Key risks and opportunities within asset-backed securities (ABS) for investors seeking to navigate the evolving fixed income landscape.

Insights

Private credit has become a core allocation for investors. Hear insights from Janus Henderson and Victory Park Capital on the risk and opportunities in MENA and asset-backed finance.

Ongoing reforms in Japan and South Korea could turn governance into a durable competitive advantage and catalyst for a re-rating of these markets.

When traditional commodity strategies fall short, how can alternative strategies unlock broader, more resilient opportunities?

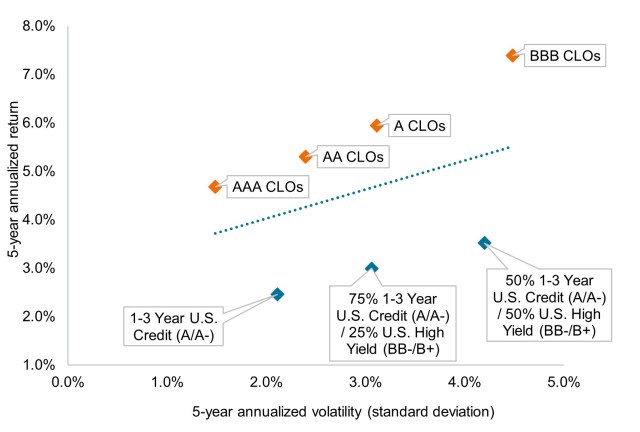

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

Exploring the dispersion in the loan market.

How interest rates, AI trends, and evolving policy dynamics are influencing the outlook for the energy and financial sectors.

Wide dispersion in 2026 is creating a strong backdrop for selective global small cap investing.

After attending the sector’s flagship conference, we come away with strengthened conviction in the constructive backdrop shaping healthcare in 2026.