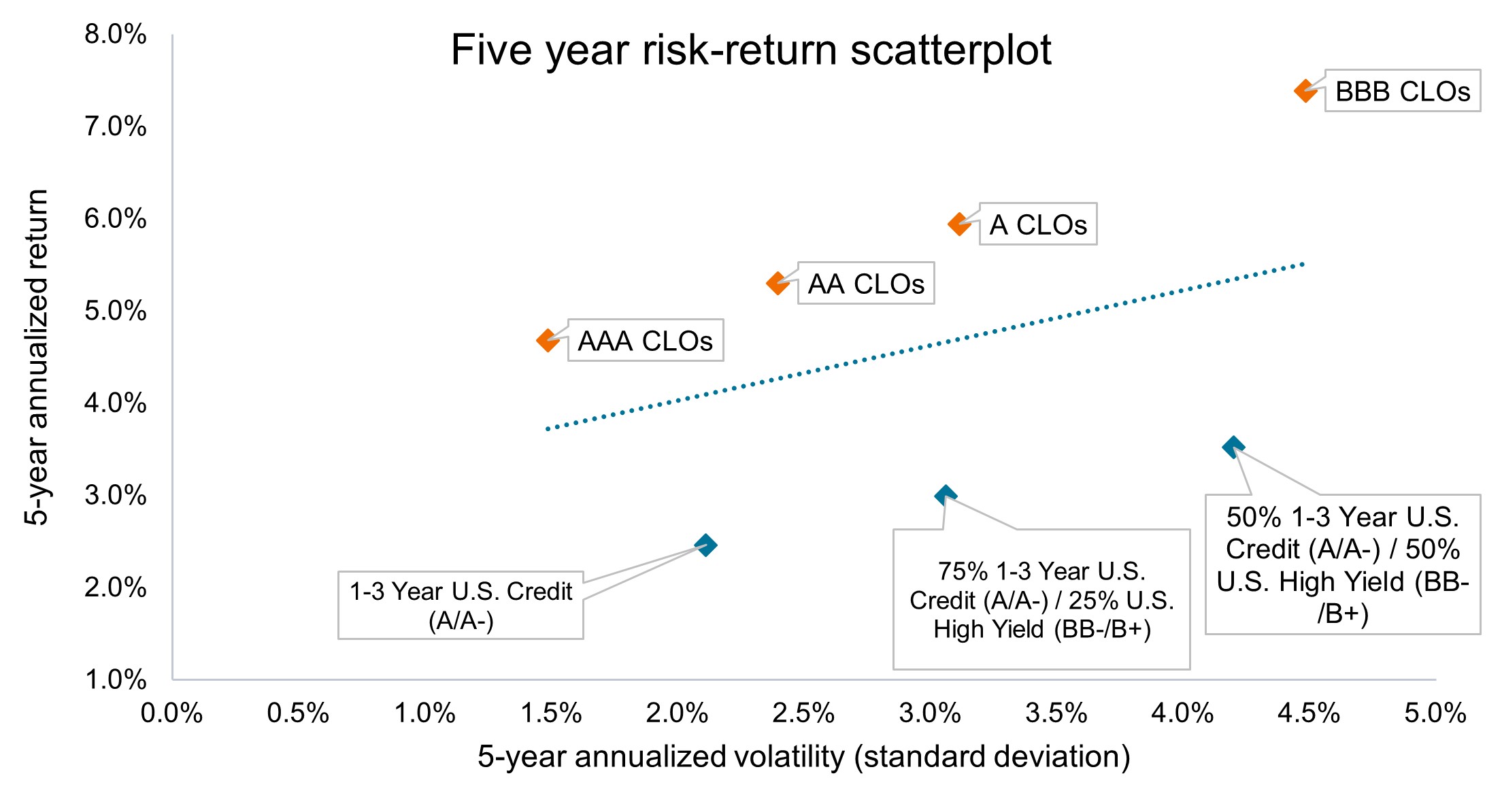

Chart to Watch: AA and A rated CLOs have offered compelling risk-adjusted returns

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

AA and A rated CLOs bridge the gap between the AAA and BBB segments, providing attractive returns with strong credit ratings and moderately low volatility.

Source: Bloomberg, J.P. Morgan, Janus Henderson Investors, as of 31 December 2025. Indices used to represent asset classes: CLOs = J.P. Morgan AAA/AA/A/BBB CLO Indices, 1-3 Year U.S. Credit = Bloomberg 1-3 Year Credit Index, U.S. High Yield = Bloomberg U.S. Corporate High Yield Index. Past performance does not predict future results.

At Janus Henderson, we are on an ongoing pursuit to equip our clients with the tools they need to achieve their investment outcomes. The recent proliferation of investment vehicles that can target specific tranches of CLOs gives investors the opportunity to be more selective about, and truly customize, their desired level of risk and expected returns. – John Kerschner, Global Head of Securitized Products

- In our view, CLOs provide a highly efficient source of yield. For example, A rated CLOs returned 5.9% per year for the five-year period ended 31 December 2025, while a portfolio of 75% 1-3 Year U.S. Credit / 25% U.S. High Yield with virtually the same level of volatility delivered just 3.0% per year.

- For investors prioritizing low volatility, AAA CLOs might be a good option. Those seeking more return with a slightly higher risk profile may consider layering in AA and A CLOs.

- While BBB CLOs may appeal to the more aggressive investor with a higher risk appetite, AA and A tranches remain inherently low volatility due to their minimal interest-rate risk, structural credit enhancements, and strong credit ratings.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

High-yield or “junk” bonds involve a greater risk of default and price volatility and can experience sudden and sharp price swings.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Standard deviation (SD) is a statistical risk measure that quantifies the amount of variation or dispersion of a set of data values around their mean. A low SD indicates data points are clustered closely around the mean, while a high SD signifies they are spread over a wider range.

Structural credit enhancement is a risk-reduction technique in structured finance that redistributes credit risks among different bond classes (tranches) to protect senior investors from losses. By creating a senior-subordinated structure, subordinated tranches absorb losses first, enhancing the credit profile of senior securities and allowing them to achieve a higher rating than the underlying collateral.

Tranche: In securitized products like CLOs, a tranche is one of a number of related securities offered as part of the same transaction, with each representing a different degree of risk and carrying a commensurate credit rating.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.