Source: Morgan Stanley, Janus Henderson Investors as at 30 September 2025.

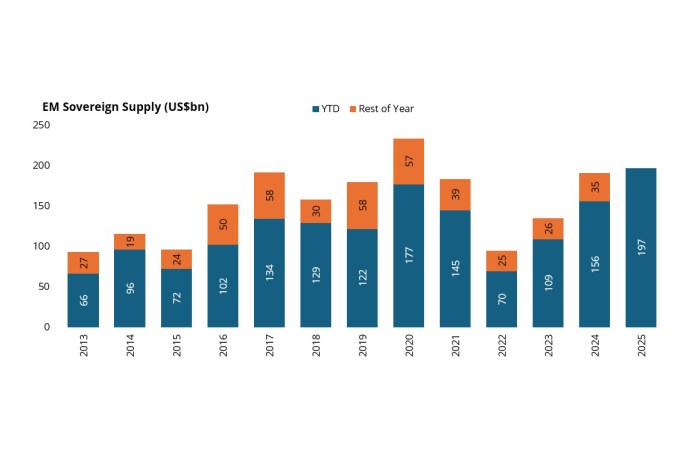

EM sovereign issuance has surged to nearly US$200bn year-to-date, marking the highest level for the first nine months of any calendar year. But what’s truly notable is the currency composition of new issuance. Euro-denominated bonds now account for 30% of new issuance (on a 12-month average basis), while the US dollar (USD) share has declined to around 50% versus recent peaks of 70% in 2021[1]. That means half of the new bonds issued are denominated in currencies other than the dollar.

We expect this trend to continue with EM sovereign issuers seeking to expand their financing options. Colombia issued a euro bond in September, which was the first euro issuance since March 2016. In 2025, other issuers such as Brazil have signalled plans for debut euro or other currency bonds, and even an Australian dollar issue for Indonesia.

What’s driving the shift?

With higher risk-free rates in the US compared to Europe and Japan for example, EM issuers are increasingly turning to euro, swiss franc and yen markets to reduce borrowing costs. Lower coupons in these currencies make issuance more attractive, while also broadening the investor base – especially among domestic investors seeking diversification away from the US dollar (in some instances into other safe haven currencies).

Active management maximises the EMD HC opportunity set

This trend underscores the growing relevance of active management in EMD HC. Unlike passive benchmarks such as JP Morgan EMBI Global Diversified, which only include USD-denominated bonds, active managers can tap into the full opportunity set. For example, it’s often possible to buy a euro-denominated bond from the same EM issuer, hedge the FX and rates risk back to USD, and enhance yield – without taking on additional credit risk.

Security selection – alongside country allocation – are key alpha drivers in our EMD portfolios. The ability to look beyond USD bonds has consistently added value, and this evolving issuance landscape makes the case for active management even stronger.

– Jacob Nielsen, Portfolio Manager

Footnotes

[1] Source: Bond Radar, Bloomberg, Morgan Stanley Research, as at 30 September 2025. Share of sovereign issuance by currency is based on number of bonds issued in each currency as a proportion of total not the market value.

IMPORTANT INFORMATION

The J.P. Morgan EMBI Global Diversified Index (EMBIGD) tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

Emerging market investments have historically been subject to significant gains and/or losses. As such, returns may be subject to volatility.

Sovereign debt securities are subject to the additional risk that, under some political, diplomatic, social or economic circumstances, some developing countries that issue lower quality debt securities may be unable or unwilling to make principal or interest payments as they come due.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Alpha: Alpha is the difference between a portfolio’s return and its benchmark index after adjusting for the level of risk taken. This measure is used to help determine whether an actively-managed portfolio has added value relative to a benchmark index, taking into account the risk taken. A positive alpha indicates that a manager has added value.

Coupon: A regular interest payment that is paid on a bond described as a percentage of the face value of an investment. For example, if a bond has a face value of £100 and a 5% annual coupon, the bond will pay £5 a year in interest.

Credit risk: The risk that a borrower will default on its contractual obligations to make the required interest payments or repay the loan. Anything that improves conditions for a company can help to lower credit risk.

Currency hedge: A transaction that aims to reduce the impact of currency fluctuations on the value of an investment; this is done by using derivatives.

Diversification: A way of spreading risk by mixing different types of assets or asset classes in a portfolio on the assumption that these assets will behave differently in any given scenario.

FX risk: FX risk, also known as foreign exchange risk or currency risk, refers to the potential for financial losses resulting from fluctuations in the exchange rate between two currencies.

Refinancing: The process of revising and replacing the terms of an existing borrowing agreement, including replacing debt with new borrowing before or at the time of the debt maturity.

Risk-free rate: The rate of return of an investment with theoretically zero risk. The benchmark for the risk-free rate varies between countries. In the US for example, the yield on a 3-month US Treasury bill (a short-term, money-market instrument) is often used.

Safe haven: An asset that is expected to retain its value or potentially gain value during periods of economic uncertainty or market turbulence (e.g., gold, US government debt, the US dollar, cash, etc.).

Yield: The level of income on a security expressed as a percentage rate. For a bond, this is calculated as the coupon payment divided by the current bond price. There is an inverse relationship between bond yields and bond prices. Lower bond yields mean higher bond prices, and vice versa.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.