In a year marked by policy uncertainty, global trade turmoil, and heightened geopolitical tensions, one of the more remarkable stories of 2025 has been the strong outperformance of non-U.S. stocks. Indeed, international equities have outpaced the S&P 500® Index by a wide margin and are currently on pace for their best year since 2017 (as of this writing).

Meanwhile, after shaking off a rocky start to the year – punctuated by the April tariff turmoil – U.S. equities appear poised for another year of solid gains, albeit with the bulk of this year’s performance driven by handful of companies.

A different setup for global equity markets heading into 2026

For perspective, it’s worth recalling the investment backdrop at this time last year. In the fourth quarter of 2024, U.S. stocks surged into year-end on the back of post-election “Trump trade” optimism, while overseas markets lagged quite dramatically. As a result, international stocks started the year deeply oversold and trading at historically deep discounts to their U.S. peers.

This reversed in early 2025. As mega-cap tech stocks wobbled and Trump’s tariff threats shook investor confidence in the sustainability of “U.S. exceptionalism”, a powerful catch-up trade in international markets gained momentum. And while U.S. equities rebounded in April after the Trump Administration paused its “Liberation Day” tariffs, this relief rally also extended to overseas markets.

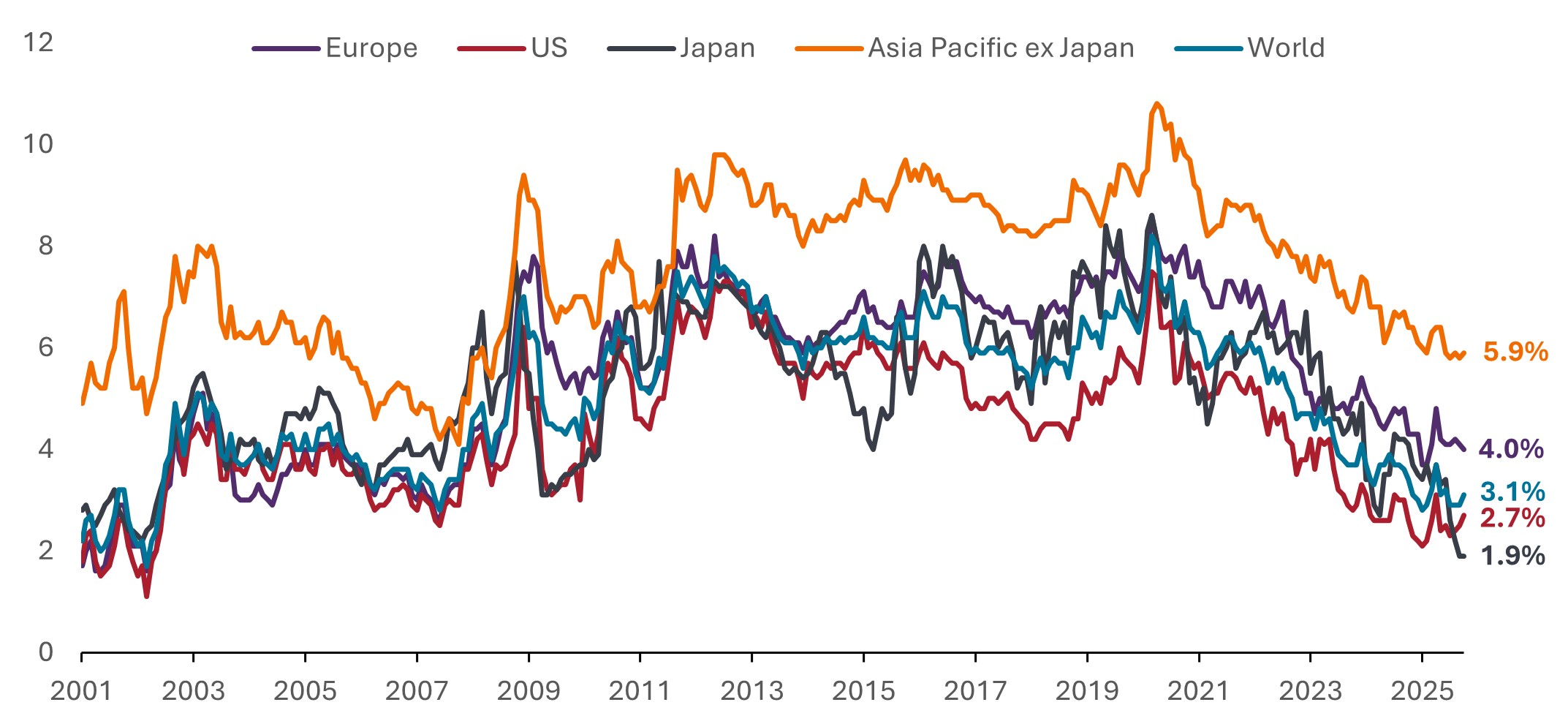

All this to say, markets in general are sporting fairly high valuations as we move into 2026. Earnings multiples have climbed and equity risk premiums (ERPs) – the difference between the risk-free rate and the cost of equity implied by current share prices – have compressed globally (Exhibit 1).

Exhibit 1: Market-implied equity risk premiums

After strong stock market performance, ERPs have narrowed globally to multi-year lows.

Source: Goldman Sachs Investment Research, as of 23 October 2025. Note: Represents market-implied ERP % as calculated by Goldman Sachs regional strategy teams.

To be clear, we continue to find attractive investment opportunities across a range of global markets and sectors. But while beta drove the rally coming out of Liberation Day, we believe current valuations make selectivity all the more critical heading into 2026.

Where opportunities can still be found

In our view, European banks remain one of the most compelling opportunities despite a strong run over the last two years. Valuations are still modest relative to the sector’s improved fundamentals, even as profitability has reached levels not seen in well over a decade. These firms are also better capitalized and have more diversified earnings streams than 15 years ago, while prospects for banking-sector deregulation could provide an additional tailwind for loan growth. Taken together, we see conditions for continued earnings growth and believe the valuation rerating story is far from complete.

Similarly, structural forces are driving increased defense spending globally, particularly in Europe, where we see ample room for further upside for well-positioned firms. After years of underinvestment, rebuilding military readiness in Europe will take well over a decade. And with orders there just beginning to build, we believe the potential magnitude and duration of the cycle remains underappreciated by the market.

Elsewhere, we would highlight some glaring valuation disconnects in the semiconductor industry. In international markets, for instance, investors can find high-quality companies integral to the artificial intelligence (AI) buildout that trade at meaningful discounts to U.S. mega-cap peers. We would focus on those that combine strong revenue growth with leading market positions and established, defensible moats.

Finally, we see a favorable backdrop for select Japanese financials, particularly rate-sensitive firms that could benefit as the Bank of Japan moves forward with policy normalization. After years of ultra-low rates, rate hikes could provide a meaningful earnings tailwind for insurers and regional banks with strong balance sheets.

Potential headwinds

Elevated valuations and pronounced U.S. market concentration stand out as the most notable near-term headwinds for global equities. U.S. equities now make up nearly two-thirds of the MSCI All Country World Index, and just 10 companies (primarily large-cap tech) account for roughly 40% of the S&P 500’s market capitalization. As shown by the turbulence in mega-cap tech stocks in November 2025, any concerns around cracks in the AI super-cycle have the potential to drive sharp corrections at the benchmark level.

Beyond these structural risks, macro uncertainty remains a defining feature of the global investment backdrop. In the U.S., questions around labor market resilience and whether inflation will remain subdued are front of mind given their implications for monetary policy. Should the Federal Reserve (Fed) refrain from further rate cuts, equity valuations could come under pressure. Internationally, while fiscal stimulus and deregulation should serve as tailwinds in Europe, we will be watching for signs that these initiatives are translating into GDP acceleration as spending plans take hold.

Finding value overseas

While international equities have closed some of the valuation gap with the U.S. after strong performance in 2025, we remain constructive on the opportunity set heading into the new year. The varied composition of overseas markets also bears consideration. For instance, the technology sector makes up a much smaller share of the equity landscape outside of the U.S., whereas financials, materials, and other sectors less tethered to the AI growth cycle carry more weight. This mix can provide diversification benefits and a counterbalance to U.S. market exposure.

Finally, given the run-up in valuations globally, fundamentals are likely to matter more than momentum in the year ahead. In our view, companies with durable competitive advantages, strong free cash flow, and clear earnings visibility offer the most compelling opportunities as we head into 2026.

IMPORTANT INFORMATION

Aerospace and defense industries can be significantly affected by changes in the economy, fuel prices, labor relations, and government regulation and spending.

Artificial intelligence (“AI”) focused companies, including those that develop or utilize AI technologies, may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property, invest significantly in research and development, and depend on maintaining and growing consumer demand. Their securities may be more volatile than those of companies offering more established technologies and may be affected by risks tied to the use of AI in business operations, including legal liability or reputational harm.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

Free cash flow (FCF) yield is a financial ratio that measures how much cash flow a company has in case of its liquidation or other obligations by comparing the free cash flow per share with the market price per share and indicates the level of cash flow the company will earn against its share market value.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

MSCI All Country World Index℠ reflects the equity market performance of global developed and emerging markets.

Price-to-Earnings (P/E) Ratio measures share price compared to earnings per share for a stock or stocks in a portfolio.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Equity Risk Premium (ERP) reflects the excess return investors can be expected to earn over a risk-free rate, such as U.S. Treasuries, by investing in the stock market.