Busting the bias against US securitized

In his 2024 investment outlook, Head of U.S. Securitized Products John Kerschner seeks to identify and debunk the biases that keep some investors from considering an allocation to U.S. securitized fixed income.

10 minute read

Key takeaways:

- In the aftermath of the Global Financial Crisis (GFC), many investors have eschewed U.S. securitized assets out of fear of a repeat of what happened in 2008.

- While securitization played a meaningful role in the GFC, the full story is more nuanced, and the conclusions to be drawn are more balanced. In our view, investors’ aversion to securitized is founded on bias, not fact, and can potentially lead to suboptimal investment decision making.

- We believe that securitized sectors have much to offer investors by way of improved diversification, unique interest-rate and credit spread exposure, and access to debt instruments that encompass the broad U.S. economy.

To be a successful investor, it is essential to base our decisions on facts and a rational investment philosophy. In contrast, biases (irrational assumptions or beliefs that can cloud our judgement) may compromise our ability to make good investment decisions.

One of the most striking biases we notice in our work with investors is an aversion to securitized assets within their fixed income allocations. (Even hearing the word “securitized” makes some investors run for the proverbial hills!) As a result, many investors may have significant underweight allocations to securitized assets.

Below we aim to highlight the top 10 false beliefs that tend to result in this bias and offer what we believe is a clearer, fact-based picture of the U.S. securitized market.

1. Securitized bonds are riskier than corporate bonds.

This is the most common misconception we come across when discussing the securitized market with investors – that securitized is inherently more risky than corporate bonds.

Each fixed income sector may include bonds across the risk spectrum: The corporate universe includes bonds that are rated AAA through CCC, and the same holds true for securitized sectors. As such, it would be inaccurate to label an entire sector as being riskier than another without a comparison of their credit ratings and risk exposures.

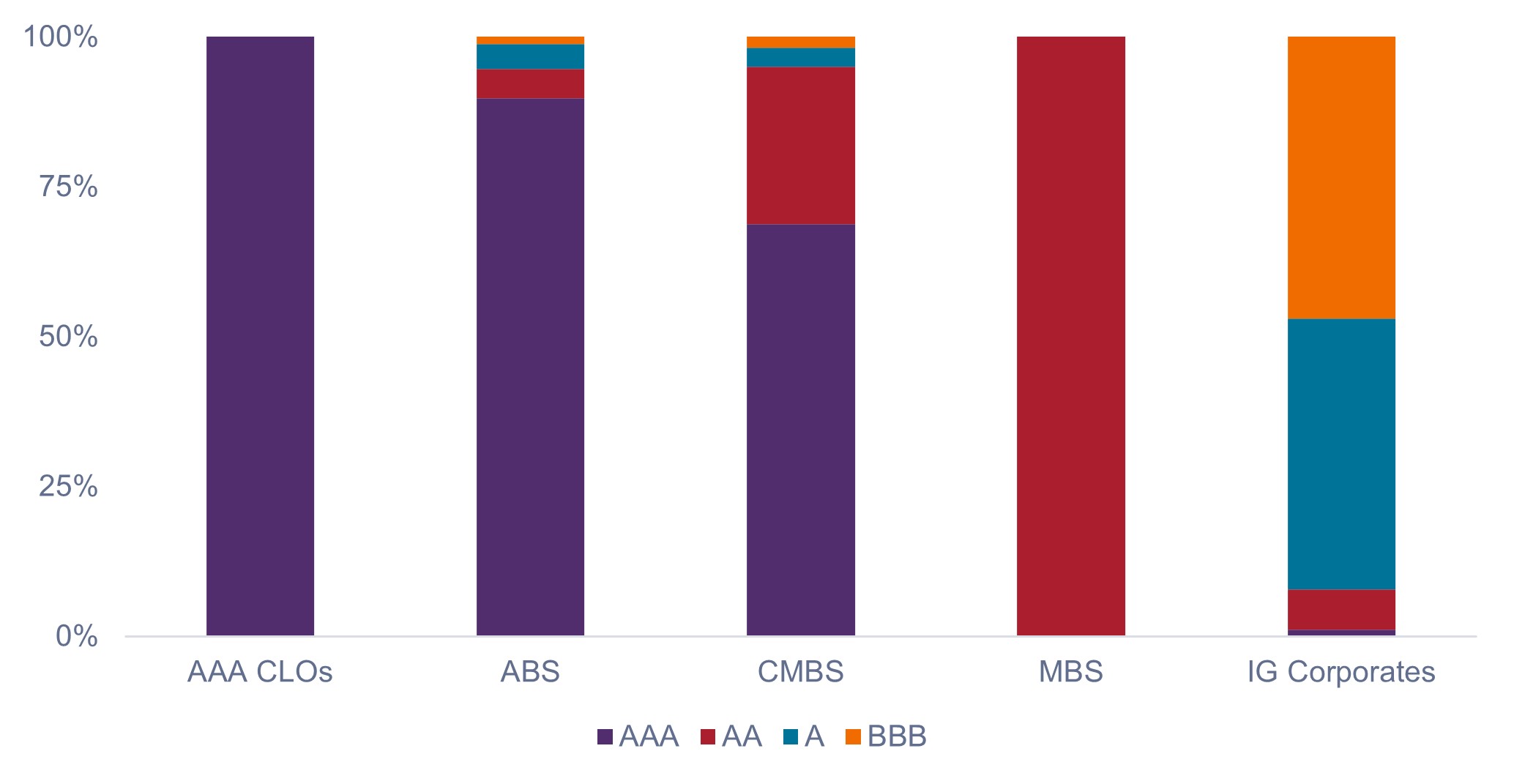

Despite the common misconception that they are riskier than corporate bonds, securitized indices exhibit higher average credit ratings than their corporate counterparts, as shown in Figure 1.

Figure 1: Fixed income sectors by credit rating

Securitized indices generally exhibit stronger credit quality than investment-grade (IG) corporates.

Source: Bloomberg, as of 1 December 2023. Indices used to represent asset classes: AAA CLOs = J.P. Morgan CLO AAA Index, ABS = Bloomberg U.S. Aggregate Asset Backed Securities Index, CMBS = Bloomberg U.S. Commercial Mortgage Backed Securities Investment Grade Index, MBS = Bloomberg U.S. Mortgage Backed Securities Index, IG corporates = Bloomberg U.S. Corporate Bond Index.

Source: Bloomberg, as of 1 December 2023. Indices used to represent asset classes: AAA CLOs = J.P. Morgan CLO AAA Index, ABS = Bloomberg U.S. Aggregate Asset Backed Securities Index, CMBS = Bloomberg U.S. Commercial Mortgage Backed Securities Investment Grade Index, MBS = Bloomberg U.S. Mortgage Backed Securities Index, IG corporates = Bloomberg U.S. Corporate Bond Index.

2. I don’t trust the credit ratings.

Ironically, some investors are more comfortable owning a BBB corporate bond than a AAA collateralized loan obligation (CLO).

This bias stems somewhat from the role that credit rating agencies played in the Global Financial Crisis (GFC) by giving AAA ratings to securities filled with risky subprime mortgages. As a result, many investors still do not trust the credit ratings on securitized assets.

While the rating agencies were at fault back in 2008, one should also consider what was taking place in lending markets leading up to the GFC.

First, mortgage lenders were making huge numbers of risky (and often illegal) subprime loans to unqualified buyers. Second, the rating agencies faced a significant challenge in that subprime mortgages did not exist in securitizations before the year 2000, so they had no track record to work from in calibrating their models when subprime lending ballooned. Third, until the GFC, the U.S. housing market had not experienced a year of negative home price growth since the Great Depression, so rating agencies’ models were not adjusted to factor in an eventual fall of over 30% in home prices.

Following 2008, lending standards tightened up immensely (anyone who has applied for a mortgage can attest to this), and models now incorporate more conservative assumptions regarding home prices and default rates.

In our view, credit ratings on securitized sectors carry the same level of integrity as ratings on corporate or government debt, and investors need not be skeptical of the ratings on securitized sectors due to what took place during the GFC.

3. Securitization caused the 2008 financial crisis.

It is true that securitization played a leading role in the GFC – if not for securitization, the crisis would not have reached the dire levels it did. However, as mentioned above, the bigger issue was fraudulent lending, which led to the poor quality of the underlying mortgage loans that were going into securitizations, coupled with the inability of rating agencies to correctly evaluate their risk. Following industry reform, we think the risk of a recurrence of this situation within the securitized space is low.

While there were issues with ratings on MBS during the GFC, the agencies largely got their ratings right in other securitized sectors. For example, no auto asset-backed security (ABS) bond has ever defaulted going back to the late 1990s, and there were no impairments to investment-grade CLOs through the GFC.

In our view, to shun securitized fixed income following the GFC would be akin to writing off industrial stocks following the Great Depression, banks following the Savings and Loan Crisis, or technology stocks following the dot-com bubble.

4. Securitized is a small, insignificant asset class.

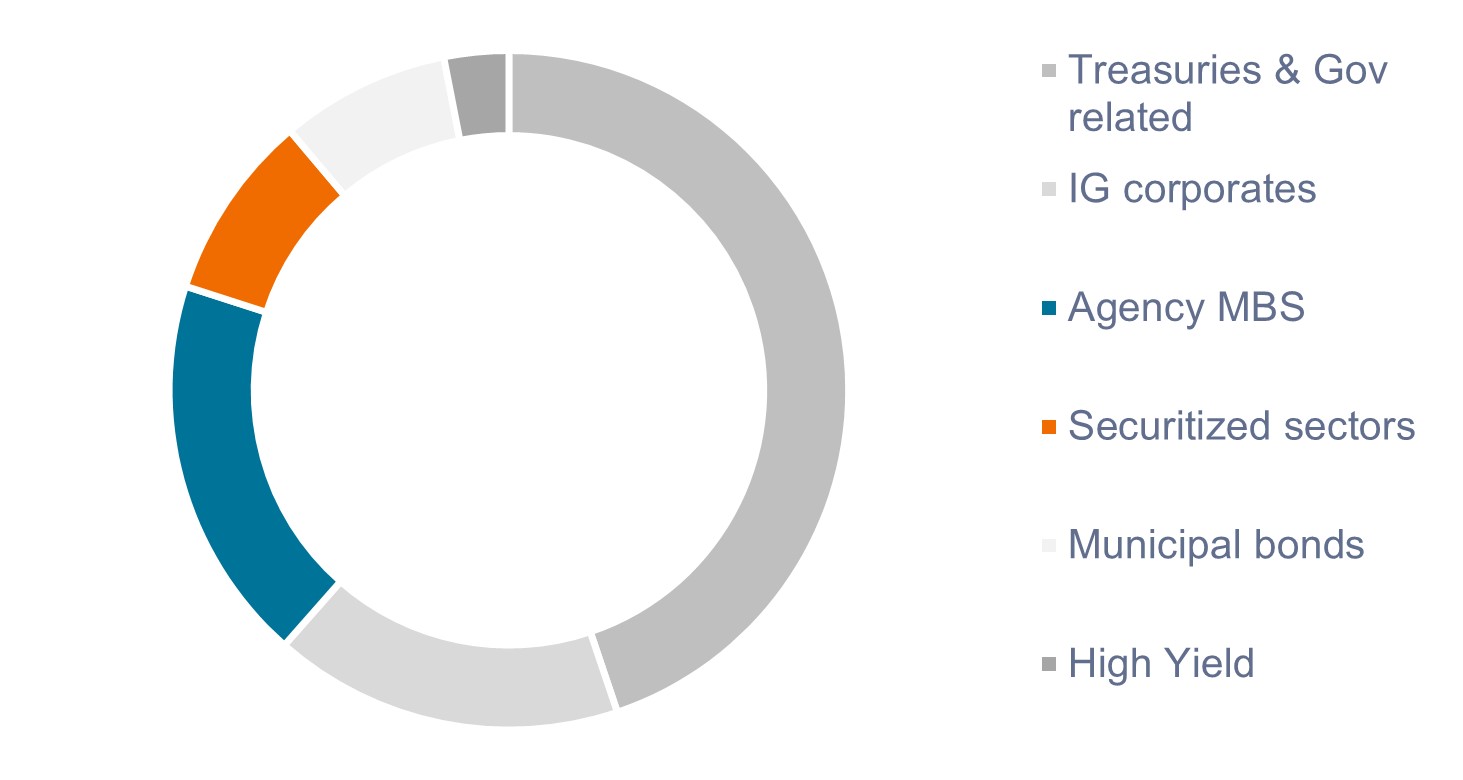

While some investors may consider the U.S. securitized market to be a small, niche market, the reality is very different. As shown in Figure 2, securitized sectors and agency MBS make up over 27% of the U.S. fixed income universe.

Figure 2: Agency MBS + securitized sectors = 27% of the U.S. fixed income universe.

Source: Bloomberg, SIFMA, as of 31 December 2021. Note: Securitized category includes ABS, CMBS, CLOs, and CMOs.

Source: Bloomberg, SIFMA, as of 31 December 2021. Note: Securitized category includes ABS, CMBS, CLOs, and CMOs.

5. Securitized is a new and unproven market.

We believe securitization is positive for the economy because it takes illiquid assets and turns them into investments that can trade in financial markets – allowing for liquidity, price discovery, and exposure to a wide array of investors. Additionally, MBS have contributed to lowering the cost of mortgages, thereby making homeownership broadly more accessible.

The market for securitized products is also mature and well established, with MBS having been around since the 1970s and other securitized sectors such as ABS and commercial mortgage-backed securities (CMBS) dating back to the 1990s.

6. I don’t understand how securitization works.

Some investors might point to the advice of world-renowned investor Warren Buffett, who famously stated that one should not invest in something one does not understand. While true, it is important to note that Mr. Buffett has spent his life researching and trying to understand various investment opportunities. Perhaps a better lesson would be if, after doing your research, you still don’t understand it, then you shouldn’t invest in it.

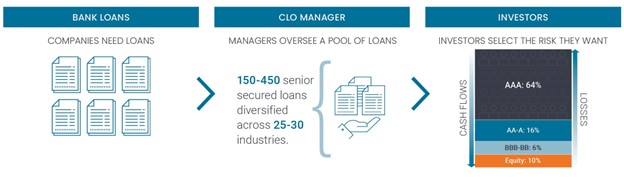

While it does involve an additional layer of complexity, we think that with some education and research, most investors will find securitization quite straightforward. Simply put, while corporate bonds provide access to a single loan and single borrower, securitization gives investors access to a pool of loans and borrowers. There is also the added overlay of a securitization manager: The securities are divided into classes – or tranches – and ranked according to their credit quality, so investors can purchase securities in the tranche that suits their risk profile.

Figure 3 shows a typical CLO securitization, the basic structure of which also applies to other securitized sectors.

Figure 3: Typical CLO securitization

Source: Janus Henderson Investors.

7. There are too many acronyms.

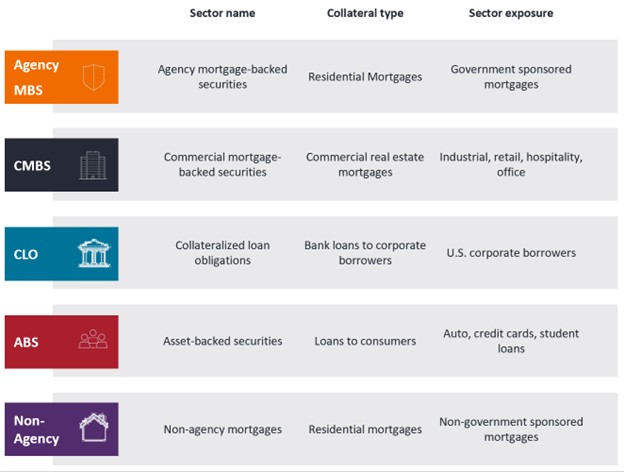

While the numerous acronyms within securitized can be daunting at first, the securitized universe is broadly comprised of five subsectors or categories, as shown in Figure 4. Each subsector grants investors access to the debt of a particular area of the U.S. economy. Notably, securitization not only allows investors access to corporate debt, but also consumer loans.

Figure 4: U.S. securitized universe

Source: Janus Henderson Investors, as of 1 December 2023.

8. I have done well enough in the Bloomberg U.S. Aggregate Index.

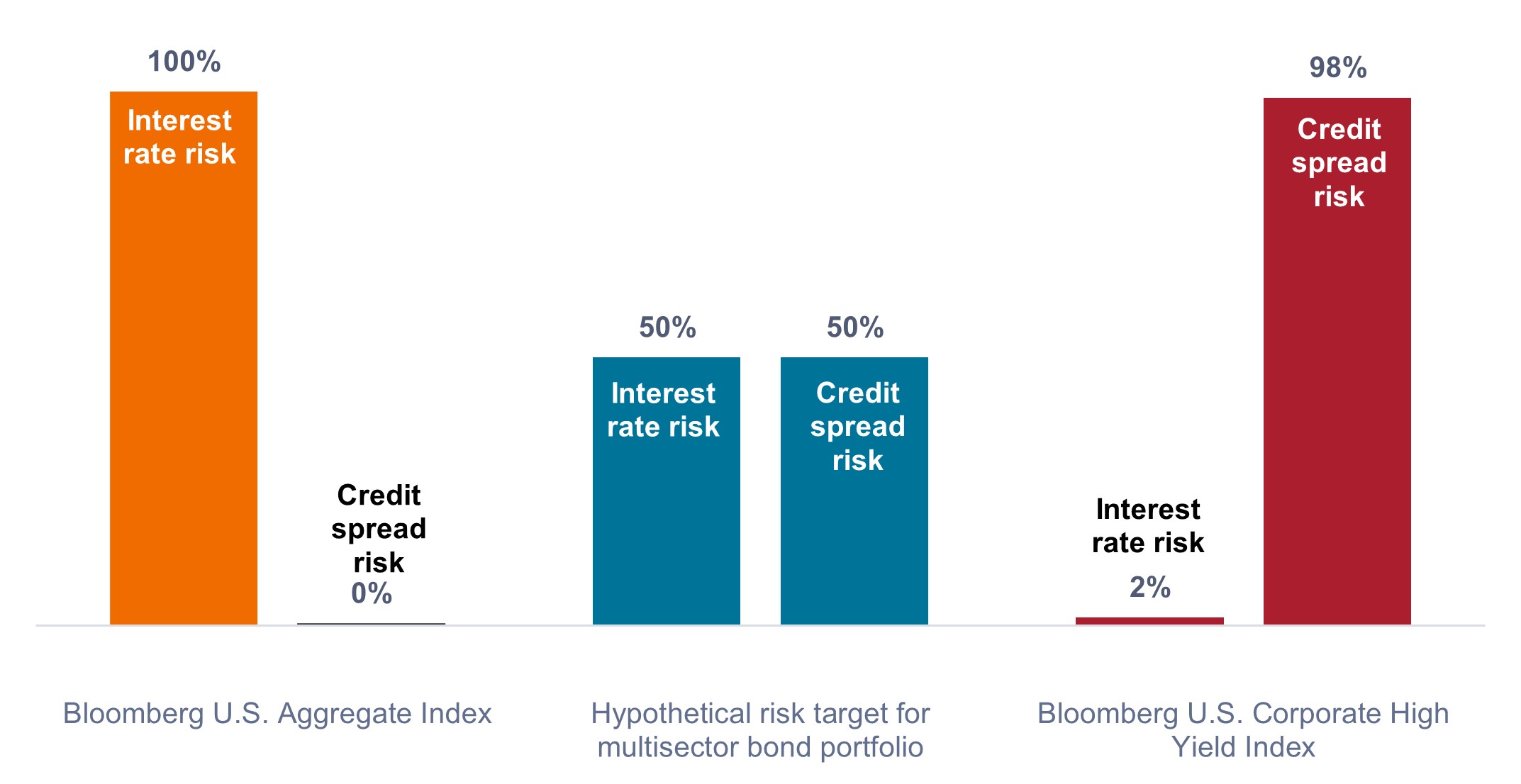

It is critical for investors to know which risk factors are driving their fixed income returns. As shown in Figure 5, returns on the Bloomberg U.S. Aggregate Index (U.S. Agg) are firmly driven by interest-rate risk. As a result, the U.S. Agg has historically outperformed when rates are falling, but has struggled when rates rise (as we have witnessed since late 2021). On the other hand, returns on the Bloomberg U.S. Corporate High Yield Index (U.S. high yield) have been driven almost entirely by credit spread risk.

As investors contemplate their appropriate mix of interest rate and credit spread risk, a hypothetical multisector allocation might aim to strike a balance between these risk exposures. And while this balance could theoretically be achieved by blending the U.S. Agg and U.S. high yield indexes, that approach leaves portfolios exposed exclusively to corporate issuers and the corporate credit cycle. By layering in securitized sectors, with their own unique blend of interest rate and credit-spread risk and exposure to other areas of the U.S. economy, we believe the appropriate risk factor balance can be achieved in a more efficient manner.

Figure 5: Factor risk decomposition (Sep 2018 – Sep 2023)

Investors should aim to balance their interest rate and credit risk exposure.

Source: Janus Henderson Investors, as of 1 December 2023.

Source: Janus Henderson Investors, as of 1 December 2023.

9. Relative value trades are nonexistent in fixed income.

While investors might pay close attention to relative value opportunities in their equity allocations, the search for relative cheapness may not always be front of mind in fixed income.

As shown in Figure 6, though, relative value opportunities do exist in fixed income, particularly now that securitized sectors are trading at meaningful discounts to their 10-year average spread levels, while corporates are trading at a premium to their long-term averages. Such dislocations may create opportunities for improved risk-adjusted returns through active management.

Figure 6: Current spread relative to 10-year average spread

Securitized spreads are trading wider than their 10-year averages, while corporates are less attractively priced.

Source: Bloomberg, Janus Henderson Investors, as of 1 December 2023. Past performance does not predict future returns.

Source: Bloomberg, Janus Henderson Investors, as of 1 December 2023. Past performance does not predict future returns.

10. There is no benefit to adding new fixed income sectors.

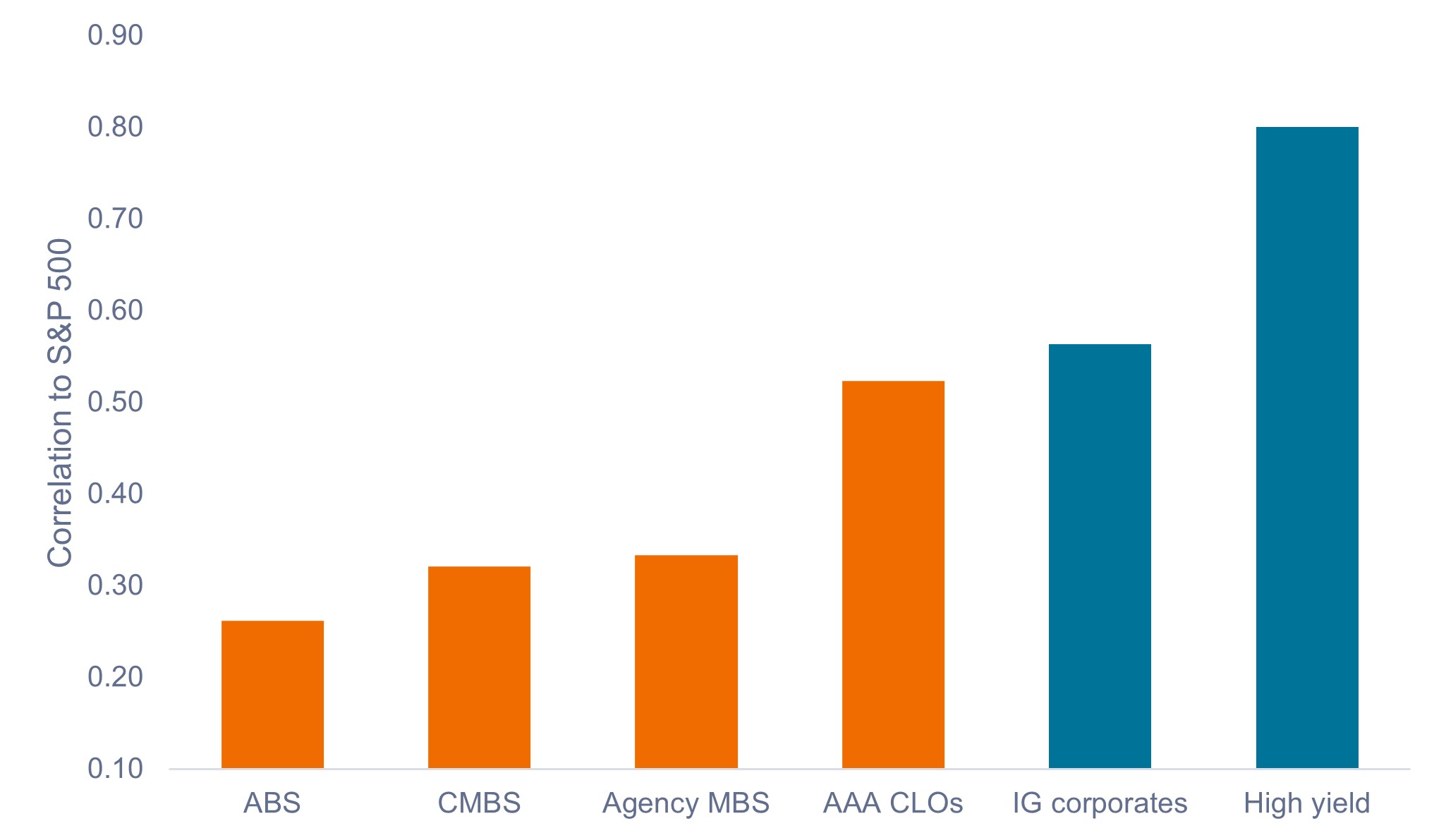

In addition to providing relative value opportunities, an allocation to securitized assets can help to lower overall portfolio volatility. As shown in Figure 7, fixed income sectors exhibit vastly different levels of correlation, with securitized indices generally exhibiting lower correlation to equities than corporates.

Figure 7: Correlation to the S&P 500® (2013-2023)

Securitized sectors have exhibited lower correlation to U.S. equities than corporate bonds.

Source: Bloomberg, as of 30 November 2023. Note: Monthly correlations for the 10-year period ended 30 November 2023. Indices used to represent asset classes as per Figure 2. Past performance does not predict future returns.

Source: Bloomberg, as of 30 November 2023. Note: Monthly correlations for the 10-year period ended 30 November 2023. Indices used to represent asset classes as per Figure 2. Past performance does not predict future returns.

In summary

Understandably, scar tissue remains following the role securitization played in the 2008 financial crisis. Integrity, once questioned, can be hard to earn back. That said, we encourage investors to challenge any biases they may have against the asset class. In eschewing this large, liquid, and relatively high-credit quality asset class, we believe investors may be missing an opportunity to optimize their portfolios for strong risk-adjusted returns.

Bloomberg U.S. Aggregate Bond Index is a broad-based measure of the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Corporate High Yield Bond Index measures the US dollar-denominated, high yield, fixed-rate corporate bond market.

Bloomberg U.S. Corporate Bond Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate bond market.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

J.P. Morgan CLO AAA Index is designed to track the AAA-rated components of the USD-denominated, broadly syndicated CLO market.

Bloomberg U.S. Mortgage-Backed Securities (MBS) Index measures the performance of U.S. fixed-rate agency mortgage-backed pass-through securities.

Commercial mortgage-backed securities (CMBS): fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

High yield bond: Also known as a sub-investment grade bond, or ‘junk’ bond. These bonds usually carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher interest rate (coupon) to compensate for the additional risk.

Investment-grade bond: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments, reflected in the higher rating given to them by credit ratings agencies.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money. Monetary tightening/hawkish policy refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Mortgage-backed security (MBS): A security which is secured (or ‘backed’) by a collection of mortgages. Investors receive periodic payments derived from the underlying mortgages, similar to the coupon on bonds. Mortgage-backed securities may be more sensitive to interest rate changes. They are subject to ‘extension risk’, where borrowers extend the duration of their mortgages as interest rates rise, and ‘prepayment risk’, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

Risk assets: Financial securities that may be subject to significant price movements (ie. carrying a greater degree of risk). Examples include equities, commodities, property lower-quality bonds or some currencies.

Volatility measures risk using the dispersion of returns for a given investment.

IMPORTANT INFORMATION

Actively managed investment portfolios are subject to the risk that the investment strategies and research process employed may fail to produce the intended results. Accordingly, a portfolio may underperform its benchmark index or other investment products with similar investment objectives.

Derivatives can be more volatile and sensitive to economic or market changes than other investments, which could result in losses exceeding the original investment and magnified by leverage.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.