Global dividends rose to a record $568.1 billion in Q2

According to the latest Janus Henderson Global Dividend Index, global dividends reached $568 billion in the second quarter of 2023, with underlying growth of 6.3%. Head of Global Equity Income Ben Lofthouse and Client Portfolio Manager Jane Shoemake discuss the key drivers and their outlook for dividend growth through the end of the year.

30 minute read

Key takeaways:

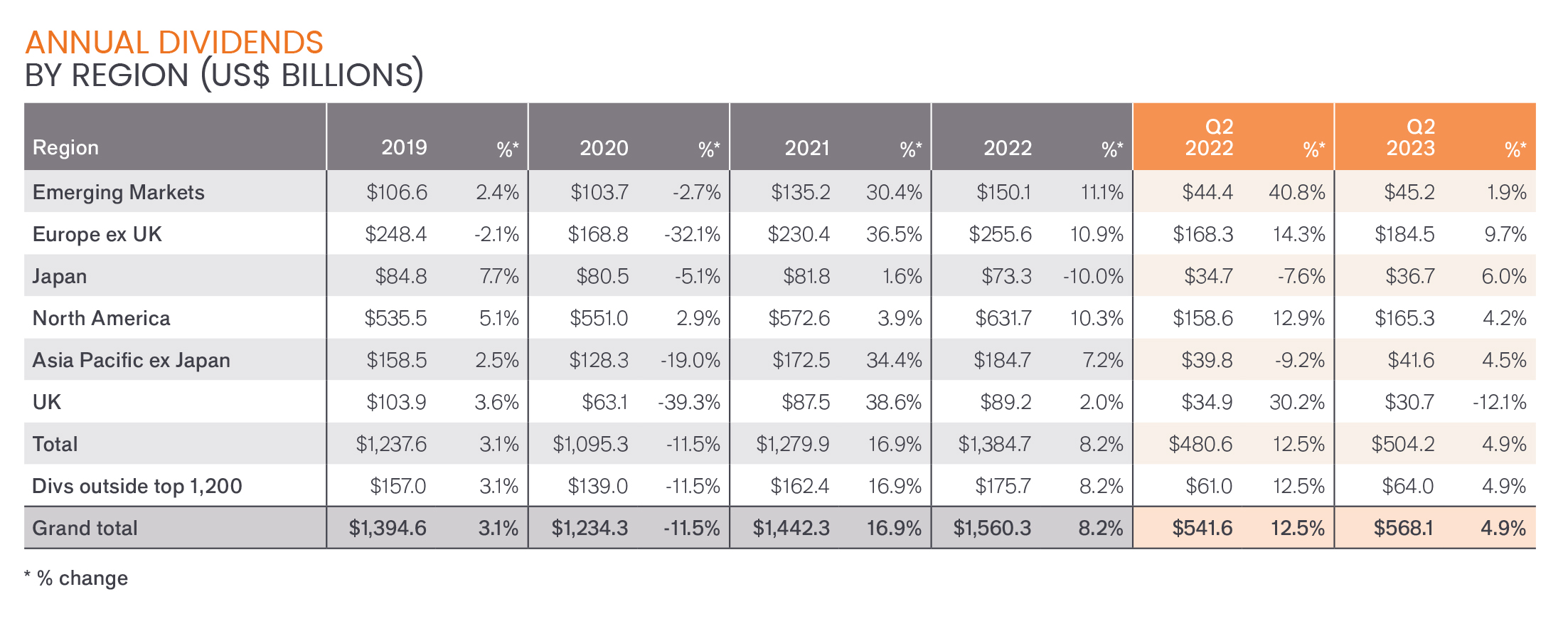

- Global dividends rose to a record $568.1 billion in the second quarter, up 4.9% on a headline basis. Globally, 88% of companies either increased dividends or held them steady in Q2.

- Underlying growth of 6.3%, once lower special dividends were excluded, marked an acceleration compared to the first quarter.

- Janus Henderson has not changed its 2023 forecast given uncertainty about the global economy, but still expects dividends to rise 5.2% on a headline basis to $1.64 trillion, equivalent to underlying growth of 5.0%.

The Janus Henderson Global Dividend Index (JHGDI) is a quarterly, long-term study into global dividend trends. The index measures the progress global firms are making in paying their investors an income on their capital.

According to the latest edition of the JHGDI, global dividends had a strong second quarter, just ahead of our optimistic expectations. Payouts reached a new record of $568.1 billion, up 4.9% year-on-year on a headline basis. Underlying growth of 6.3%, once lower special dividends were excluded, marked an acceleration compared to the first quarter and reflected the seasonal dominance of Europe during the second quarter.

European payouts rose by a tenth year-on-year (+9.7% headline, +10.0% underlying), reflecting strong profitability in the 2022 financial year, with most European companies making their customary single annual payment. Much higher banking dividends were the most important driver of European growth, followed by vehicle manufacturers. Indeed, banks accounted for half the global growth in Q2 as rising interest rates boosted margins and pandemic related disruption to dividend payments finally worked its way out of the numbers.

The pattern was evident all over the world with few exceptions. For example, in the UK total payouts were resilient in the face of lower mining dividends as HSBC returned to quarterly payments at a much higher level than seemed possible even a few months ago, while in Singapore, banks propelled the total paid to record levels.

Q2 is also seasonally important in Japan and payouts here rose 8.4% on an underlying basis, well ahead of the global average. Half the Japanese companies in our index delivered double-digit increases. The rate of growth in the U.S. continued its steady deceleration, however, while in Asia-Pacific ex Japan, Hong Kong and South Korea were relative weak spots. Emerging market dividends fell.

From a sector perspective, beyond the strong contribution made by banks, vehicle manufacturers accounted for one seventh of the year-on-year increase in Q2 payouts. Half of this came from German companies, but the sector was strong all over the world. Miners made the biggest negative contribution, owing to lower commodity prices, while oil payouts fell owing to cuts from Latin American producers.

Globally, 88% of companies either increased dividends or held them steady in Q2.

The second quarter was very positive for dividend payments, but when we speak to companies around the world, they are cautious about the outlook for growth. Having upgraded our 2023 global forecast in our last report, we are now prudently holding that dividend forecast steady for the year. We expect payouts to rise 5.2% on a headline basis to a record $1.64 trillion, equivalent to underlying growth of 5.0%.

Unless otherwise stated, all data is sourced by Janus Henderson Investors as of 30 June 2023. Nothing in this document should be construed as advice.

Past performance does not predict future returns. International investing involves certain risks and increased volatility. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments.

The value of an investment and the income from it can fall as well as rise and you may not get back the amount initially invested.

JHI

JHI

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.