Beating a challenging market by harvesting global income

In a weaker economic environment, Portfolio Manager Ben Lofthouse argues that investing in globally diversified equities remains one of the best options for generating income in the medium to long term. The generally strong corporate results in the first quarter of 2023 provides grounds for optimism.

9 minute read

Key takeaways:

- While the last few years have been challenging for investors, a diversified approach to income investing across regions and sectors has softened the blow. The correction in technology stocks underscores how important diversification is for building long-term wealth.

- The global economy is slowing as interest rates move higher and corporate profits come under pressure. We think that despite the pressure on corporate earnings, dividend growth is likely to continue to be positive, moderating to around 5-7% for 2023.

- We continue to be positively surprised by total shareholder returns, both in terms of dividends and share buybacks.

Investors’ quest for reliable, consistent and competitive income with attractive capital growth has become ever more challenging. While interest rate hikes have led to improved yields on bonds, investors could still lose out in the long term if inflation remains stubbornly high. When growth and return expectations are low, global equities can be a good option for investors seeking steady income as well as capital growth. Dividends provide some consistency in periods when stock markets are volatile or weak, meaning they can smooth out total returns in the short term. Meanwhile, reinvested dividends account for a large proportion of shareholders’ total returns over longer periods. Investors are often surprised by the consistency of growth across a range of sectors, from technology to healthcare.

Helping us to keep faith with equities is the fact that company finances are in a much stronger position prior to previous downturns, with cash reserves still high after pandemic belt-tightening. While consumers remain concerned about the economic outlook, certain areas like restaurants, travel, groceries and apparel have held up despite falling real incomes.

Dividend growth helps compensate for market volatility and inflation. By receiving attractive dividends, investors are being ‘paid to wait’ until the true value of stocks is realised. Dividends can also help compensate for weaker capital returns when share prices are falling.

Diversification has worked

Having the flexibility to invest in companies across regions can lower portfolio risk because a global dividend portfolio can benefit from different macro environments and business cycles. During the pandemic, markets across the board suffered. Even defensive sectors like consumer staples and utilities were down – almost as much as technology and industrials. 2022 was the perfect example of the benefits that diversification can offer to income investors given it was a much more nuanced market environment. Our strategy was to focus on high-quality companies benefiting from strong pricing power (i.e., the ability to pass on rising costs to protect margins). Those look less enticing in a world in which interest rates are going up. We saw that companies like Coca-Cola, Mondelez (food & beverage manufacturer) and Merck (pharmaceuticals) were able to pass on significant price rises in line with inflation, which meant they were able to end the year with higher earnings, or at least in-line earnings.

There was a collapse in the valuations of some companies, particularly in the technology sector and among early-stage growth companies, given investors value these firms based on expectations for future profits. So, while 2022 was a volatile year, diversification worked. This is because some companies’ earnings fell sharply, creating a big disparity between those whose earnings held up and those that did not. Investing across a variety of companies thus helped to reduce overall portfolio risk.

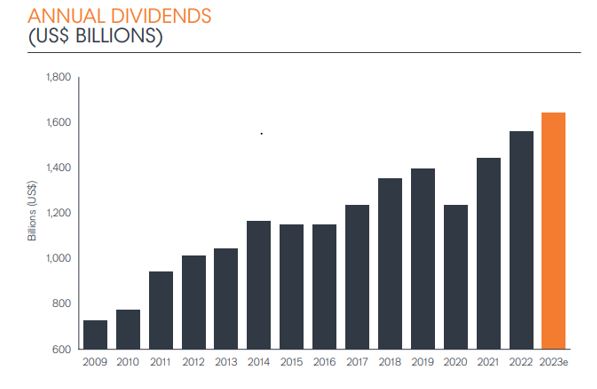

Dividends are still delivering surprises

Last year we consistently increased our dividend forecasts, with significant dividend growth driven by the recovery in areas like oil and financials. The corporate results in the first quarter of 2023 were generally solid, providing grounds for optimism rather than pessimism. We saw strong headline dividend growth of 12% in the first quarter, as reported by the Janus Henderson Global Dividend Index. This period benefited from some very large special dividends. Stripping these out, underlying growth was a more muted 3%, but there was nonetheless a slight upgrade to total forecasted dividends for 2023 of US$1.64 trillion.*

Global annual dividends

Source: Janus Henderson Investors as at 31 March 2023. There is no guarantee that past trends will continue, or forecasts will be realised.

Among the companies that announced special dividends were automotive manufacturers Volvo and Volkswagen, as well as companies in the oil, transport and software sectors. So, we are seeing slightly better dividend growth than we would expect from large-cap companies that do not have too much debt, and hence will likely be less impacted by much higher costs of debt refinancing.

We think dividend growth this year is likely to be more moderate; potentially around 5% to 7% because earnings growth is likely to be not as strong. Inflation, higher interest rates and tighter financial conditions increasingly will impact demand, putting profits and margins under pressure. That said, dividends tend to be much less volatile than profits over the cycle, so any slowdown or outright decline in earnings will likely have a more muted impact on payouts over the next year or so.

How sustainable are some of the current dividend payouts?

Despite pressure on company margins because of higher input costs across the board, dividend payouts appear sustainable. Areas like pharmaceuticals and consumer staples have provided that stability and consistency, and we’re seeing higher volatility in some of the more economically and demand-sensitive sectors like mining and materials, where there has been a shift towards variable dividends as part of a refocus on shareholder returns rather than ‘growth at all costs’. Mining giant BHP recently reported a much lower dividend year-on-year, but the markets didn’t react in a huge way because the expectation that dividends would be variable had already been well telegraphed.

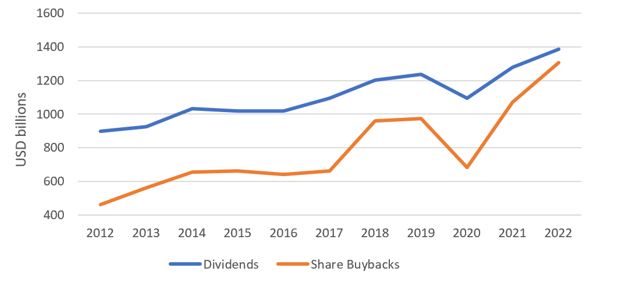

Share buybacks are increasingly beefing up total returns

An interesting trend that we have seen is the rapid growth in share buybacks, which has been a multi-year phenomenon. A consequence of this has been a significant increase in the importance of share buybacks. According to a special supplementary study related to the Janus Henderson Global Dividend Index, global buybacks have almost tripled in value since 2012 (+182%) to 2022, easily outpacing the 54% increase in dividends over the same period.

Share buybacks versus dividends

Source: FactSet, Janus Henderson Investors, data to 31 December 2022. Top 1,200 companies globally by market capitalisation. Past performance does not predict future returns.

In every region, almost every country and almost every sector, share buybacks have seen strong growth.

In the media sector, neither Facebook owner Meta nor Google owner Alphabet pays a dividend, but both are big buyers of their own shares. The global value of the sector’s share buybacks was eight times larger than dividends paid in 2022. By contrast, in the high dividend-yielding utilities sector, dividends were eight times larger than buybacks. Adding buybacks and dividends together, the so-called total shareholder yield, significantly reduces the differences.

We think this reflects a strong profit and free cash flow performance, and a willingness to reward shareholders without setting unintended expectations for dividends. Buybacks cannot always be relied on to enhance shareholder returns. Their discretionary nature makes them more volatile as evidenced in 2020’s COVID disruption when they fell dramatically.

In addition, they don’t always create shareholder value and some shareholders who rely on an income stream from their investments often prefer dividends. The global cost of capital is now significantly higher than in the last few years. The big question is what this will do to share buybacks in the months and years ahead. When companies could essentially access finance at almost zero cost, there was a huge incentive to issue debt and buy back shares as this added immense value. For companies generating very large amounts of cash, like Apple or Alphabet, this is not a major factor. For others, especially in the US, that have used borrowing to fund buybacks, the calculations will now be much more finely balanced.

Seeking out attractive income opportunities

At the moment, it is becoming trickier to properly distinguish between value and growth. For example, it is harder to see the true demand and supply trends within industries post-COVID – will the shift in consumer preferences stick? Supply chain issues, the stimulus that was applied in that period and the volatility of company results add complexity to investment analysis. The so-called value parts of the market are generating better growth now given higher inflation and the scarcity of resources around oil and gas.

Aside from financials, miners and oil & gas, there are also sectors that will benefit from long-term trends like technology use and adoption, and clean energy. What we have seen in many countries, including China, is how we’ve underestimated how quickly some areas of spending normalise (such as travel, eating out and entertainment). In Asia, companies with underappreciated potential look attractive, especially those that are emerging-markets focused, while in Japan, some companies are trading at cheap valuations versus history and haven’t been impacted by inflation or interest rate changes to the extent that their counterparts in the West have.

We continue to be positively surprised by the shareholder returns being announced in terms of both dividends and share buybacks. The robust shareholder returns from corporates suggest that management teams share our confidence in the long-term outlooks for their companies and that higher costs of debt are manageable at this stage.

Footnotes:

* The Janus Henderson Global Dividend Index (JHGDI) is a long-term study into global dividend trends. It measures the progress global firms are making in paying their investors an income on their capital by analysing dividends paid every quarter by the world’s largest 1,200 firms by market capitalisation. There is no guarantee that past trends will continue, or forecasts will be realised.

Headline growth rate describes the change in the total dollar amount paid by companies compared to the corresponding quarter each year. The underlying figure adjusts for the distortion that can be caused by one-off special dividends, changing exchange rates, the effect of companies entering and leaving the global top 1,200 that comprise the JHGDI and the impact of changes in payment dates.

IMPORTANT INFORMATION

Volatility measures risk using the dispersion of returns for a given investment.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Healthcare industries are subject to government regulation and reimbursement rates, as well as government approval of products and services, which could have a significant effect on price and availability, and can be significantly affected by rapid obsolescence and patent expirations.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.