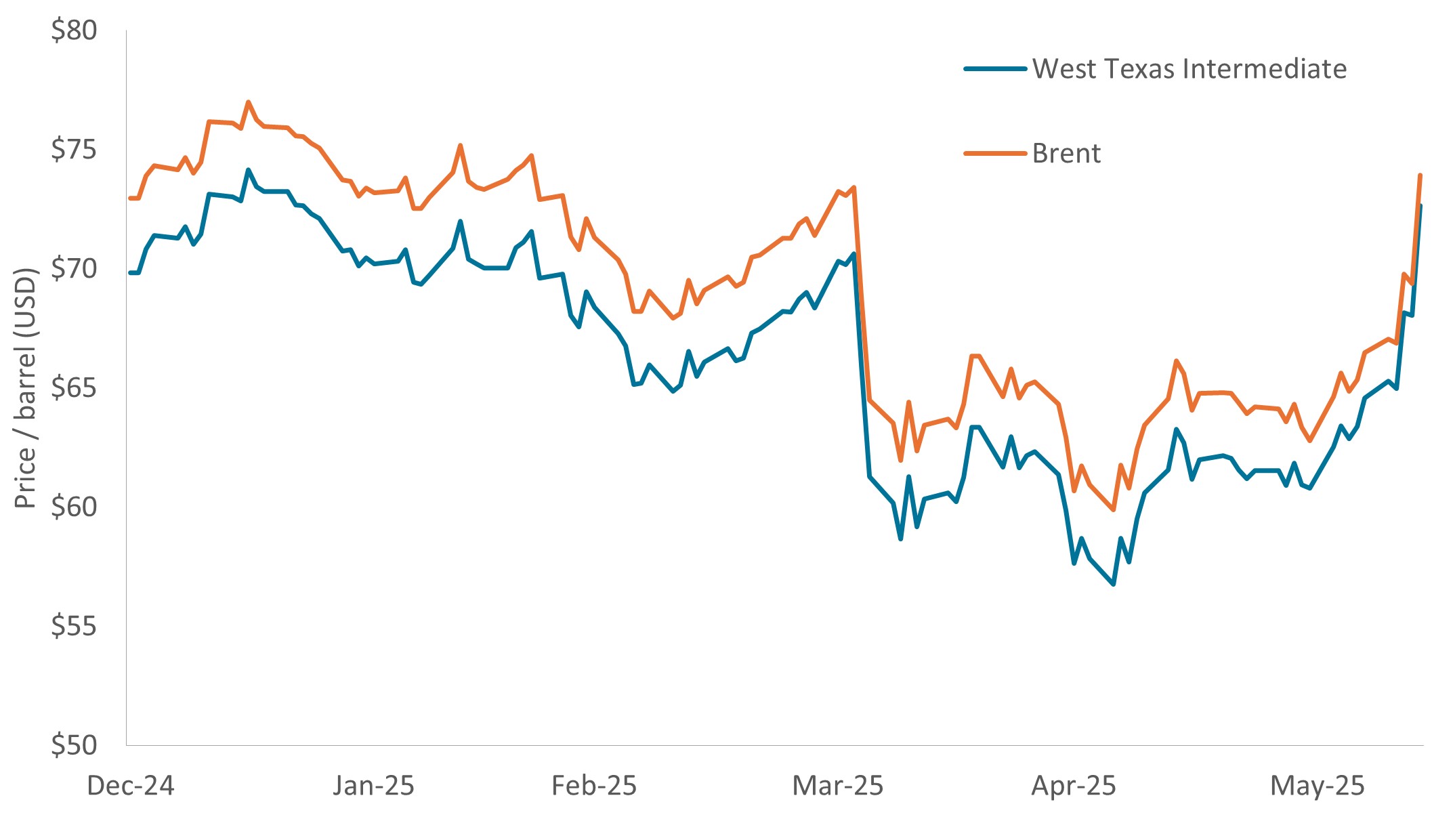

While oil prices eventually pared gains, both Brent and WTI now trade at more than $70 per barrel, well above the lows of roughly $58 per barrel earlier this year. Energy equities also saw gains, with oil-weighted exploration and production companies, not surprisingly, leading the rally. Companies with exposure to North American activity were also among top performers as investors bet that higher crude prices could lead to more short-cycle production activity (primarily U.S. onshore), benefitting companies with exposure to drilling and completion activity and/or production volumes.

Global crude prices reverse course

But the long-term trajectory will depend on the Organization of the Petroleum Exporting Countries (OPEC) and further hostilities between Israel and Iran

Source: Bloomberg, data from 31 December 2024 to 13 June 2025.

While the move in crude has been meaningful, we would expect the rally to fizzle out unless we see tangible evidence of supply disruptions. For the moment, Iran is reporting that oil refineries and storage tanks have not been damaged.

However, given commentary from both Iran and Israel, this conflict seems to be far from over, creating the potential for targeted strikes on oil infrastructure. Additionally, in retaliation, Iran could close the Strait of Hormuz, disrupting the roughly 25% of global oil shipments and 20% of liquified natural gas shipments that flow through the Strait each day, pushing prices higher.

Implications for energy stocks

In our view, the key points to watch going forward are 1) any signs of oil production being disrupted and 2) any signs of oil/gas flows being disrupted. If neither materialize, we believe crude prices could pull back as the outlook for supply in the second half of 2025 is likely to be increasingly driven by an expected rise in production from OPEC and its allies ( OPEC+). In a major policy shift, select members of OPEC+ began increasing output in April after several years during which production was restrained by about 2.2 million barrels per day.

To that point, energy companies with relatively lower Middle East exposure could be well positioned going forward, given concerns around elevated tensions in the region.

IMPORTANT INFORMATION

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Commodities (such as oil, metals and agricultural products) and commodity-linked securities are subject to greater volatility and risk and may not be appropriate for all investors. Commodities are speculative and may be affected by factors including market movements, economic and political developments, supply and demand disruptions, weather, disease and embargoes.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.