For years, mitigation efforts to reduce carbon emissions have dominated climate discussions and funding. But as climate-related disasters intensify and mitigation efforts fall short of targets, climate adaptation – preparing for and adjusting to the impacts of climate change – is gaining prominence.

This growing prominence is expanding market opportunities across an established but evolving set of adaptation solutions and technologies.

A market driven by reality and policy

The drivers accelerating demand for adaptation solutions are straightforward. Regardless of one’s stance on climate policy or mitigation targets, the physical impacts are increasingly visible. Each year brings hotter temperatures, more frequent floods, and hurricanes that affect communities and businesses alike. We’re seeing this play out in real time, from California wildfires driving insurers out of markets due to unsustainable coverage costs under regulatory price caps, to Houston grappling with multi-day storm flooding.

The policy backdrop is fragmented and imperfect, but supportive overall. In the U.S., the 2021 bipartisan infrastructure law included funding for climate resilience and adaptation. Certain provisions in the Inflation Reduction Act that support adaptation weren’t reduced as much as some expected under the current administration. And post-disaster relief bills continue to pass following major hurricanes and other climate events, creating ongoing funding streams.

Outside the U.S., Europe remains active, and development finance institutions have elevated adaptation in emerging markets programs. Notably, at the latest UN climate summit (COP30), nations agreed on a first-ever set of 59 adaptation indicators, creating a framework to track climate adaptation progress globally. This provides investors and policymakers with a clearer “common language” on adaptation goals and outcomes.

While policy can swing, we think the direction of travel is durable. Both parties in the U.S. recognize that upgrading aging infrastructure and building resilience contributes directly to economic growth. This bipartisan need provides a structural tailwind regardless of which party holds power.

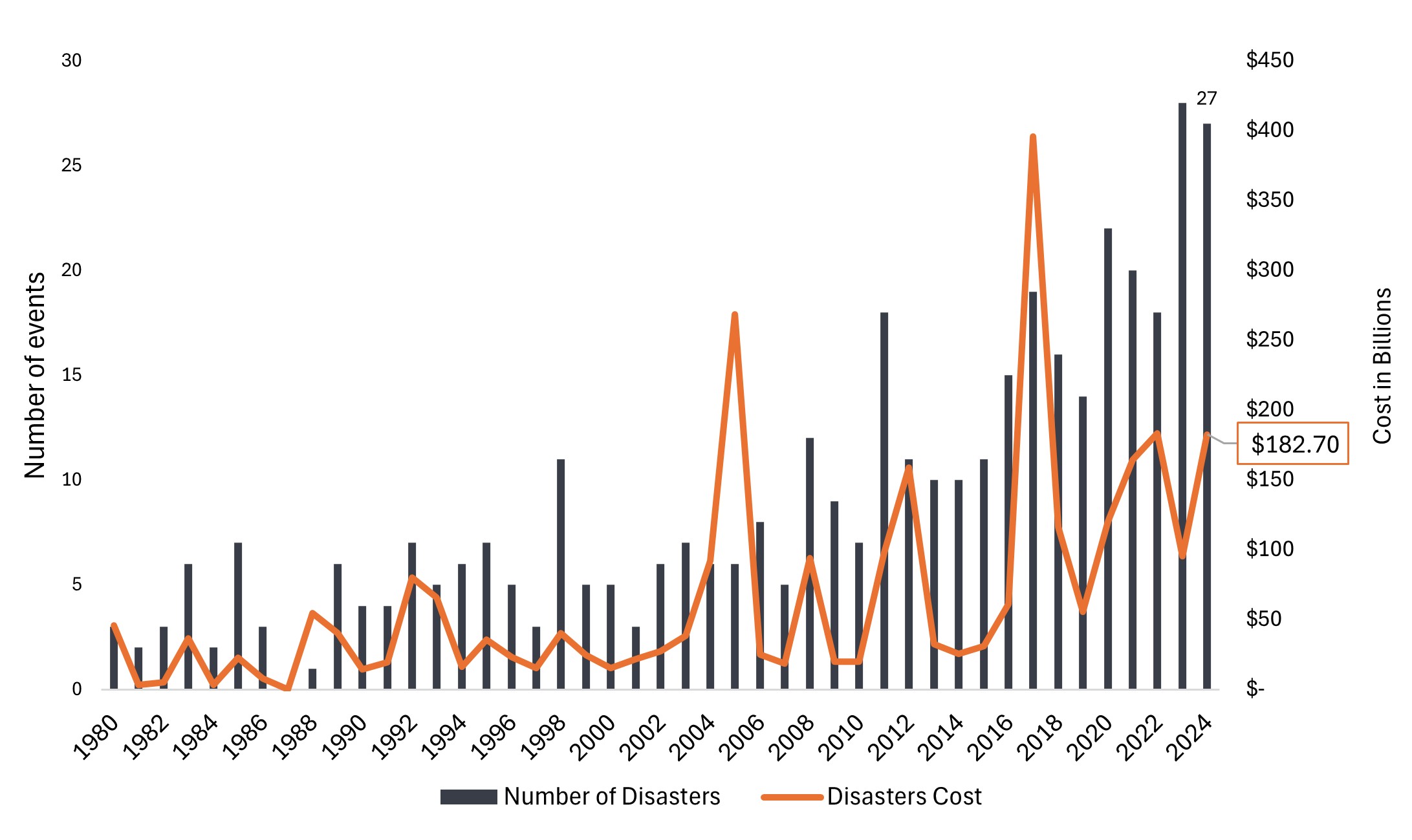

Exhibit 1: U.S. billion-dollar disaster events from 1980 to 2024, adjusted for inflation

Losses from these events have averaged $140 billion per year over 10 years through 2024.

Source: NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2025).

Where to find exposure

Investing in adaptation-solution providers covers a broad ecosystem spanning several industries. There are opportunities to gain exposure through water infrastructure and treatment, insurance and risk transfer, engineering and consulting, and materials and HVAC tied to resilient buildings. These are solutions that move water, harden assets, and price risk.

It’s worth noting that no company represents a pure climate adaptation play, as each faces its own fundamental considerations and market dynamics. HVAC manufacturers, for example, might see strong data center demand but face offsetting weakness in residential markets. Investors need to evaluate each opportunity individually while recognizing the structural tailwinds supporting the broader theme.

Water infrastructure: Solutions for scarcity and excess

Water infrastructure represents one of the more notable areas within climate adaptation. Major corporations increasingly face water constraints as data centers and semiconductor facilities require enormous amounts of clean water. In many jurisdictions, local utilities say they simply can’t provide more supply. Drought conditions, particularly across the western U.S., have intensified these challenges.

This has created opportunities for companies offering water-as-a-service solutions that enable circular water utilization, allowing corporations to reuse water rather than drawing continuously from strained local supplies. The same companies often play a critical role in storm water management. When a hurricane dumps days of rain on a city, removing and redirecting that water becomes essential. The equipment and expertise required represents another facet of the adaptation opportunity.

Many water infrastructure companies possess specialized intellectual property, and those able to execute better than competitors can ride a structural wave of growing demand. Given decades of underinvestment in U.S. infrastructure, we expect sustained federal and state spending to smooth out traditional cycles.

Insurance: Aligning incentives with resilience

We think the insurance sector is one of the most underappreciated adaptation angles. The sector has integrated climate into risk models for years, and now we are seeing more incentives for policyholders to take their own adaptation actions, with the goal of lowering damages and keeping premiums affordable.

The business case is clear: Reduce damage, lower loss costs, and maintain insurability. As premiums rise, fewer people can afford coverage. In several U.S. states, property insurance has already become difficult or unavailable in high-risk zones. California wildfires and Florida hurricanes have created a crisis of affordability and access.

Some property and casualty insurers have established climate change institutes that help local governments anticipate climate risks and advise communities on where not to build and how to strengthen resilience. Insurers also provide incentives for policyholders to take adaptation actions that reduce premiums, creating a positive feedback loop.

In addition, concepts like parametric insurance policies, which pay out based on predetermined triggers such as a specific wind speed or rainfall level rather than assessed damages, represent an innovative approach that is gaining traction as a tool for rapid post-disaster recovery.

Done well, helping customers adapt may help reduce claim severity, protect market share, and support profitability.

Engineering, materials, and building systems

Engineering and consulting firms play an often-underappreciated but mission-critical role in climate adaptation. Whether the need is transportation infrastructure, storm water removal, or facility upgrades, these firms provide the expertise to design and implement solutions, from flood barriers to climate-smart urban planning.

Materials and building systems round out the backbone. Building materials companies that supply roofing and other products see rising demand as rebuilding costs surge post-disaster. Innovators in durable, weather-resistant materials—such as hurricane-proof roofing or fire-resistant composites—are benefiting from this trend.

HVAC is a straightforward adaptation play as heat becomes more extreme. Cooling is not only about comfort; data centers and other mission-critical facilities require efficient climate control, driving demand even as residential cycles can weigh on near-term results. As with many adaptation-linked businesses, exposure is mixed, but the underlying need is growing.

A long-duration opportunity

There is a massive, structural need to upgrade infrastructure and support a more resilient economy, and we believe that work will continue.

From a market perspective, this is a financially material opportunity rooted in practical solutions: water treatment and storm drainage, insurance that aligns prevention with affordability, engineering that makes projects happen, and materials and systems that keep buildings standing and operating.

We see a structural wave of investment building. Decades of underinvestment in U.S. infrastructure and new public funding can help smooth traditional cyclicality. The demand for resilient systems is not a one-quarter or even one-year story. It is, in our view, a long-duration trend.

We believe the winners will be the companies that can solve real problems, at scale, in the physical world. As physical risks rise, the adaptation conversation is getting louder, and the market implications are getting clearer.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.