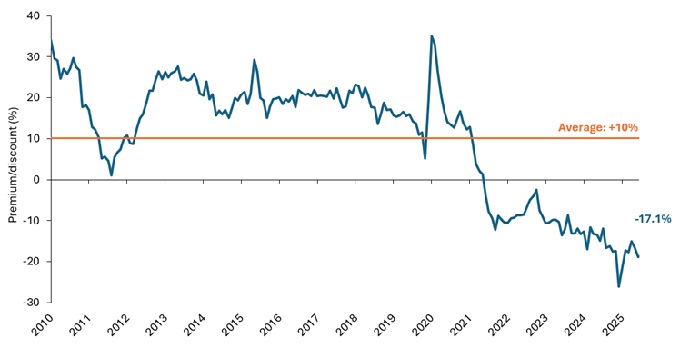

Global small caps have struggled to match large caps since 2022, a decline driven by macroeconomic (macro) shocks: surging inflation, aggressive interest rate hikes, geopolitical conflicts, energy market volatility, and prolonged inventory adjustments post-COVID. This has prompted investors to de-risk their portfolios, which has led valuations to move from trading at a premium, relative to large caps, to a meaningful discount today.

However, conditions are reversing. Inflation is at more moderate levels, conflicts are easing, energy prices have stabilised, and central banks are re-setting monetary policy, with more interest rates cuts expected. Destocking of inventories is largely complete, improving supply chain dynamics. As these changes are yet to be reflected in prices for small cap stocks, partly due to relatively anaemic earnings growth –this leaves global small caps primed for a potential re-rating, should economic confidence and earnings momentum strengthen into 2026.

The stage is set for small cap resurgence

There are several key themes that we expect to shape the prospects for global small caps in 2026:

1) Economic recovery: Small caps are well positioned to benefit from broadening global economic growth. Lower interest rates, improving sentiment and spending initiatives help to support stronger demand.

2) AI integration: While small caps are not going to compete with big tech firms in building the next dominant large language model (LLM), the scale of labour intensity means that adopting AI-driven efficiencies can help smaller companies to deliver significant growth opportunities.

3) M&A acceleration: Lower borrowing costs and growing confidence are favourable conditions for mergers and acquisition (M&A) activity. This is an area where small caps are likely to be a significant beneficiary, both as acquisition/merger targets, and through financials that thrive on increased deal activity.

4) Geopolitical stabilisation: A de-escalation in global conflicts in places like Ukraine opens the door to significant infrastructure and industrial spending to help the rebuilding process – areas where small caps have strong representation. Peace also helps to build confidence, encouraging risk appetite among investors and consumer activity, and improving the prospects for lower energy prices.

Risks and opportunities for global small caps

The current macroeconomic backdrop is something we look at from a glass half full perspective for small cap stocks. On the positive side, we see a supportive US policy backdrop ahead of midterm elections helping to broaden economic growth beyond big-tech AI spending. In Europe, Germany’s fiscal stimulus and debt brake release offer a strong catalyst for recovery, while Southern Europe continues to deliver solid growth. In the UK, a three-year suspension in stamp duty on new stock market listings following a company’s initial public offering (IPO) should hopefully encourage growth and liquidity in the small-cap space. We see these factors as helpful tailwinds in narrowing the valuation gap between small and large caps.

However, risks remain. While AI-related spending is likely to continue, its concentration among mega-cap tech and private giants underscores the challenge for smaller firms to capture meaningful upside. Overall, the environment favours selective positioning and diversified exposure, as inefficiencies create opportunities but demand caution.

Growth potential at a lower price

Overall, 2026 looks promising for small caps as macro tailwinds, technological adoption, and strategic activity converge to narrow the valuation gap with large caps (Exhibit 1). We are big believers over the long term that smaller companies can deliver strong operational performance. This is not currently reflected in their valuations. Should conditions align favourably, the smaller cap space could deliver strong growth prospects for investors.

Exhibit 1: Global small cap valuations remain attractive relative to large caps

Source: Bloomberg, Janus Henderson Investors Analysis, at 12 November 2025.

Indices used: MSCI World Small Cap, MSCI World. There is no guarantee that past trends will continue, or forecasts will be realised. Past performance does not predict future returns.

Debt brake: Germany’s balanced budget fiscal rule, ie, strict limits that prohibit the federal government and states from taking extra loans (focusing on balancing their books).

Fiscal stimulus: Fiscal measures are those related to government policy regarding setting tax rates and spending levels. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and retail price index (RPI) are two common measures.

Interest rates: The amount charged for borrowing money, shown as a percentage of the amount owed. Base interest rates (the Bank Rate) are generally set by central banks, such as the Federal Reserve in the US or Bank of England in the UK, and influence the interest rates that lenders charge to access their own lending or saving.

Large caps: Well-established companies with a valuation (market capitalisation) at the larger end of the scale; it can also be used as a relative term. Large-cap indices, such as the UK’s FTSE 100 or the S&P 500 in the US, track the performance of the largest publicly traded companies rather than all stocks above a certain size.

Macroeconomics: Macroeconomics is the branch of economics that considers large-scale factors related to the economy, such as inflation, unemployment, or productivity.

Mega caps: The largest designation for companies in terms of market capitalisation. These tend to be major, highly recognisable companies with international exposure, often comprising a significant weighting in an index.

Small caps: Companies with a valuation (market capitalisation) at the smaller end of the market scale. Examples of small-cap indices include the FTSE SmallCap and the Russell 2000 in the US. Small-cap stocks tend to offer the potential for faster growth than their larger peers, but with greater volatility.

Valuation: The worth of an asset, such as a company, security, or other investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.