Source: BofA Global Research, QUICK. Japan Equity Strategy note 2 June 2025. Based on TOPIX constituents. Tokyo Stock Price Index (TOPIX) is a free-float adjusted market capitalisation-weighted index used as a benchmark for investment in Japanese stocks. The TOPIX Index Value and the TOPIX Marks are subject to the proprietary rights owned by JPX Market Innovation & Research, Inc. or affiliates of JPX Market Innovation & Research, Inc.

Investors should look beyond the volatility and uncertainty caused by US policy rates, still ongoing US-Japan trade deal talks, and the Bank of Japan’s pursuit of rate normalisation. Instead, they should focus on the certainty of Japanese corporate reform efforts that are gaining momentum. This is being boosted by the transition to an inflationary economy with companies more likely to be able to pass on price hikes to customers, improving margins, supporting wage hikes and consumer spending, and ultimately feeding through into economic strength.

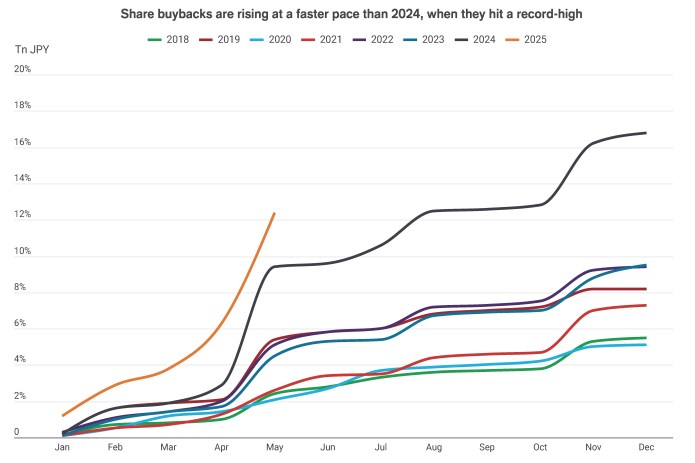

Many Japanese companies have accumulated capital much higher than the optimal level. Led by Tokyo Stock Exchange initiatives, more and more corporates are working towards optimising their capital structures by increasing dividend payout ratios and conducting share buybacks.

This combination of factors is improving Japanese companies’ return on equity (ROE), which for decades has been low. In fact, Japan is catching up with developed economies; Japanese companies’ total shareholder return ratio in FY 2024 was on par with European companies at 60%.1

The outlook for Japanese equities remains supportive. With corporate reforms in full swing, this should continue to provide a tailwind for the positive flows into the asset class that we have seen since mid-April, amid the rotation out of US stocks and should pick up as tariffs uncertainty fades.

We believe active stock picking focusing on quality businesses with strong management teams that are cognisant of their capital allocation and shareholder return is a prudent investment approach.

1 JP Morgan Japan Equity Strategy: 2025 Mid-Year Outlook, 27 June 2025.

Capital structure: refers to the amount of debt and/or equity used by a company to fund its operations and finance its assets. The optimal capital structure is the proportion of debt and equity that results in the lowest weighted average cost of capital (WACC), ie. the blended cost of all sources of capital, including common shares, preferred shares, and debt.

Dividend payout ratio: the percentage of earnings (after tax) that are distributed to shareholders in the form of dividends in a year.

Return on equity (ROE): a company’s net income (income minus expenses and taxes) over a specified period, divided by the amount of money its shareholders have invested. It is used as a measurement of a company’s profitability, compared to its peers. A higher ROE generally indicates that a management team is more efficient at generating a return from investment.

Share buybacks: when a company buys back its own shares from the market, it leads to a reduction in the number of shares in circulation, and as a consequence increases the value of each remaining share. A company may launch a buyback because it believes its shares are undervalued and it wants to provide investors with a better return.

Total shareholder return: the overall appreciation in the stock’s price per share, plus any dividends paid by the company, during a particular measured interval; this sum is then divided by the initial purchase price of the stock.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.