SHIFTING MARKETS

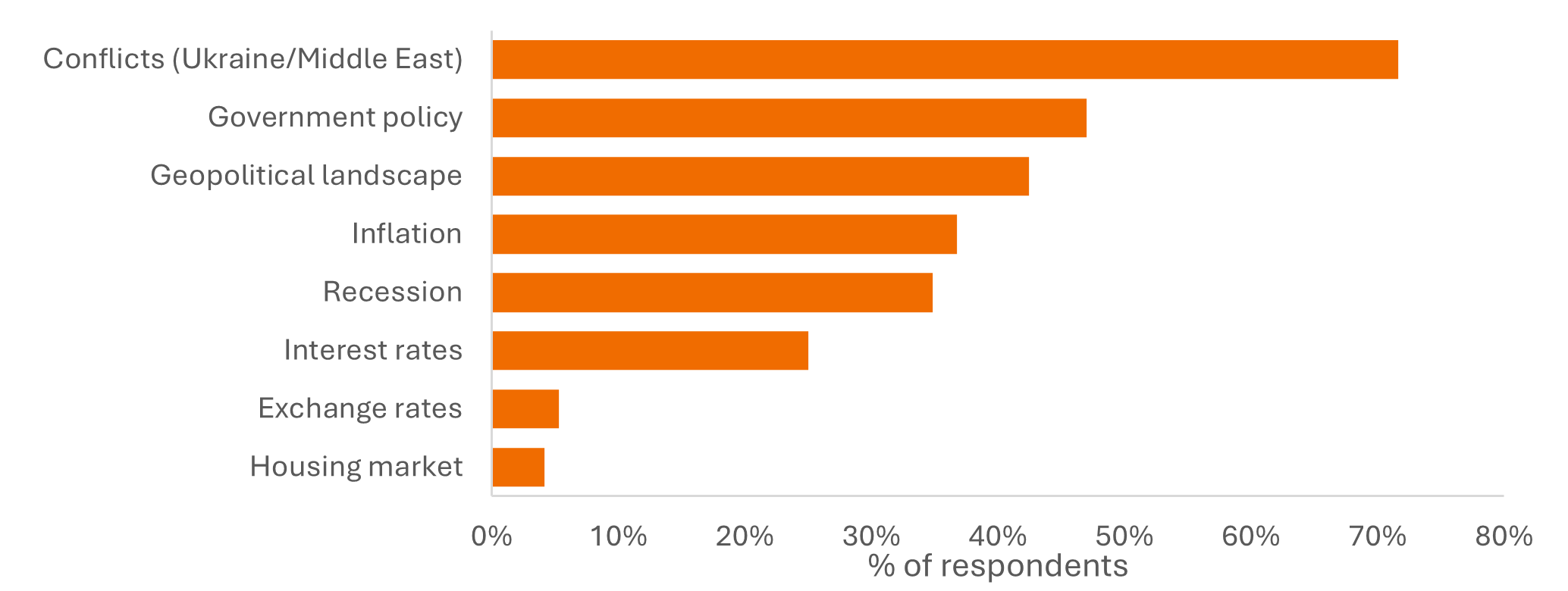

1. What are your top investment concerns? (select up to three)

In a shift from when we asked these questions back in December 2025, conflicts overtook government policy to move into the top spot, likely because the survey was conducted when Israel and Iran were exchanging fire. Interest rates fell back, with only 25% of respondents selecting this as a concern compared with 40% six months earlier, potentially reflecting recent Bank of England rate cuts.

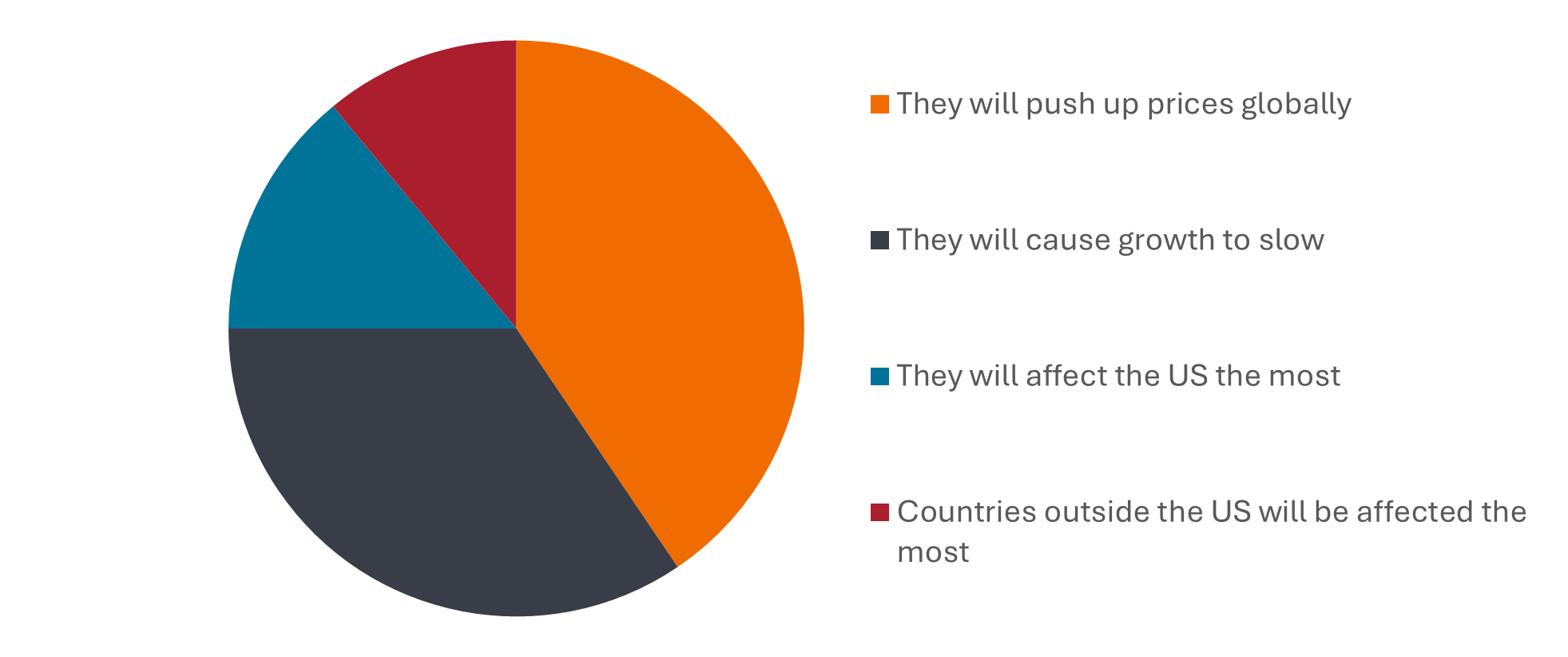

2. What is your expectation of the effect of tariffs? (Select one that best describes your view)

Building on earlier questions about tariffs we asked you what you thought was the likely biggest impact. The potentially inflationary aspect of extra taxes on imports was your dominant concern, followed by concerns that trade friction could slow growth.

3. Asset markets were volatile after the tariff announcements. Did the volatility cause you to reconsider your allocations to bonds and equities? (Select one)

The vast majority of responding investors were fairly sanguine about the market volatility, preferring to ride out the volatility rather than panicking or seeking to reallocate. Some 3% added to equities, which in hindsight proved to be a rewarding move.

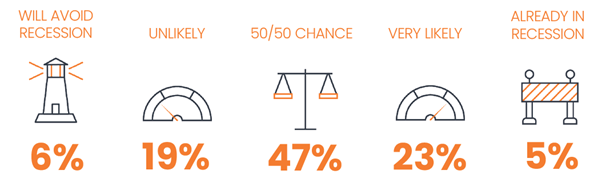

4. Tariffs are seen as contributing to a slowdown in the US economy. How likely do you think it is that the US will enter a recession (two consecutive quarters of negative economic growth) in the next 12 months? (Select one)

Respondents were fairly evenly split on the prospects for the US entering a recession (the % figure reflects respondents’ selection). Given some of the conflicting economic data and the debate within the US Federal Reserve about the direction of interest rates, the level of uncertainty seems to be widely shared.

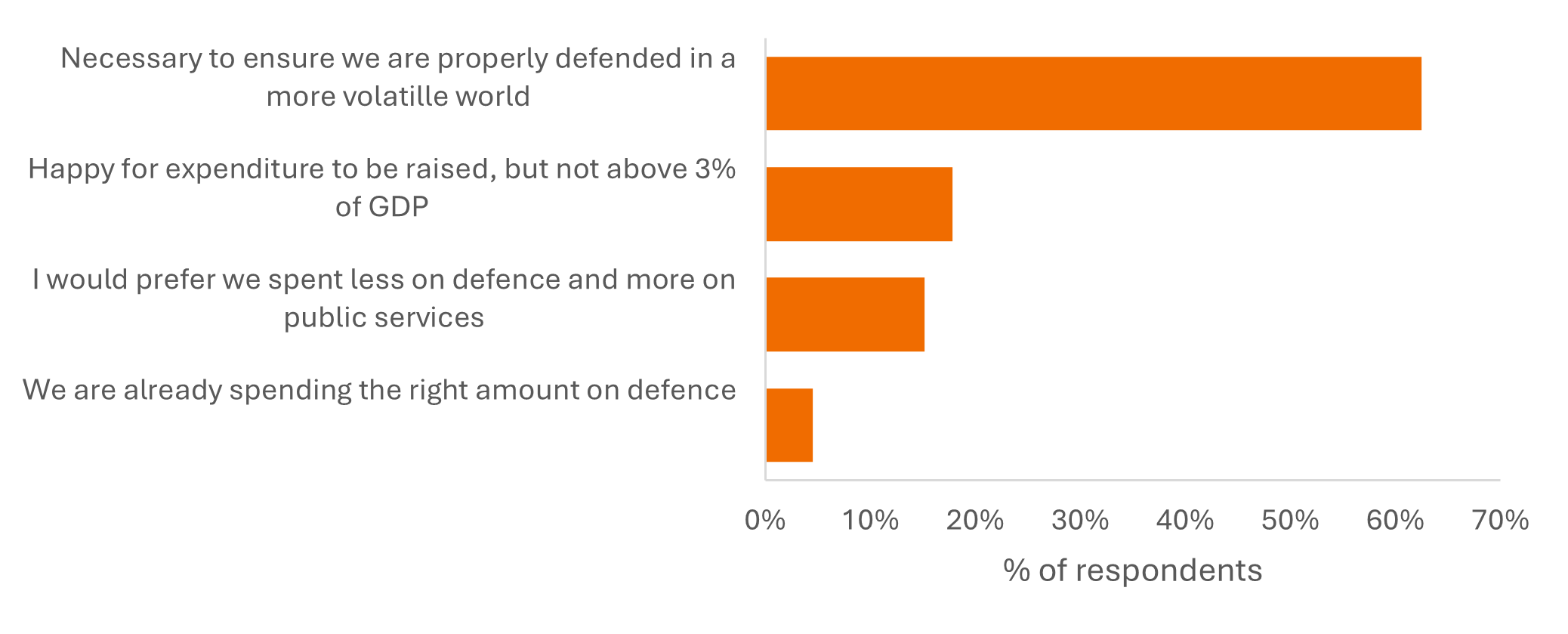

5. NATO members are expected to increase their defence spending. Do you think this is a good use of government spending? (Select one)

Your responses here were generally supportive of extra defence spending and NATO countries actually pledged to increase spending to closer to 5% of gross domestic product (GDP) by 2035 at their summit on 27 June 2025.

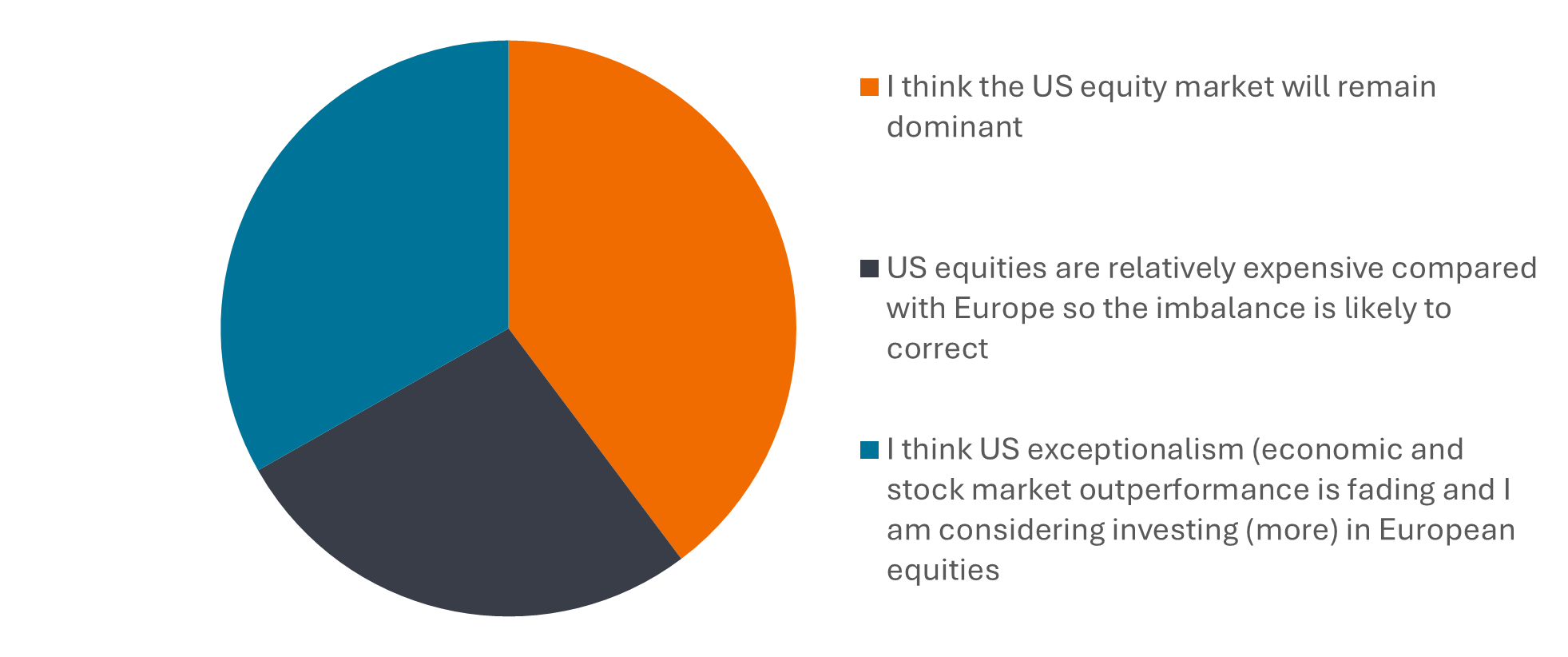

6. With European politics relatively stable in comparison to the US, and Germany embarking on big infrastructure and defence spending, there has been fresh interest in European equities. Which best describes your view?

While 37% of respondents thought the US equity market would remain dominant, a majority of you saw the relative prospects for European equities improving.

“European equities have enjoyed a strong first half of 2025, outperforming the US, both in local currency and in sterling terms. We think the economic momentum unleashed by additional government spending, more probusiness language emanating from regulators especially in the financial space, plus the fact that valuations of European equities are, on average, undemanding, creates the potential for European equities to continue to perform well, although we remain mindful that tariffs have the potential to cause some disruption.1”

-Marc Shartz,

Portfolio Manager, European Equities

1Source: LSEG Datastream, at 30 June 2025, the MSCI USA Index was trading on 22 times forward earnings, so more expensive than the 15 times forward earnings for the MSCI Europe ex UK Index. Forward earnings are expected earnings over the coming 12 months according to consensus earnings estimates. There is no guarantee that past trends will continue or forecasts will be realised.

Customer Panel

If you are interested in participating in the Customer Panel Surveys, please email customer.panel@janushenderson.com with your name and email address and we will get in touch with you. Existing members will continue to be included and do not need to reapply. To join the Panel you must be 18 years of age or over and hold an investment directly with Janus Henderson Investors. The survey is conducted a few times each year and participation is voluntary. Please note that your individual responses are confidential and remain anonymous but we may publish the aggregate results from time to time.

The Customer Panel Survey was conducted between 20 June 2025 and 27 June 2025. 264 respondents took part online.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.