2022 – a defining moment for sustainable investing

The Portfolio Construction and Strategy Team explain why an active, forward-looking approach key to navigating through the sustainable investing space, which has come under pressure in 2022.

3 minute read

This article is part of the latest Trends and Opportunities report, which seeks to provide therapy for recent market shocks by offering long-term perspective and potential solutions.

We believe tailor-made active solutions, proprietary tools and research, coupled with experience and expert judgement are essential when trying to build successful ESG portfolios.

YTD Recap

- Europe is grappling with an energy shortage just when governments have pledged to reduce carbon emissions. The move towards greater sustainable energy production while trying to ‘keep the lights on’ leaves policy makers and investors with a significant moral dilemma.

- Following a strong year of risk-adjusted returns and large inflows in 2021, sustainable portfolios have come under pressure in 2022, largely due to their growth-orientated nature.

- On top of tumbling returns, the Russia-Ukraine war has led sustainable investors to reassess how they ultimately define sustainability and to reconsider how best to achieve sustainable goals while navigating a global energy and food crisis.

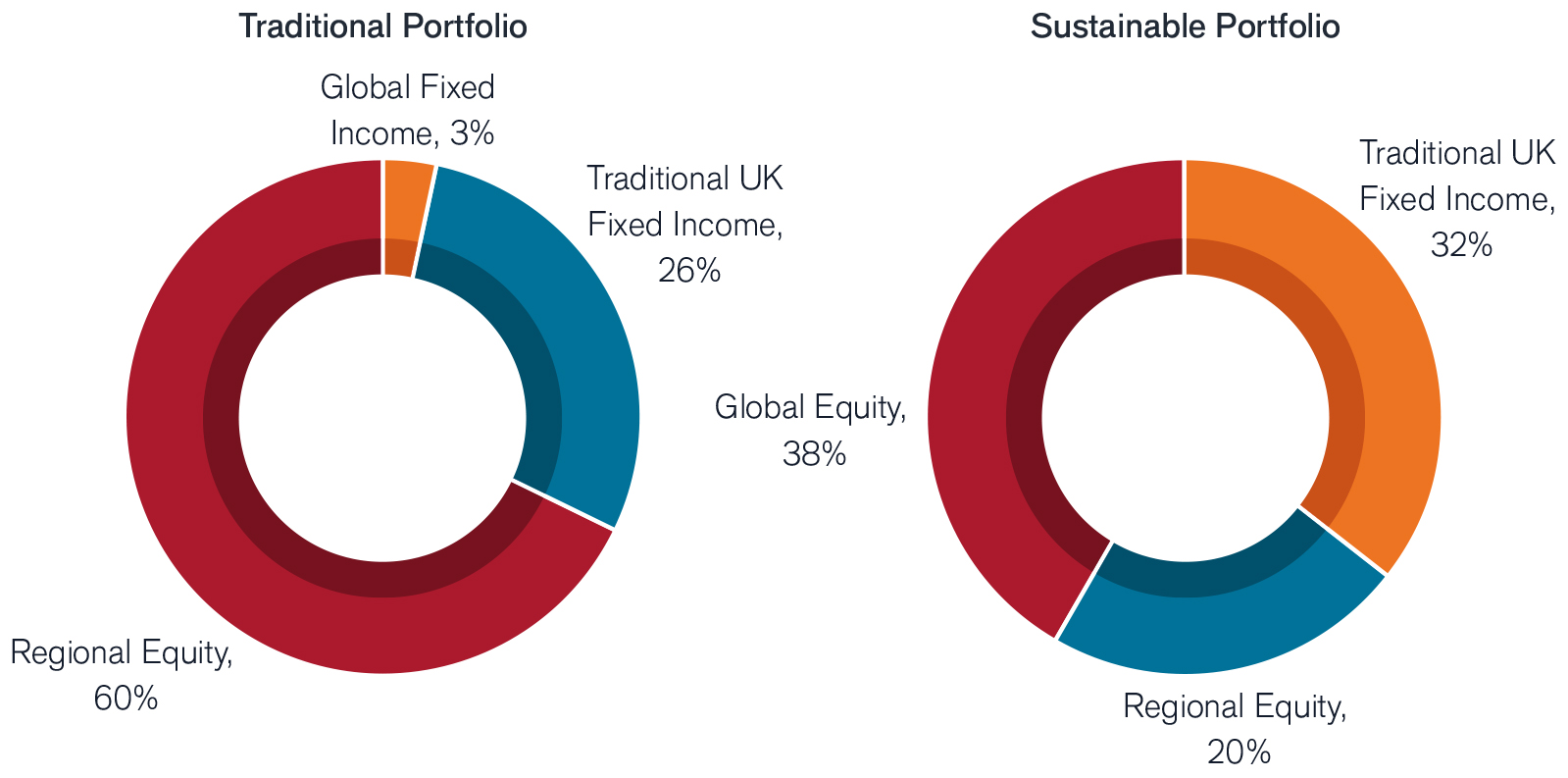

Average advisors’ traditional vs. sustainable moderate allocation, 2020 and YTD risk and return

| 2020 | H1 2020 | |

|---|---|---|

|

Return

|

+10.0% | -8.8% |

|

Return

|

16.2% | 12.9% |

| 2020 | H1 2020 | |

|---|---|---|

|

Return

|

+10.0% | -8.8% |

|

Risk

|

16.2% | 12.9% |

Source: Janus Henderson Portfolio Construction and Strategy, as at 30 June 2022. Past performance does not predict future returns. Average UK advisor allocation based on data shared with the PCS team by UK financial advisory clients.

Outlook

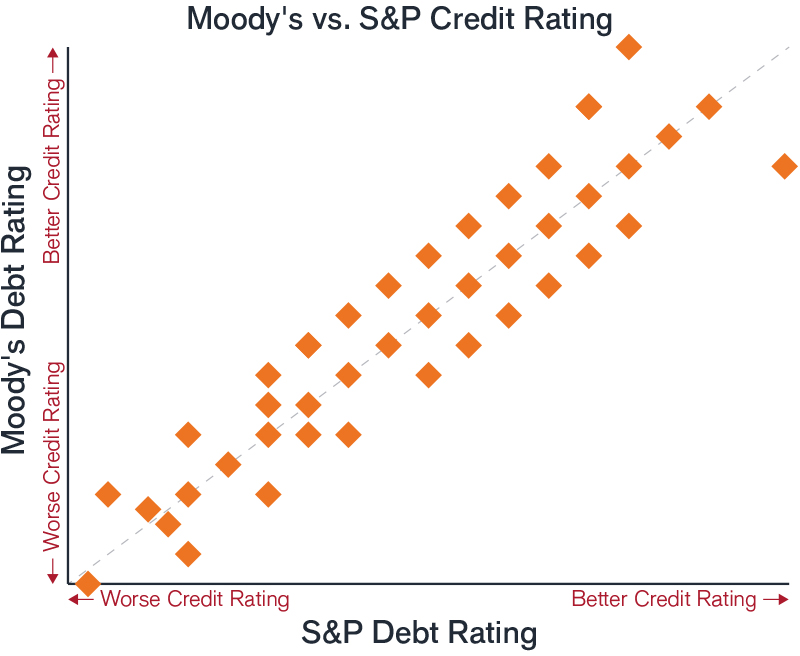

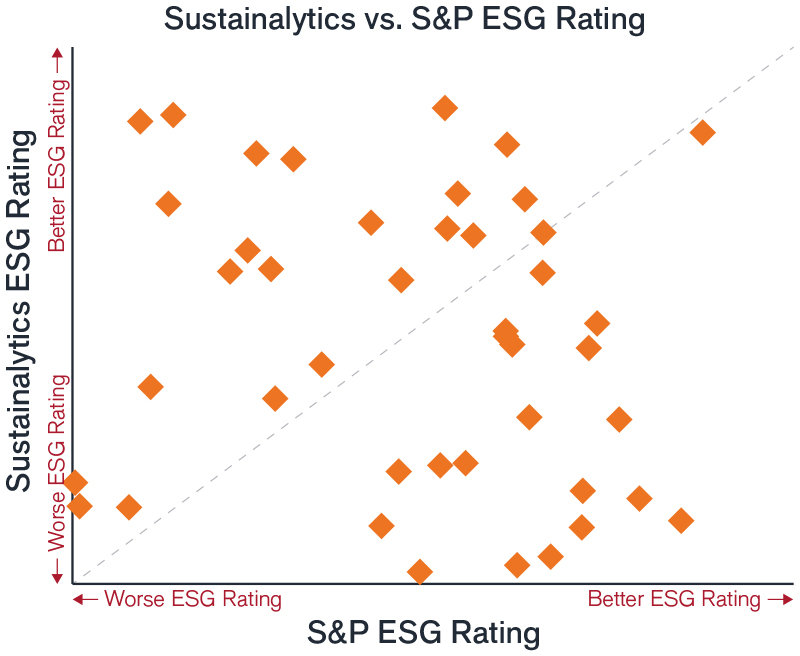

- Despite regulators’ efforts to harmonise ESG data and to tackle ‘greenwashing’, inconsistent, incomplete, contradictory, and backward-looking ESG ratings will remain a headache for investors and a challenge to thoroughly assess sustainable assets in portfolios.

- The asset management industry is yet to offer a sufficient number of sustainable strategies within asset classes and countries, particularly those that focus on the UK, emerging markets or value-oriented strategies. Such strategies are essential building blocks for a well-diversified and robust portfolio.

Credit ratings vs. sustainability ratings: a lack of consistency

Source: Janus Henderson Portfolio Construction and Strategy, S&P, Moody’s, Morningstar.

PCS Perspective

- Sustainability remains a diverse investment theme and this year’s events have highlighted the moral dilemma of economies to move towards greater sustainable energy production, while at the same time ‘trying to keep the lights on’.

- With no off-the-shelf ESG solution available for every investor, we believe that tailor-made active solutions, proprietary tools and research, coupled with experience and expert judgement are essential when trying to build successful ESG portfolios.

- We believe that sustainable investing offers the opportunity for investors to add long-term value. An active and forward-looking approach is key when navigating constant change and short-term noise in the ESG space. Relying on passive strategies comes with unintended risks and biases, which could diminish the diversification benefits of a well-constructed portfolio.

Queste sono le opinioni dell'autore al momento della pubblicazione e possono differire da quelle di altri individui/team di Janus Henderson Investors. I riferimenti a singoli titoli non costituiscono una raccomandazione all'acquisto, alla vendita o alla detenzione di un titolo, di una strategia d'investimento o di un settore di mercato e non devono essere considerati redditizi. Janus Henderson Investors, le sue affiliate o i suoi dipendenti possono avere un’esposizione nei titoli citati.

Le performance passate non sono indicative dei rendimenti futuri. Tutti i dati dei rendimenti includono sia il reddito che le plusvalenze o le eventuali perdite ma sono al lordo dei costi delle commissioni dovuti al momento dell'emissione.

Le informazioni contenute in questo articolo non devono essere intese come una guida all'investimento.

Comunicazione di Marketing.