The rating downgrade

Late last week, Moody’s downgraded the United States’ credit rating from Aaa to Aa1. The downgrade came in response to the rating agency’s concerns regarding rising debt driven by poor fiscal discipline and the increasing interest burden.

The rating change did not come as a major surprise. Moody’s is the last of the three major ratings agencies to downgrade the world’s largest issuer of debt, aligning its rating with S&P and Fitch Ratings, which downgraded the U.S. to AA+ in 2011 and 2023, respectively.

This leaves just 10 countries with the coveted AAA sovereign credit rating: Australia, Germany, Switzerland, Canada, Netherlands, Singapore, Denmark, Sweden, Norway, and New Zealand.

Likely impacts on U.S. Treasuries

Given that major index providers have already been assigning the U.S. a AA+/Aa1 rating since Fitch’s downgrade in 2023, the Moody’s downgrade will have no impact on the U.S. government’s overall blended rating.

We do agree that the debt and deficit trends discussed in the Moody’s release are cause for concern. However, we believe these trends and policy expectations (such as the likely extension of the 2017 Tax Cuts and Jobs Act) are already being discounted by financial markets. Therefore, we do not expect to see a dramatic market response to the downgrade.

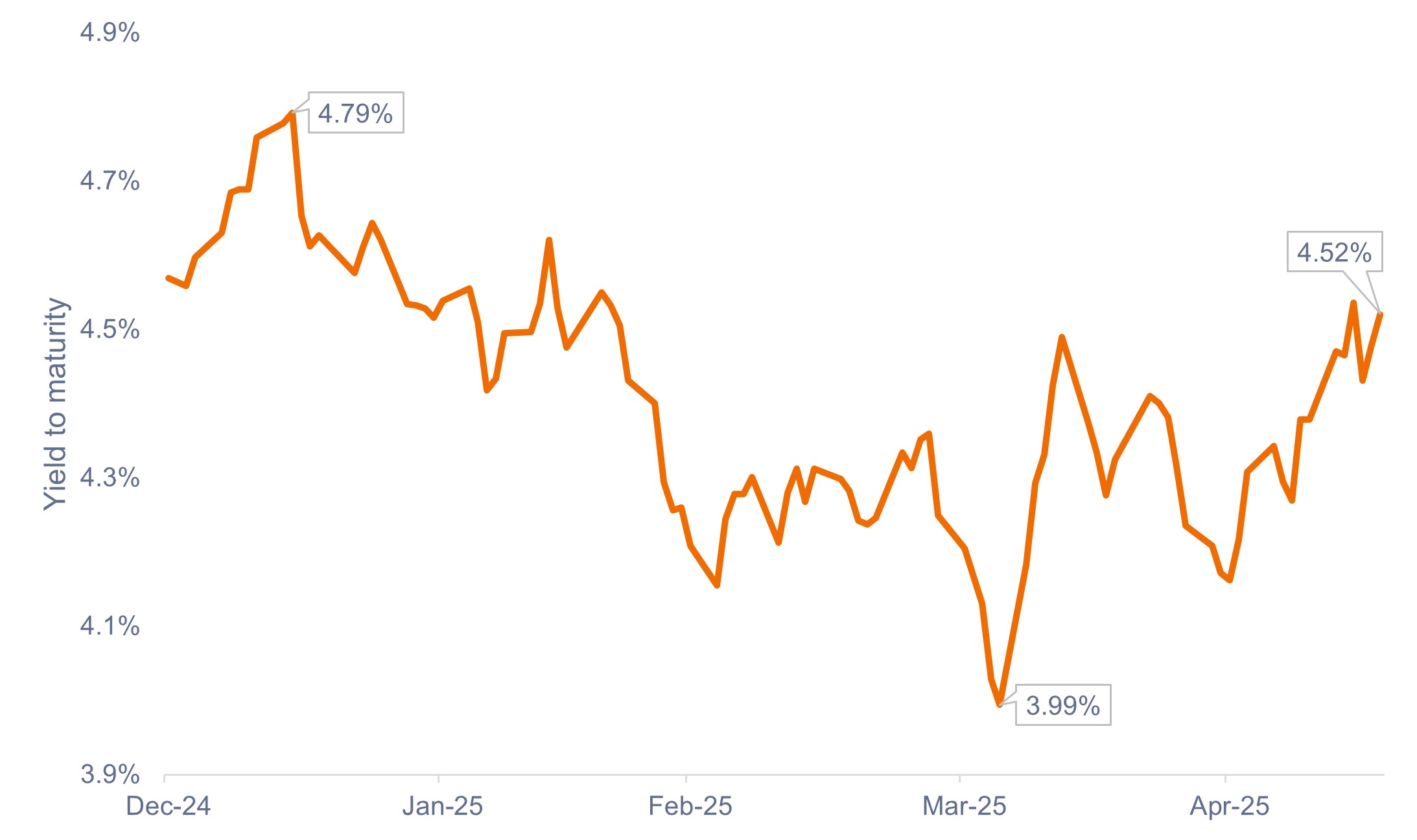

While Treasury yields ticked up following the news, yields are still trading around the 4.5% level, comfortably within their 2025 trading range and well off their year-to-date high of 4.79%, as shown in Exhibit 1.

Exhibit 1: Yields on 10-year U.S. Treasuries (Jan 2025 – May 2025)

Treasury yields are trading comfortably within their year-to-date range despite Moody’s downgrade.

Source: Bloomberg, as of 19 May 2025. Past performance does not predict future returns.

What it means for the government and the Fed

The Moody’s downgrade reiterates that the U.S. government has work to do on the fiscal side.

Market participants will continue to monitor the evolution of government policies as they relate to the budget, tariffs, and trade negotiations, while trying to gauge their effects on the debt outlook and economic growth.

Layered in is also uncertainty surrounding the impact of trade negotiations on inflation and the labor market, as well as how, and when, the Federal Reserve (Fed) might respond.

The Fed does find itself in a potentially tricky scenario in which their dual mandate goals of price stability and full employment could move in opposite directions. Even though the central bank has said that tariffs are more of a one-time tax, it will need to err on the side of caution to ensure that inflation expectations do not snowball.

We believe the Fed could be on hold longer than expected due to the unclear economic outlook. Soft data has been weak, but hard data has continued to show resilience. As a result, the central bank has stated it will wait and see how things evolve before considering any adjustments to its policy stance.

Implications for fixed income investors

The clear takeaway for fixed income investors is that there are several balls up in the air right now, creating conflicting dynamics that are impacting Treasury yields. As we would expect, the uncertainties are manifesting themselves to a greater extent at the long end of the yield curve.

In our view, however, the short end of the yield curve presents an entirely different prospect. The forces impacting shorter-term yields are skewed more one-directionally, with potentially falling yields acting as a ballast for investors.

If the economy or labor market weakens materially, the Fed has room to aggressively cut policy rates. In such a scenario, we think longer-term inflation expectations would likely remain well anchored (even if tariffs drive up prices in the short run), which would allow the Fed to be more accommodative.

How investors might think about positioning

In our view, any rate cuts are likely to flow through to the front of the curve, whereas the impacts may be more ambiguous on longer-dated bonds.

We believe investors should seek to position their portfolios to be more insulated from the uncertainties and aim to take advantage of any future rate cuts through exposure to high-quality, shorter-maturity bonds. While short-duration corporates may be a suitable option, we believe securitized sectors are more attractively priced and benefit from inherently shorter duration.

Curated portfolios of asset-backed securities (ABS), AAA rated collateralized loan obligations (AAA CLOs), and commercial mortgage-backed securities (CMBS) may offer alternate ways for investors to gain exposure to the short end of the curve, while agency MBS may provide investors with exposure along the entire yield curve.

Additionally, fixed income investors may also look for opportunities to diversify to non-U.S. issuers, including emerging markets (EM).

While the International Monetary Fund (IMF) recently downgraded its global economic growth outlook, it maintained an increasing EM-to-developed-market growth differential. EM fundamentals are relatively resilient, while their real economic sensitivity to the U.S. economy has declined significantly in recent decades.

Furthermore, EM growth has exceeded U.S. growth since 2010 and is forecast to exceed U.S. growth at an accelerating pace over the next four years.

10-Year Treasury Yield is the interest rate on U.S. Treasury bonds that will mature 10 years from the date of purchase.

Credit quality ratings are measured on a scale that generally ranges from Aaa (highest) to C (lowest).

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

Yield to maturity (YTM) represents the total return an investor can expect if they hold a bond until it matures.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Collateralized Loan Obligations (CLOs) are debt securities issued in different tranches, with varying degrees of risk, and backed by an underlying portfolio consisting primarily of below investment grade corporate loans. The return of principal is not guaranteed, and prices may decline if payments are not made timely or credit strength weakens. CLOs are subject to liquidity risk, interest rate risk, credit risk, call risk and the risk of default of the underlying assets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.