Alison Porter

Portfolio Manager

Alison Porter is a Portfolio Manager on the Global Technology Leaders Team at Janus Henderson Investors, a position she has held since joining Henderson in 2014.Prior to Henderson, she was at Ignis Asset Management (formerly Resolution and Britannic Asset Management) as an investment analyst, portfolio manager, and head of US equities.

Alison has a BA degree (Hons) in economics and industrial relations from the University of Strathclyde and a master’s degree in investment analysis from the University of Stirling. She has 31 years of financial industry experience.

Articles Written

Payment innovation: Progress in the shift towards digital finance

How are stablecoins, tokenization, and artificial intelligence (AI) reshaping payment systems and financial markets?

Riding the AI wave: How can tech investors harness change and volatility?

Selectivity and valuation discipline are key to investing in tech stocks as as AI continues to drive economic transformation in 2026 and beyond.

Janus Henderson Live: Investing responsibly in the power of AI

AI is reshaping industries with applications ranging from cancer detection to surgical training, underscoring the need for active research and responsible engagement.

AI versus the Dotcom Bubble: 8 reasons the AI wave is different

Why the AI wave’s unique dynamics distinguish it from the dotcom era.

AI: A real gamechanger for sports

How AI and accelerating technology adoption is disrupting sports.

Global Technology Leaders strategy update

Richard Clode and Alison Porter, Portfolio Managers at Janus Henderson joined for a Q&A webcast where they covered the biggest topics shaping Tech markets in 2025.

Autonomous driving: Physical AI is moving closer

Commercial development and adoption of autonomous driving is being driven by accelerating AI advancements.

Tech stocks and tariffs: 5 key considerations for investors

A discussion on how tariffs will impact the technology sector.

Why choose a tech fund over individual stock picking?

What are the benefits of an active fund approach to investing in tech stocks compared to picking individual stocks?

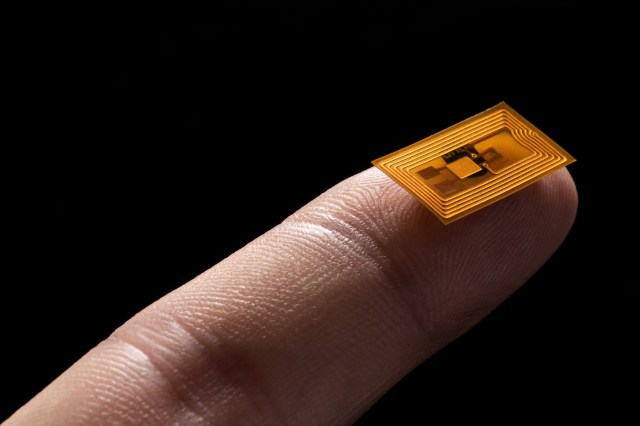

Impinj is enabling resource and productivity optimisation

Tech companies like Impinj are providing solutions to businesses in the quest to achieve better efficiency, productivity and sustainability.

Shifting demographics are driving tech and sustainability preferences

Findings from a study into generational preferences and attitudes toward technology and sustainability.

Global Perspectives: AI – Invest with patience

Discussion on the implications for tech investing in terms of demographic differences, geopolitical factors, and why patience is needed to invest in AI opportunities.