A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

What Trump’s nomination of Kevin Warsh as the next Fed chairman could mean for markets and the future path of monetary policy.

A stabilizing U.S. labor market gives the Fed room to wait and see whether inflation resumes its downward path.

A monthly market update featuring global equity and fixed income performance, sector and asset class trends, and key themes shaping the investment landscape.

Surging supply from AI-driven tech giants is reshaping investment grade credit. Explore what this means for spreads, sector shifts, and investor strategies in 2026.

Although facing risks to both sides of its dual mandate, the Fed prioritized soft jobs data by delivering a quarter-point rate cut.

Why the shifting attitude of rate markets may cause some re-evaluation of bond positioning.

A discussion on equity and fixed income positioning during a period of AI-driven economic growth and Fed policy uncertainty.

An economy with balanced economic risks merits an equally balanced approach to bond allocations until greater clarity emerges on the labor market and inflation.

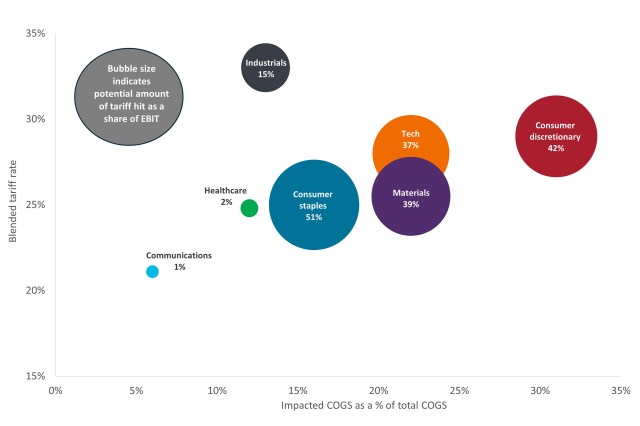

U.S. companies have thus far withstood the Trump administration’s barrage of tariffs, but signs of stress are emerging in the most exposed sectors.

Perspectives on volatility, tariffs, AI, and U.S. consumer strength.