The outlook for the US economy remains caught between a soft labour market, resilient consumption and some signs of a broader re-acceleration in surveys. However, analysis of the world’s biggest economy has been somewhat hampered by the lack of official data due to the US government shutdown that occurred in late 2025. Labour market weakness has been in focus increasingly, with the recent uptick in US unemployment likely to influence the Federal Reserve’s thinking in the months ahead. November’s inflation reading was notably soft, though partly shaped by methodological factors, and may offer only limited support for additional easing. With uncertainty around the inflation outlook persisting, interest rate decisions in early 2026 are set to remain finely balanced as the Fed weighs conflicting signals.

Tax cuts as a result of the One Big Beautiful Bill Act are likely to encourage business investment and could support the US consumer. We see company earnings remaining solid and the potential for further merger and acquisition (M&A) activity. The big caveat to US equities is rich valuations, with many companies trading on relatively high price/earnings ratios. After a strong run, we may see more volatility going forward.

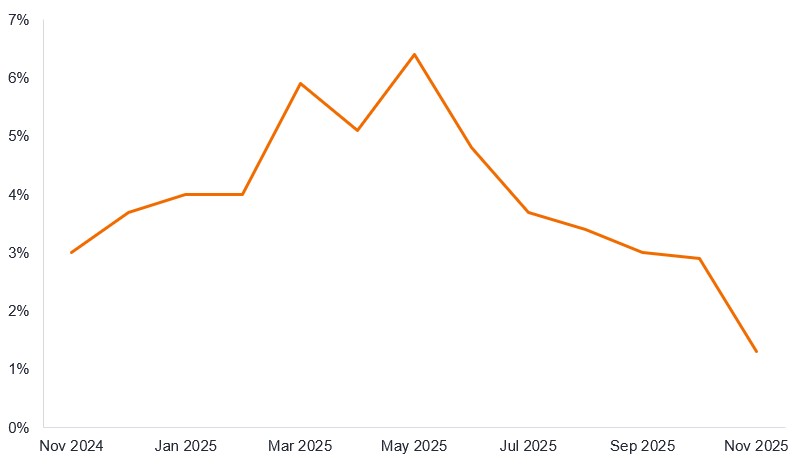

Elsewhere, there are signs of slowing growth in China as investment stalls, retail sales growth slows and house prices are falling faster again. The decline in fixed asset investment (a contraction of 2.6% over the January-November 2025 period) appears to have percolated through the economy, weighing on consumer confidence. While industrial output held up (up 4.8% year-over-year in November) despite the tariff shocks, domestic consumption in China remains moribund (see Figure 1).1

Figure 1: Total retail sales of consumer goods in China (year-on-year % growth)

Source: China National Bureau of Statistics, November 2024 to November 2025.

In contrast, there are some signs of improvement in Europe. We believe that the German fiscal stimulus should begin to have an effect on the regional economy more broadly in 2026 and the European Central Bank (ECB) has already lowered interest rates meaningfully. To some extent, European equity prices already reflect this, with the STOXX 600 Index up 19.4% in euro terms (26.3% in sterling terms) year to date, and defence-related companies having performed particularly well.2 However, European equities remain cheaper on a price/earnings ratio basis (16x forward earnings) than the US (22x forward earnings), with lower earnings expectations offering more potential for upside surprise.3 Geopolitically, a resolution of the Russia-Ukraine conflict would be welcome, although hopes have been dashed several times before and it is difficult to gauge what the impact might be on Europe’s economy and markets. There may be a relief rally which is tempered by the practicalities and costs of rebuilding Ukraine.

Market sensitivities around rates, geopolitics and AI

Markets remain highly sensitive to trade developments, signals on the interest rate outlook, and any indication of a slowdown in the artificial intelligence (AI)-driven investment boom. While reduced uncertainty around trade tariffs has supported risk assets, the recent rally in gold appears driven by expectations of lower interest rates alongside broader uncertainty — including geopolitical risks such as Venezuela, the potential expropriation of Russian assets in Europe, and continued central bank buying. Any perception that the Fed may ease policy more slowly than anticipated still tends to weigh on asset prices.

The AI theme could still have room to run in equity markets, but we should expect volatility along the way. Markets are likely to be more circumspect around whether AI adoption translates into meaningful productivity gains and can ultimately boost corporate profitability. A key question remains how countries manage structurally higher energy demand from data centres to support AI compute and increasing electrification. This, in itself, is creating new investment opportunities within infrastructure.

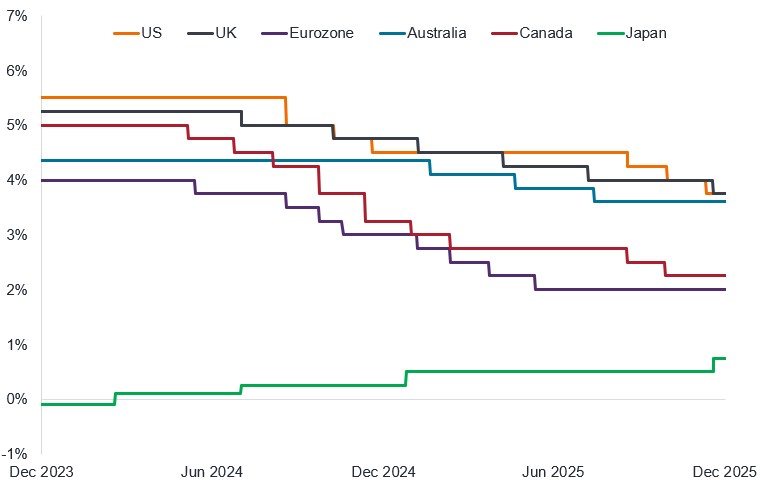

Fixed income markets likely to see more divergence

Within fixed income markets 2026 is likely to bring a more differentiated market. Most of the developed world has been in policy easing mode but 2026 looks to be a year of greater divergence. We can probably expect further interest rate cuts in the US and the UK, but it is looking increasingly likely that the next move in rates in Australia or Canada could well be a rise. Meanwhile Japan is expected to continue to normalise interest rates.

Figure 2: Policy interest rate direction set to diverge

Interest rates (%)

Source: LSEG Datastream, policy interest rate of US Federal Reserve, Bank of England, European Central Bank, Reserve Bank of Australia, Bank of Canada, Bank of Japan, 31 December 2023 to 29 December 2025.

Government bonds remain caught between soft labour markets, concerns about government debt levels and worries among central banks about inflation reasserting itself. We await greater clarity on the US labour market as an indicator of global economic momentum that will likely dictate the medium-term trend in yields. Among corporate bonds, credit spreads (the difference in yield between a corporate bond and a government bond of similar maturity) remain low. This is a signal that markets are reasonably confident that companies can repay their debt. Nevertheless, this leaves little room for error and limited scope for spreads to decline further. While we think spreads could remain rangebound and yields remain attractive, we believe that investors need to be increasingly selective, particularly as we anticipate a rise in debt issuance in 2026.

All told, expectations are that corporate earnings will grow positively on average in most regions in 2026. This should support asset markets but we need to be mindful that markets have been on an extended rally since the lows of the Covid pandemic and valuations are not cheap. We believe it is too early to call the end of the current economic cycle but see advantages in having a diverse portfolio that can manoeuvre between different asset classes and potentially benefit from uncertainty.

1Source: China National Bureau of Statistics, December 2025.

2Source: LSEG Datastream, EuroStoxx 600 Index, total return terms, 31 December 2024 to 22 December 2025. Past performance does not predict future returns.

3Source: LSEG Datastream, estimated forward price earnings ratios of MSCI USA and MSCI Europe ex UK Index at 22 December 2025. Forward price earnings reflect the share price divided by estimated earnings per share over the next 12 months. For an index this is done at an aggregate level. There is no guarantee that past trends will continue, or forecasts will be realised.

Fiscal/Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal policy is separate from monetary policy, which is typically set by a central bank. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Inflation: The rate at which prices of goods and services are rising in the economy.

Issuance: The act of making bonds available to investors by the borrowing (issuing) company, typically through a sale of bonds to the public or financial institutions.

Interest rate cycle: The interest rate cycle reflects the fluctuation of interest rates over time. It is typically linked to the economic cycle as central banks alter monetary policy in response to economic conditions.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money.

Price/earnings ratio: A popular ratio used to value a company’s shares compared to other stocks or a benchmark index. It is calculated by dividing the current share price by its earnings per share. Forward price/earnings ratio is a version of the P/E ratio used to value a company’s shares that utilises forecasted earnings for the next 12 months in its calculation.

Tariff: A tax or duty imposed by a government on goods imported from other countries.

Valuation: An estimation of the worth of something, usually using financial metrics. If something has a high or rich valuation it is typically viewed as expensive, whereas if valuations are low they are typically considered inexpensive.

Volatility: The rate and extent at which the price of a portfolio, security, or index, moves up and down.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund invests in other funds (including exchange-traded funds and investment trusts/companies). This may introduce more risky assets, derivative usage and other risks associated with the underlying funds, as well as contributing to a higher level of ongoing charges.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.