Reviewing the potential impact of tariffs on US inflation from multiple angles.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

NATO's European members have committed to a major increase in defence spending. What does it mean?

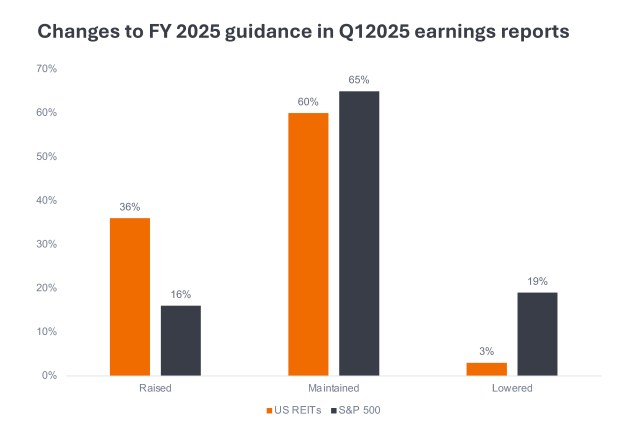

Listed REITs can offer lower volatility and better earnings visibility versus broader equities.

How AI and accelerating technology adoption is disrupting sports.

Ali Dibadj, CEO, spoke with Richard Clode and Agustin Mohedas about AI’s potential to unlock opportunities in trillion-dollar markets.

Can the EU's securitisation reforms stimulate growth in the economy, while still safeguarding financial stability?

How this year's Wimbledon championships are embracing AI.

A trip to this year’s Computex trade show in Taipei reinforced our team’s bullish view on AI.

Integrating ABS in portfolios is like core-strengthening exercises, enhancing their stability, flexibility, and resilience, while optimising risk-adjusted returns.

Assessing the impact of higher mortgage rates on U.S. homeowners.

Our experts explore how the integration of financially-material ESG factors is essential for mining companies.