In recent years, dissent within the Bank of Japan’s (BoJ’s) Monetary Policy Meetings (MPMs) has emerged as a powerful signal of change. Historically, the BoJ has operated with a high degree of consensus, but when two or more board members have a differing view, it often marks a turning point towards monetary policy.

We saw signs of this in the latest September meeting, where Naoki Tamura and Hajime Takata voted for an immediate rate hike to 0.75%, against the majority’s decision to hold at 0.5%. Although we did not see a hike, the decision was accompanied by a surprise announcement from the BoJ to begin selling exchange-traded funds (ETFs) and Japanese Real Estate Investment Trusts (J-REITs). The immediate market reaction was negative on the news, but when looking at the pace of the new divestment programme it aligns with previous programmes, and the BoJ is focused on minimising the market impact. But more importantly, these ETF and J-REIT sales send a wider signal to markets, that the BoJ is keen to undertake a broader shift toward policy normalisation.

Inflation driven by structural wage growth

Latest inflation data also supports the view favouring a hike. Japan’s inflation is no longer just a transitory phenomenon. It is increasingly underpinned by structural wage growth. Japan is experiencing a long-awaited virtuous cycle of rising wages and prices, and this current cycle is supported by a tight labour market, corporate profitability, and strong domestic demand. This is supportive of a longer term and more sustainable path for inflation.

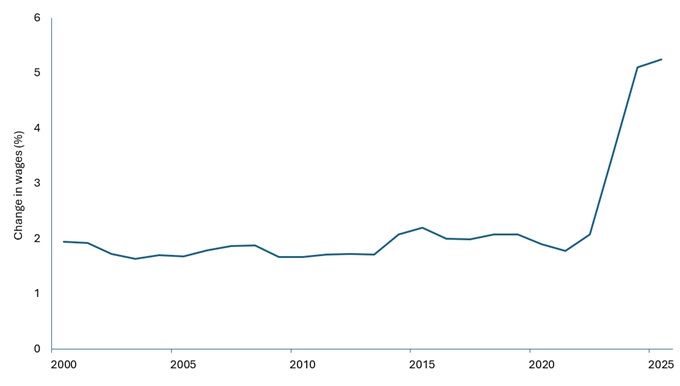

Exhibit 1 illustrates the outcomes of Japan’s annual ‘Shunto’ wage negotiations, an annual discussion held between major labour unions and employers, which highlights a growing corporate willingness to raise wages. The BoJ also uses this information to gauge whether inflation is demand driven and if hikes are justified.

Exhibit 1: Shunto wage negotiations saw a steep rise

Source: Bloomberg, Janus Henderson Investors, 2000 to 2025 Shunto wage settlements.

This wage-driven inflation is a departure from Japan’s deflationary past and gives the BoJ a stronger rationale to continue raising rates. With unemployment low and wage negotiations yielding meaningful increases, the central bank is under pressure to act decisively to prevent overheating.

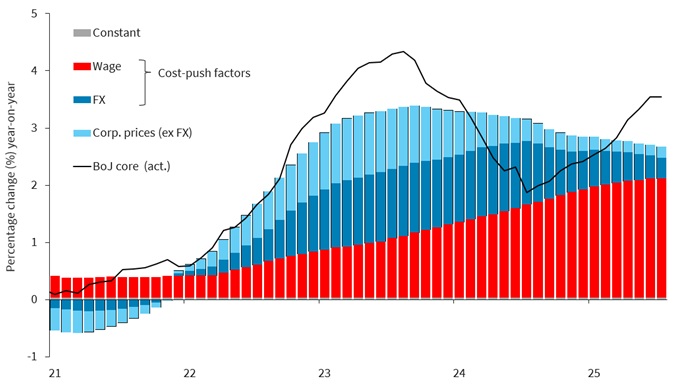

Exhibit 2: A steady increase in wage inflation supports BoJ action

Source: MIC, BoJ, Bloomberg, Barclays Research, 1 December 2021 to 1 July 2025.

International pressure mounts

Adding to the internal momentum is external pressure, particularly from the United States. US Treasury Secretary Scott Bessent has been vocal in his criticism of the BoJ’s monetary policy stance, stating that Japan is “behind the curve” on inflation and will likely need to raise interest rates soon. In recent interviews, Bessent emphasised that Japan’s inflation challenge is both real and persistent. He argues that tighter monetary policy is essential, not only to contain price pressures, but also to support the weakening yen, which the BoJ is keen to prevent from depreciating too far.

Conclusion

We believe that Japan’s economy is approaching a point where further tightening is necessary. Since the economy has managed to improve margins through mild inflation, it is crucial for both corporate profits and the capital market that this situation is maintained through appropriate monetary policy. The risk is that delaying action could lead to a bubble and subsequent burst.

So, the pattern is clear. When two or more BoJ members dissent, it often precedes a policy shift. Combined with structural inflationary forces and international pressure, Japan appears to be entering a new phase of monetary policy – one where rate hikes are not just probable, but necessary.

From an investor perspective, Japanese financial institutions are well-positioned to benefit from any tightening in monetary policy. Banks in particular stand to gain as rising yields boost profitability by widening net interest margins (charging more on loans than they pay on deposits) and enhancing returns on their cash reserves and bond holdings.

Cost-push factors: These are conditions that affect the cost of production for goods or services, such as the increased cost of raw materials, higher wages, currency depreciation, or rising taxes.

Exchange traded fund (ETF): A security that tracks an index, sector, commodity, or pool of assets (such as an index fund). ETFs trade like an equity on a stock exchange and experience price changes as the underlying assets move up and down in price. ETFs typically have higher daily liquidity and lower fees than actively managed funds.

Inflation: The rate at which the prices of goods and services are rising in an economy. The consumer price index (CPI) and retail price index (RPI) are two common measures.

Real estate investment trust (REIT): An investment vehicle that invests in real estate through direct ownership of property assets, property shares, or mortgages. As they are listed on a stock exchange, REITs are usually highly-liquid and trade like shares. Real estate securities, including REITs, may be subject to additional risks including interest-rate, management, tax, economic, environmental, and concentration risks.

Monetary policy: The policies of a central bank aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Monetary-policy normalisation: The process by which a central bank returns its policy to a more standard, neutral stance, from a previously expansionary (or unconventional) position. This typically involves moving interest rates back to their long-term average, ending asset purchase programmes, and phasing out extraordinary measures put in place to stimulate or protect an economy during a crisis.

Tight labour market: An environment where there is a scarcity of available workers and a high demand for labour. This kind of market is characterised by low unemployment, where businesses are competing for talent, generally resulting in higher wages and greater bargaining power for job seekers.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.