I was fortunate recently to share dinner and conversation with two leading experts on EU defence, and Europe’s broader security backdrop, as Janus Henderson hosted a client event to discuss this seminal topic for today’s markets.

The NATO Summit was important, not just on the issue of strategic questions around defence, but also geopolitical realignments, risks to European assets, and market disruption across sectors. All have the potential to create opportunities for agile investors, suiting Janus Henderson’s active approach.

In the days leading up to the event, we saw intense focus on the NATO Summit on 24-25 June, amid changes to US defence doctrine, and increasing uncertainty over US commitment to the Alliance and Europe. Recent rhetorical pressure from US Defence Secretary Hegseth and US President Trump iterated the urgency of Europe’s renewed focus on defence spending, making it a key focus for investors across the spectrum, from equities to fixed income.

Expert insight

The keynote speakers at the dinner were General Sir Nicholas Carter, an accomplished strategic expert with decades of military experience, serving as principal military advisor to the UK Prime Minister and as Chief of the General Staff, the official head of the British Army. General Carter was joined by Baroness Catherine Ashton, a distinguished British diplomat and Nobel Peace Prize nominee, who – among other prominent roles – served as the EU’s first High Representative for Foreign Affairs and Security Policy, from 2009 to 2014.

This was the kind of opportunity that we relish, to test our assumptions with direct insight from people who have been involved in high-level decision making in areas that have huge ramifications for us all. Not just in terms of market prospects and challenges, but also the shifting geopolitical dynamics that underpin our lives.

Following the event, it was useful to reflect on this historic shift in strategy towards Europe’s security needs, given it has potentially significant ramifications for investors as countries (and regions) seek to prioritise their own interests.

Defence now a priority in Europe

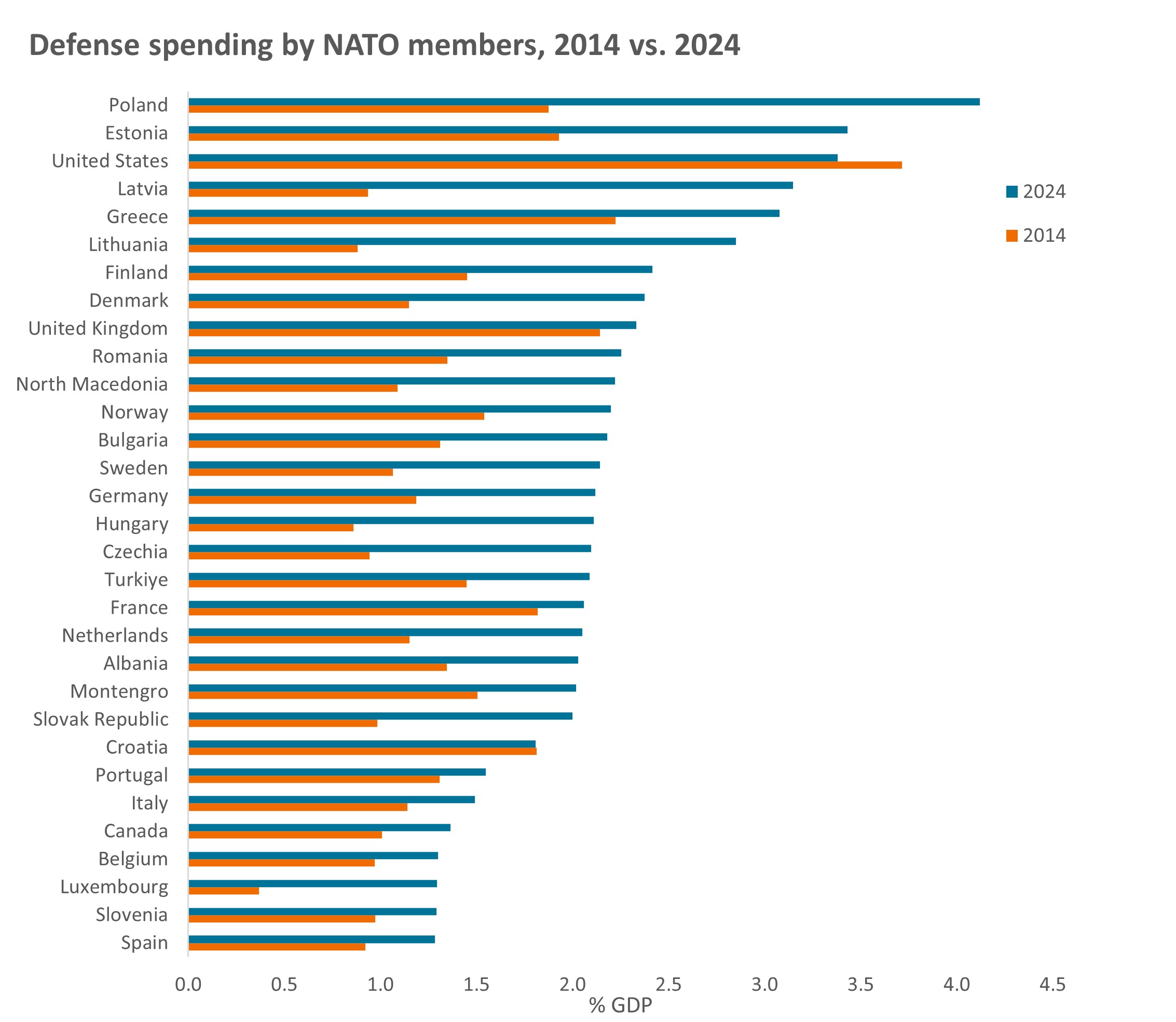

A positive NATO summit seems to have settled much of the fractious longer-term tensions between the US and other NATO states, which have been laid bare in recent weeks. Following Europe’s NATO members’ commitment to spending 5% of GDP per annum on defence, split between 3.5% of ‘core defence’ spending, plus 1.5% ‘broader security’ spending, the US seems more comfortable within the current NATO framework. This accelerates the trend of higher defence spending by NATO members that we have seen over the past decade (Exhibit 1):

Exhibit 1: NATO defence spending has been steadily ramping up

Source: NATO, Defence Expenditure of NATO Countries (2014-2024), 17 June 2024. GDP=gross domestic product. NATO=The North Atlantic Treaty Organization, an intergovernmental transnational military alliance of 32 member states (30 European and two North American). Data excludes Iceland, which has no armed forces.

The summit put in place new pathways for what will be required from Europe, in terms of security and defence, and its need to achieve strategic autonomy. It also gave a degree of clarity about what the US is willing commit, that aligns with its vested interests, at a time when the US is signalling a shift in focus from Europe to the Indo-Pacific.

What was clear is that Europe remains highly reliant on US intelligence, reconnaissance technology and defence capabilities, something that will take years to develop independently. Higher spending needs to be matched by improved cohesion, overcoming issues with interoperability between NATO members’ military capabilities.

There is also recognition that member states in Europe need to improve their procurement processes to ensure that money is spent more optimally. Complex European defence supply chains mean that rebuilding capacity is likely to be slow and difficult, and it needs to focus on meaningful large-scale gains, rather than low volumes of expensive equipment.

“With an ambitious new Defence Investment Plan to spend 5% of GDP for defence, this will mean a huge defence dividend. An engine of growth for our economies, driving millions of jobs, on both sides of the Atlantic.” NATO Secretary General Mark Rutte, 24 June 2025

Investor ramifications

The imperative for states to ‘buy European’ in security and defence has gained significant momentum, driven by a confluence of geopolitical pressures, a focus on supply chain resilience and domestic European political shifts. The pressure for investors is to identify those companies that are best placed to meet those ongoing and future needs – not just in the security market, but across industries and sectors, such as transport, energy and utilities, technology, communications, surveillance, etc.

There is also recognition that critical physical and digital infrastructure requires protection from ‘hybrid’ threats, spanning cyber and communications systems, energy grids, transport networks, and undersea cables/pipelines. Which is generating a range of opportunities for investors across asset classes.

The security challenges facing Europe have forced a dramatic change in attitude towards defence capabilities, but they also have ramifications for the broader economy. Higher defence spending raises discussion around fiscal rules (nationally and supranationally). We expect sharp political and fiscal trade-offs, as “welfare vs warfare” debates gain salience, but also positive pressure for EU reform to boost growth.

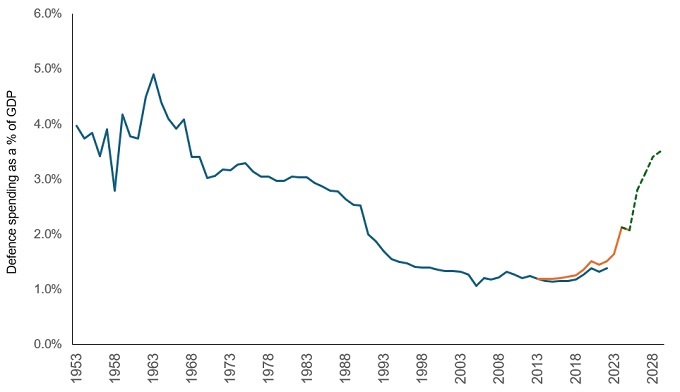

We have seen the EU respond to this pressure, evidenced by European Central Bank (ECB) banking reforms, regulatory updates on EU securitisation, and Germany loosening its debt rules, etc, with a significant planned additional allocation to defence spending (Exhibit 2). Changes like this can help to improve competitiveness, encouraging growth and attracting investment.

Exhibit 2: Germany’s budget plans more than double defence spending

Source: NATO, SIPRI, UBS. Note: The blue line refers to SIPRI data, the orange line is NATO data, which began in 2014. Both use slightly different definitions to categorise spending. The green dotted line is Germany’s forecasted defence budget spending to 2029. There is no guarantee that past trends will continue, or forecasts will be realised.

Deglobalisation reflects global tensions

In the past, the influence of globalisation, and the development of highly integrated supply chains, has facilitated the growth of trade with lower-cost countries, leading to cheaper imports. We are seeing an end to globalisation acting as a contributing cap on inflation as we shift back towards a more multipolar world.

While globalisation is far from the sole determinant of what happens to inflation, renewed geopolitical tensions, triggered by US-driven trade protectionism (including tariffs), are likely to disrupt global trade and supply, with a consequent impact on prices. Companies and governments are reacting to that change to try and mitigate the risks, reflected in the drive towards reshoring, onshoring or near-shoring, with the potential impact on supply chains varying between countries. This applies not only to the trade of physical goods, as different jurisdictions prioritise their own economic and political necessities, but also services.

This fast-evolving environment is one that increases the risk of unexpected shocks and sudden changes, both in trade and regulatory divergence. While we expect higher volatility to persist, reforms underway in Europe could be a long-term positive for both European growth prospects, and stock markets.

Fear of missing out (FOMO)

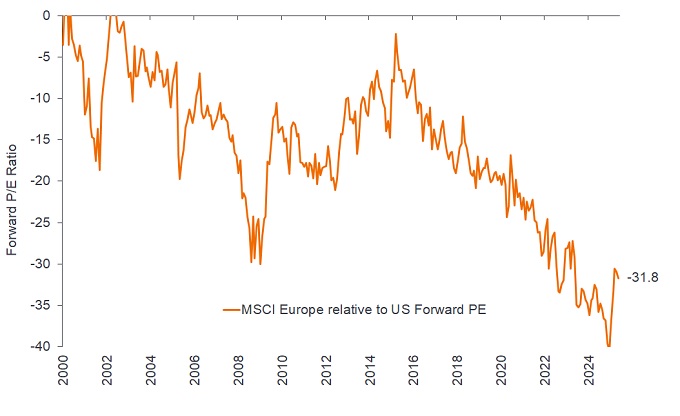

The start of 2025 has seen something of a recalibration in financial markets, with uncertainty in the US opening the door to a long-awaited period of relative strength for European equities. The increased allocation of capital from investors towards Europe comes at a time when the EU is making significant spending commitments in response to evolving global risks. But what also remains clear is that Europe still offers better diversification in its markets than the US, and remains very attractively priced, relative to history (Exhibit 3).

Exhibit 3: Europe offers more diversification, at an arguably attractive price

Source: Bloomberg consensus forecasts, Janus Henderson Investors analysis, as at 31 May 2025. Past performance does not predict future returns.

The most recent cycle of US stock market outperformance originates in the post-financial crisis era. The duration of such market dominance has created a natural hesitancy among investors, that a meaningful strategic shift away from the world’s biggest market could leave them vulnerable to missing out, should the US reassert its market leadership.

While this hesitancy seems understandable, we see the potential for a broadening and diversification in market focus as a positive. But the nature of today’s market structure suggests that that allocations are more likely to see a slow shift, rather than a seismic switch.

From our perception, the rise of passive investing has made longstanding investment trends more ‘sticky’. We see this exhibited in the extreme weighting of investment in narrow innovation ‘clusters’ in the US economy; high growth, big-tech behemoths like Alphabet, Microsoft and NVIDIA have hoovered up so much of investors’ attention.

These advantages can be hard to break, and inevitably create a risk of ‘over-valuation’ (asset bubbles). When a small number of companies dominate a market to such extent, overall market performance can become heavily reliant on the fortunes of just a few stocks. We would be encouraged to see the market spread out more, opening the door to renewed price discovery, better pricing dispersion, and greater opportunities for active investors to differentiate themselves from the pack.

Fiscal: Fiscal measures are those related to government policy, regarding setting tax rates and spending levels.

GDP: Gross domestic product (GDP) is a measure of the size and heath of a country’s economy over a specific period, usually three months or one year.

Global financial crisis (GFC): The global economic crisis from mid-2007 to early 2009 that began with losses related to mortgage-backed financial assets in the US and spread to affect financial markets and banks globally. Also known as the ‘Great Recession’.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures.

Passive investing: An investment approach that involves tracking a particular market or index. It is called passive because it seeks to mirror an index, either fully or partially replicating it, rather than actively picking or choosing stocks to hold. The primary benefit of passive investing is exposure to a particular market with generally lower fees than you might find on an actively managed fund.

Reshoring, onshoring and near-shoring: A shift by businesses to return operations that were moved overseas back to their home country, or to cheaper, closer locations that potentially offer greater certainty in regulation, supply or price.

Securitisation: The process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities, together which constitutes a market for buying or selling. The interest and principal payments from the assets are passed through to the purchasers of the securities.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

Valuations: The value or price of a stock, as determined by the market. In theory, it should reflect the fair value of the business, inclusive of performance, financial health and expectations for future earnings, but prices can be heavily influenced by investor sentiment, both by stock- and industry-level factors and broader market sentiment.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund involves a high level of buying and selling activity and as such will incur a higher level of transaction costs than a fund that trades less frequently. These transaction costs are in addition to the Fund's ongoing charges.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.