Fitch U.S. credit rating downgrade: What does it mean for fixed income investors?

Head of U.S. Fixed Income Greg Wilensky discusses the potential impact of Fitch’s downgrade of the U.S. long-term credit rating.

5 minute read

Key takeaways:

- Some investors may have been caught off guard by Fitch’s downgrade and are now wondering how it could impact their portfolio positioning going forward.

- Fitch’s rating cut has little to no impact on our constructive view on high-quality bonds. Rather than focus on the downgrade, we believe investors should be data driven, paying close attention to the economy, labor markets, inflation, and actions of the Federal Reserve (Fed).

- Considering we see the economy slowing and inflation moderating in the months ahead, we believe high-quality bonds are currently poised for strong risk-adjusted returns.

On August 1, Fitch Ratings downgraded the United States’ long-term credit rating to AA+ from AAA. The downgrade came a couple of months after it had placed the U.S. on a negative watch amid a Congressional debt ceiling standoff that was resolved just days before a potential default. In justifying the downgrade, Fitch pointed to “expected fiscal deterioration over the next three years,” an erosion of governance, and a growing general debt burden.

Understandably, the U.S. Treasury was not pleased by the news, with Treasury Secretary Janet Yellen calling the rating change “arbitrary” and “based on outdated data.” The announcement also caught many investors off guard and left them wondering how this may impact their portfolio positioning going forward.

To help provide clarity around that question, here we highlight three key considerations for fixed income investors in light of the downgrade.

1. Surprising, but not that surprising

Perhaps the most surprising aspect of the rating downgrade was that it came after June’s resolution to the debt ceiling negotiations. Following the agreement reached in Congress, the potential rating downgrade fell off the radar for many investors.

In Fitch’s defense, though, the downgrade didn’t come completely out of left field – the agency had said back in May that the U.S. was under a negative rating watch. Nor is it unprecedented, as Fitch became the second agency to downgrade the U.S. to AA+ after S&P did the same in 2011. (Moody’s remains the only major ratings agency to maintain its AAA rating on U.S. debt.)

While the U.S. Treasury may consider the downgrade unjustly punitive, when one looks at the numbers, it’s hard to argue against it. Only a handful of countries in the world – nine to be exact – still hold a coveted AAA credit rating from all three major ratings agencies.

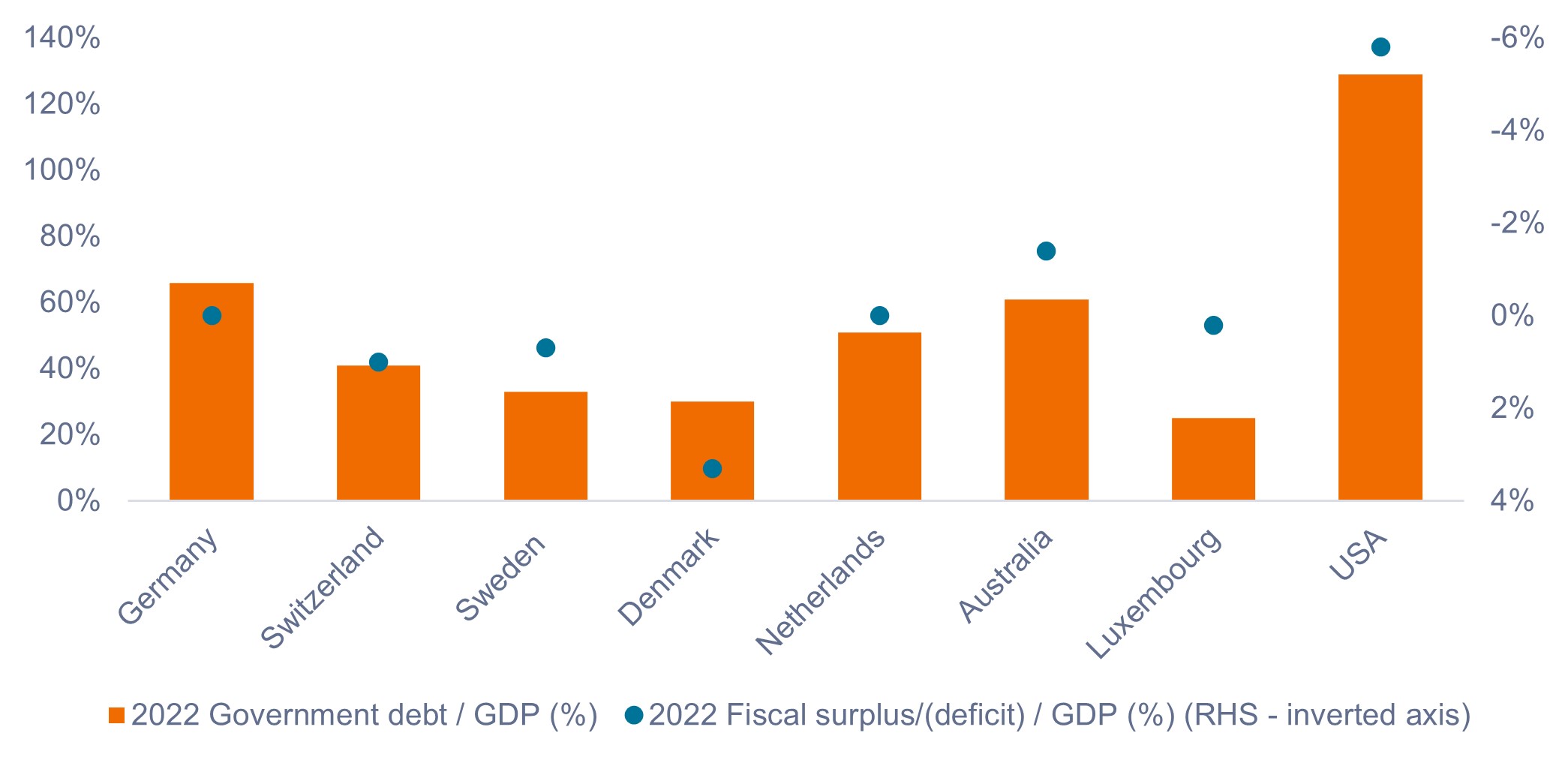

As shown in Exhibit 1, the AAA cohort exhibits superior debt-to-GDP ratios versus the U.S., while many of them run budget surpluses or very small deficits. While the U.S. remains the world’s largest economy, perhaps Fitch isn’t completely out of line in thinking it fits better in the AA+ crowd.

Exhibit 1: The U.S. vs. AAA rated economies

The U.S. exhibits both a higher debt burden and budget deficit than the AAA cohort.

Source: Trading Economics, as of 2 August 2023. Exhibit shows a cohort of economies rated AAA by all three major ratings agencies (Singapore and Norway excluded) versus the U.S.

2. Still strong, but maybe not as strong

We think a downgrade to AA+ says very little about the U.S.’s ability to repay its debts. Fitch defines AAA issuers as having the “highest credit quality” compared to “expectations of very low default risk” for AA rated issuers. Also, according to Fitch, AAA borrowers exhibit “exceptionally strong capacity” to meet their financial commitments, whereas AA issuers exhibit “very strong capacity.” In our view, the differences are more nuanced than they are pronounced.

Perhaps what the rating downgrade does tell us is that governments worldwide face a painful reckoning as record debt and higher interest rates are likely to result in skyrocketing borrowing costs over the next few years. By the end of 2022, the total value of global government debt had leapt by over 7%, with the U.S. government accounting for more additional borrowing in 2022 than every other country combined. While this may prove costly for the U.S., and ultimately a drag on future growth, we do not think it will lead to significant further deterioration in the U.S.’s ability to service its debt.

3. We are constructive on high-quality bonds

Our main takeaway is that Fitch’s downgrade has little to no impact on our constructive view on high-quality bonds.

Instead of focusing on the rating downgrade, we believe bond investors should be data-dependent in their investment decision making, paying attention to the economy, labor markets, inflation, and actions of the Federal Reserve (Fed).

As a result of the tightening of credit conditions and the cumulative effect of 5.25% of rate hikes, we expect the U.S. economy to soften in the months ahead and inflation to continue to moderate. In our view, risk markets are pricing in a relatively soft landing, whereas duration markets better reflect the risk of recession.

The sheer volume of debt owed by governments, corporates, and individuals nevertheless means that rates do not need to climb as far as in the past to have the same effect. As such, we think the Fed’s interest rate tightening cycle – raising interest rates to cool inflation – is nearing its end, and this is positive for bond markets.

The net effect, in our view, is that high-quality bonds remain attractive for investors. Short-dated bonds offer higher yields at present because they are more closely connected to central bank policy rates. This scenario is advantageous for those investors seeking income and preferring lower duration risk, although it is likely to result in less capital appreciation should rates fall. The scope for capital gains is greater for longer-dated bonds, albeit with higher interest rate risk.

As such, we continue to favor harvesting yields on the short end of the yield curve, while selectively adding duration to provide much-needed defensive characteristics in the case of an economic slowdown.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.