Plugging into the electrification theme

Portfolio Manager Brian Demain explores how investors can capitalize on a powerful secular growth opportunity: the electrification of the economy.

7 minute read

Key takeaways:

- The electrification of the U.S. economy represents a powerful, decades-long investment theme driven by decarbonization efforts and the onshoring of manufacturing facilities, as well as the growth of data centers, electric vehicles (EVs), and heat pumps.

- Key investment opportunities span utilities, electric vehicles, semiconductors, connectors, and electrical components. Utilities, in particular, should benefit from increasing electricity demand and the need to modernize and expand infrastructure.

- While valuation and risks like subsidy dependence warrant monitoring, investors can capitalize on this secular theme by focusing on companies with strong competitive positions, solid fundamentals, and sustainable growth drivers.

The world is undergoing a significant transformation driven by the electrification of the economy. This trend has the potential to span decades and has implications for different areas of the market.

At its core, the electrification theme revolves around the increasing role of electricity in various sectors. Electricity demand, which has been flat for a long time, is poised for sustainable growth over the next few decades.

JHI

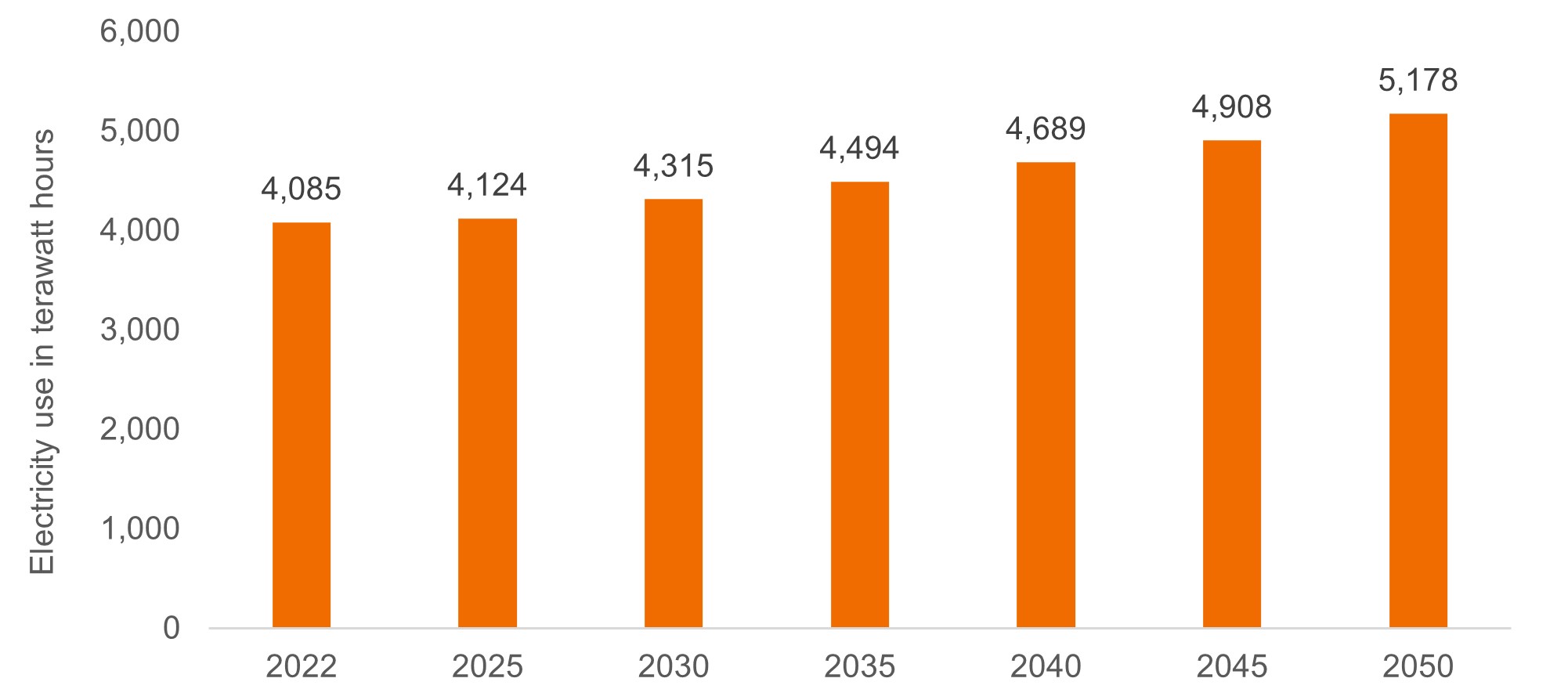

According to the U.S. Energy Information Administration, electricity demand is expected to rise 27% from 2022 to 2050 (Figure 1).1 And, notably, projections over shorter time horizons are trending higher. For instance, grid planners forecast nationwide electricity demand to increase 4.7% over the five-year period ending 2028, while estimates from the same report a year earlier called for 2.6% growth.2

Figure 1: Projected electricity use in the United States from 2022 to 2050 (in terawatt hours)

Source: U.S. Energy Information Administration, “Annual Energy Outlook 2023” Table 8, March 2023.

Source: U.S. Energy Information Administration, “Annual Energy Outlook 2023” Table 8, March 2023.

Powerful tailwinds

Several factors are supporting sustained growth in the electrification space. Decarbonization efforts are a major driver. Governmental policies aimed at emissions reductions, such as the Green New Deal and the Inflation Reduction Act (IRA), provide tailwinds through subsidies promoting clean energy adoption. Since the IRA was passed in 2021, there has been a surge in investments for the creation of new transportation and clean energy facilities. The electrical load associated with these facilities is expected to have an impact in the near term, alongside the broader trend of U.S. onshoring of manufacturing.

The exponential growth of data centers is further driving electricity consumption in the near term. In the U.S., data centers accounted for about 4% of U.S. electricity demand in 2022, that that is expected to increase to 6% by 2026.3 This growth is being accelerated by the rapid rise of generative artificial intelligence (AI). AI graphic processing units (GPUs) are dramatically more power-intensive than traditional GPUs, putting additional strain on the electrical grid.

In terms of longer-term impacts, several growth drivers are expected to be more impactful in the 2030’s, even though they exist today. For example, electricity usage will continue to rise as internal combustion engines are replaced by electric vehicles (EVs). Relatedly, the transition from heating with furnaces to electricity-powered heat pumps will further increase grid demand.

Where to look for opportunities? Start with utilities

Investors seeking exposure to the electrification theme have a diverse landscape to consider, with opportunities across various industries that are integral to the electrification of the economy. In our view, key areas include utilities, vehicles, semiconductors, and connectors.

For regulated utilities, we believe three key forces are converging to reverse decades of underinvestment in U.S. infrastructure. First, utilities will benefit from the increasing grid demand, as discussed.

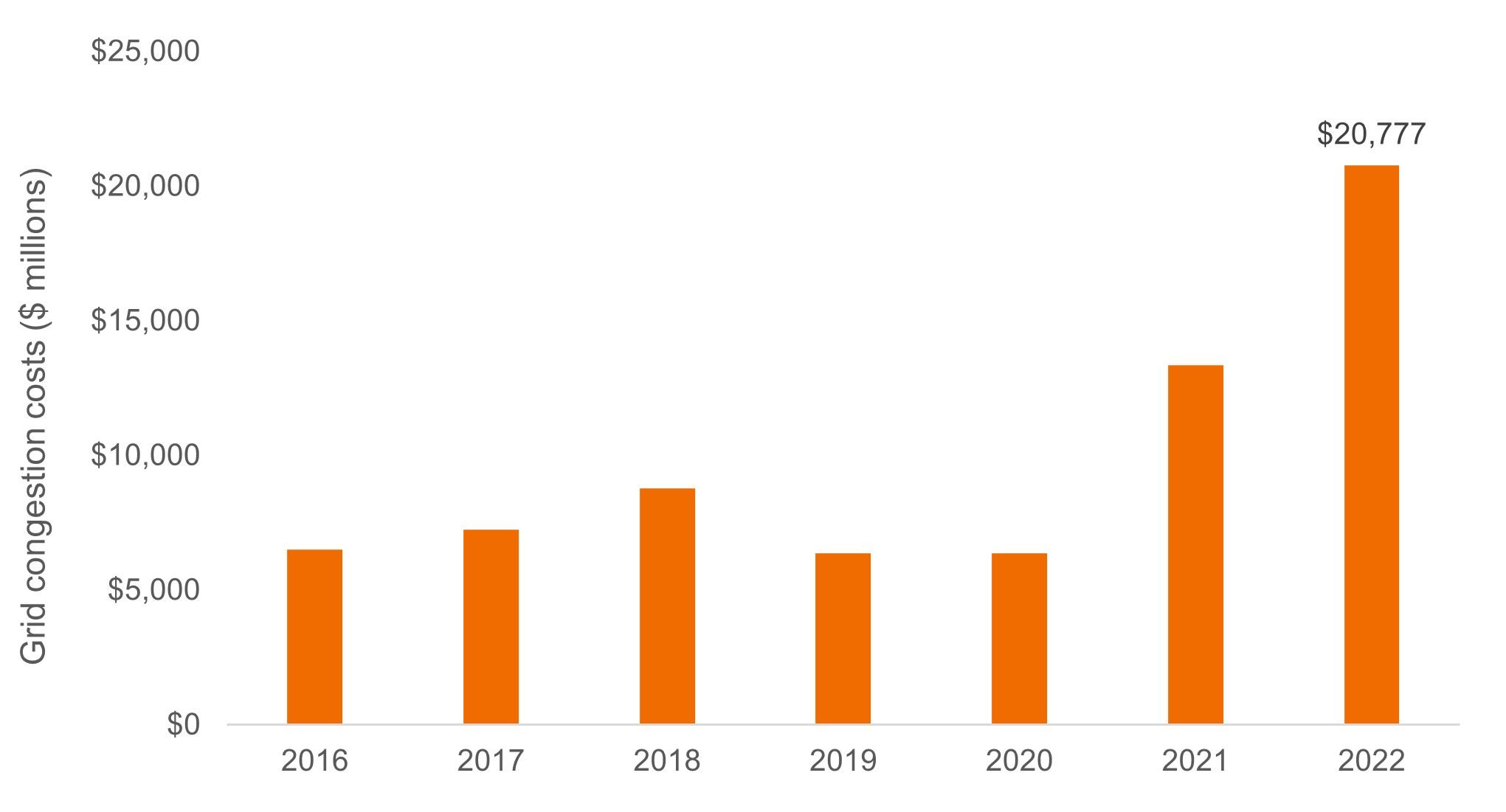

Second, grid modernization is needed. Reliability expectations are higher, and power outages that were once inconvenient are now unacceptable in a digital world. Utilities must also invest in technology infrastructure to improve customer efficiency. The cost of U.S. grid congestion, which measures the higher costs customers absorb when there is inadequate capacity to deliver lower-cost electricity, increased to over $20 billion in 2022 (Figure 2). This cost may continue to rise until additional transmission lines and equipment are built to handle electricity demand.

Figure 2: Estimated U.S. grid congestion costs ($ millions)

Source: Richard Doying, Michael Goggin, and Abby Sherman, “Transmission Congestion Costs Rise Again in U.S. RTOs”, Grid Strategies, July 2023.

Source: Richard Doying, Michael Goggin, and Abby Sherman, “Transmission Congestion Costs Rise Again in U.S. RTOs”, Grid Strategies, July 2023.

Third, the clean energy transition requires an expanded, strengthened power grid, such as new power plants and transmission. Renewable energy sources like solar and wind are often far from populated areas, so the grid needs to be extended and hardened to support those loads. This will necessitate growth in installed battery capacity for energy storage due to the intermittency of these sources. These energy storage solutions, though more nascent, also present opportunities.

We expect these slow transitions to underpin a long period of high single-digit growth in electric utility rate bases, which is the asset base on which utilities can earn a regulated return.

Semiconductors and components are integral to electrification ecosystem

Several other industries have a role in the electrification ecosystem. As the world moves from fossil fuels to renewable energy, electricity intensity and component complexity increase dramatically. For instance, EVs require more electrical wiring, copper, and semiconductor content than internal combustion engines.

Semiconductors, particularly analog and power semiconductors, are key areas. Analog semiconductors measure and regulate real world signals, while power semiconductors are essential for voltage conversions in many electrical use cases.

Meanwhile, electrical component suppliers, especially those specializing in connector components for applications in the grid or vehicles, represent additional investment opportunities.

EVs, commodities, and solar

Vehicle electrification has been, and remains, a meaningful way to gain exposure to the broader theme. However, the investment thesis has evolved recently as valuation on some of the companies in this space has expanded and certain subpar EV offerings in the U.S. aren’t landing with consumers, even though the global auto market had a strong 2023.

There could be a deceleration in the secular growth of some of these companies over the next 12-18 months, but we believe the longer-term opportunity remains. EVs are expected to continue optimizing and come down the cost curve. And as automakers launch their next-generation EV platforms, we expect penetration to reaccelerate. We still believe about 40% of new vehicles produced will be EVs by 2030, and the majority by 2040.

Notably, while commodities like copper offer a high-beta means of gaining exposure to this investment theme, there are concerns around competitive advantage and sustainable growth drivers. Rooftop solar is another area that lacks a sustainable competitive advantage, in our view. Subsidies have caused the industry to boom, but we see utility-scale solar as a more efficient way to establish a clean energy grid because it is much cheaper per unit of installed electricity. As more utility-scale renewable energy comes online, the competition may negatively impact roof-top solar.

Key considerations across the theme

The powerful tailwinds behind electrification make it an attractive theme, but not all stocks will be long-term winners. Investors should recognize that this is a multi-decade theme rather than a quick technology trend.

Therefore, investing in the theme requires a more nuanced approach, with fundamental and valuation analysis key to identifying attractive long-term investments. Companies generally trade at reasonable earnings multiples, but valuations vary across sectors, and some hyped-up stocks may trade at higher valuations without solid fundamentals.

Risks embedded in the investment theme include the U.S. consumer’s appetite for EVs, the impact of subsidies on demand, and the challenge of energy storage, especially as renewables become a larger part of power generation. It’s crucial to monitor these factors and consider their long-term implications.

In our view, by focusing on companies with solid fundamentals, competitive advantages, and sustainable growth drivers, investors can position themselves to capitalize on the secular shift toward electrification.

1 U.S. Energy Information Administration, “Annual Energy Outlook 2023” Table 8, March 2023.

2 John D. Wilson and Zach Zimmerman, “The Era of Flat Power Demand is Over.” Grid Strategies, December 2023.

3 International Energy Agency, “Electricity 2024 Report”, January 2024.

Beta measures the volatility of a security or portfolio relative to an index. Less than one means lower volatility than the index; more than one means greater volatility.

IMPORTANT INFORMATION

Automotive industries are highly cyclical and can be significantly affected by labor relations and fluctuating component prices.

Energy industries can be significantly affected by fluctuations in energy prices and supply and demand of fuels, conservation, the success of exploration projects, and tax and other government regulations.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.