You need a long memory to remember when the US equity market was not the outperforming index globally. This trend has been fuelled by significant innovations within the US technology sector and, in particular, the ‘Magnificent 7’ stocks, which have dominated returns in recent years, driving the outperformance against the UK.

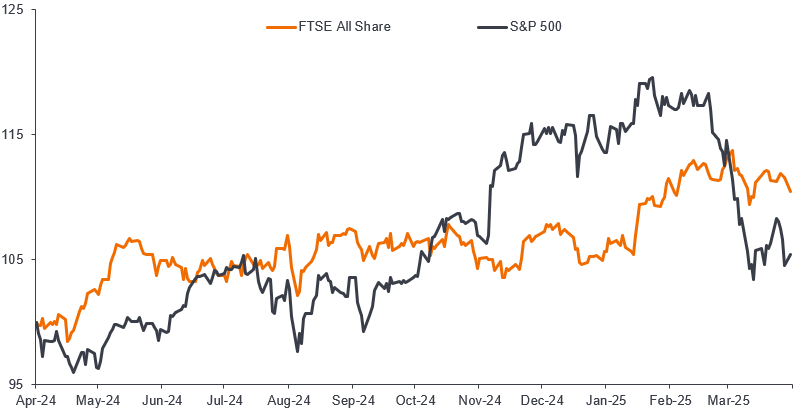

Since the Global Financial Crisis (GFC), and especially post-Brexit, the UK equity market has been a serial underperformer. However, amidst recent shifts, including US President Donald Trump’s tariff policies, rising concerns over a potential US recession, and heightened market volatility, UK equities have begun to show a performance uptick (Figure 1).

Figure 1: UK vs US equities on a one-year view

Source: Bloomberg, as at 31 March 2025.

Note: FTSE All-Share versus S&P 500 Index total returns in sterling, rebased to 100 as at 31 March 2025. Past performance does not predict future returns.

UK economic outlook

We believe there are five factors that currently support a reassessment of the attractiveness of UK equities several factors:

- The UK’s projected economic growth for 2025 stands at approximately 0.9%, which, while modest, surpasses the expectations for Germany, Italy and France, and aligns closely with Japan’s forecast. In contrast, the US’ GDP growth projection has been adjusted sharply downward to 1.4% from an earlier consensus of 2.3% just a few months ago.

- The UK economy, with its heavy reliance on the services sector which constitutes about 80% of its GDP, renders it less vulnerable to the impact of international tariffs when compared to nations with more manufacturing-focused economies.

- UK interest rates are now anticipated to decrease more rapidly than previously expected. Market forecasts now predict a drop to around 3.5% by year-end from the current rate of 4.25%.

- The combination of a robust British Pound, particularly against a weakening US Dollar, and decreasing energy costs are disinflationary forces that should provide the Bank of England with the flexibility to reduce interest rates as global economic activity decelerates. The financial health of the UK consumer is more robust than recent headlines suggest. Wage growth currently outpaces inflation, contributing to a solid foundation for consumer spending. Notably, aggregate consumer savings now exceed consumer debt levels. Additionally, unlike in the US, the savings accumulated during the COVID-19 pandemic have largely been retained, rather than spent. This has propelled the UK savings ratio to a multi-year high. The readiness of UK consumers to increase spending, if confidence improves, would help boost economic growth and presents an attractive opportunity for investors.

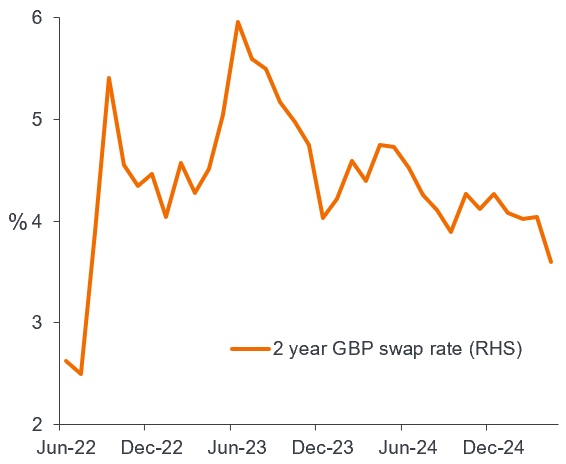

- Mortgage rates have been declining, while the availability of higher loan-to-value mortgages has improved. This is benefiting homeowners looking to remortgage and aiding first-time buyers. Recent data indicates a positive trend, with mortgage approvals increasing by 8% year-on-year, suggesting a more accessible lending environment that could help stimulate the housing market.

Figure 2: Mortgage costs have been falling

Source: Bloomberg, Janus Henderson Investors Analysis, as at 30 April 2025.

Note: Swap rates underpin fixed mortgage pricing so are an important driver of the mortgage rates offered for 2-year fixed mortgages. When swap rates rise, fixed mortgage rates typically increase. When swap rates fall, fixed rate mortgages typically decrease.

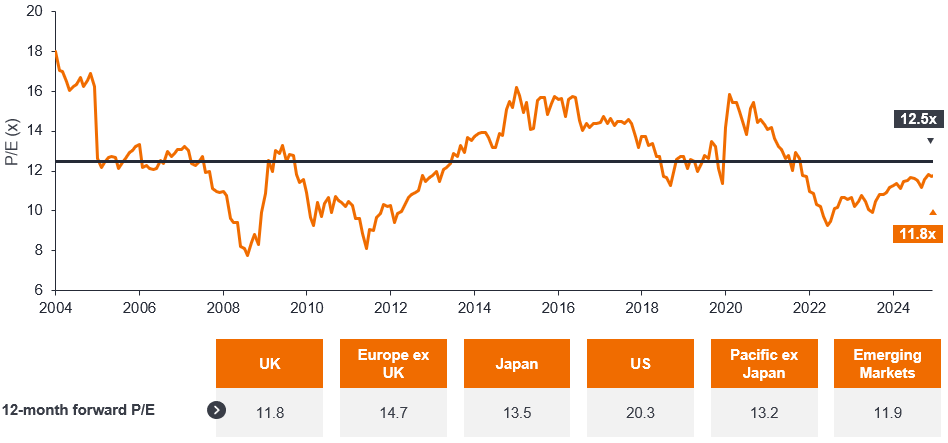

UK equity market outlook – unloved and undervalued

UK equities have experienced significant outflows for an extended period, influenced by factors such as Brexit and its political repercussions, including having five Prime Ministers since 2016, the Liz Truss “mini” budget disaster of September 2022, and more recently the mixed reaction to the October 2024 budget. These events have created perception among some investors that the UK market is “uninvestable”. However, we believe the UK should be viewed in a more positive light, given the country has a stable government that is committed to a growth strategy and fiscal responsibility. Further, the UK equity market continues to trade at a substantial valuation discount both historically and compared to international peers.

Figure 3: UK equity market valuation

Source: LSEG Datastream, Janus Henderson Investors analysis, as at 6 May 2025.

Note: Table shows MSCI regional indices. Asia Pacific ex Japan= MSCI AC Pacific ex Japan. UK= FTSE 350. Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. There is no guarantee that past trends will continue, or forecasts will be realised. The views are subject to change without notice. Past performance does not predict future returns.

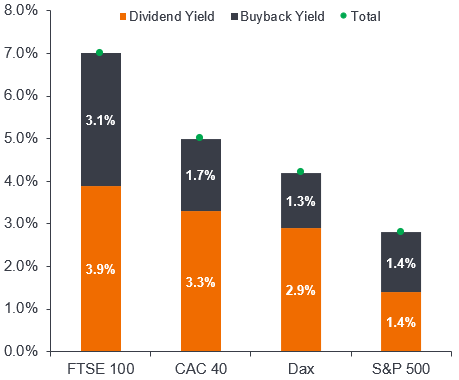

In addition, the UK offers an attractive dividend yield which is increasingly valuable to investors in a world of uncertainty (Figure 4). Further, these dividends are well-supported by robust free cash flow generation and strong corporate balance sheets.

Figure 4: UK equities’ total yield now highest among key markets

Source: Bloomberg, Barclays, as at 31 March 2025. Past performance does not predict future returns. Dividend yield = total dividend payouts given to shareholders as a proportion of the share price, buyback yield= the percentage of the amount spent by a company to repurchase its own shares to its market capitalisation.

UK equities – opportunities amid global volatility

Given the underrepresentation of UK equities in international investors’ portfolios and the country’s relatively benign economic outlook, there is a compelling case for the UK market’s attractiveness, particularly with the context of ongoing global volatility.

While market volatility is expected to persist until there is greater clarity on the impact of tariffs on economic growth, inflation and corporate profits, we see this as an opportunity for active managers such as ourselves to invest in companies that are well-positioned to navigate the uncertain environment and have the potential to prosper longer-term.

Despite being underappreciated for many years, the UK equity market is demonstrating signs of resilience and remains home to numerous globally recognised businesses that are currently trading at significant discounts when compared to their international counterparts. Given all the above, this could potentially mark the beginning of a prolonged and well-deserved re-evaluation of the UK equity market.

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Share buybacks: Where a company buys back their own shares from the market, thereby reducing the number of shares in circulation, with a consequent increase in the value of each remaining share. It increases the stake that existing shareholders have in the company, including the amount due from any future dividend payments. It typically signals the company’s optimism about the future and a possible undervaluation of the company’s equity.

Cash flow: The net balance of cash that moves in and out of a company. Positive cash flow shows more money is moving in than out, while negative cash flow means more money is moving out than into the company.

Emerging market: The economy of a developing country that is transitioning to become more integrated with the global economy. This can include making progress in areas such as depth and access to bond and equity markets and development of modern financial and regulatory institutions.

Forward dividend yield: This is an estimation of a projected dividend for a full year, expressed as a percentage of the current stock price. The projected dividend is estimated by annualising the most recent dividend payment. This can be a useful indicator of expected future dividend growth.

GBP swap rate: In the context of mortgage lending, the lender receives a floating rate (e.g., SONIA) from a counterparty and pays a fixed rate (the swap rate) to the counterparty. This allows the lender to match the fixed payments it receives from mortgage customers with the fixed payments it makes in the swap.

Global financial crisis (GFC): The global economic crisis from mid-2007 to early 2009 that began with losses related to mortgage-backed financial assets in the US and spread to affect financial markets and banks globally. Also known as the ‘Great Recession’.

Inflation: The rate at which the prices of goods and services are rising in an economy. The Consumer Price Index (CPI) and Retail Price Index (RPI) are two common measures. The opposite of deflation.

MAG 7: The term ‘Magnificent Seven’ refers to the seven major technology stocks – Apple, Microsoft, Nvidia, Amazon, Tesla, Alphabet and Meta – that have dominated markets in recent years.

Tariffs: A tax or duty imposed by a government on goods imported from other countries.

Valuation metrics: Metrics used to gauge a company’s performance, financial health and expectations for future earnings, eg. price to earnings (P/E) ratio and return on equity (ROE).

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. The higher the volatility the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund follows a responsible investment approach, which may cause it to be underweight in certain sectors (due to the avoidance criteria employed) and thus perform differently than funds that have a similar financial objective but which do not apply any avoidance criteria when selecting investments.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- The Fund follows an investment style that creates a bias towards income-generating companies. This may result in the Fund significantly underperforming or outperforming the wider market.