INVESTMENT OBJECTIVE

The Company aims to give shareholders a higher than average return with growth of both capital and income over the medium to long-term, by investing in a broad spread of predominantly UK companies. The Company measures its performance against the FTSE All-Share Index Total Return.

ABOUT THIS COMPANY

- Investing for the long term across all sizes of British business

- Seeking to deliver a predictable, growing income for shareholders

- Integrating environmental, social and governance factors throughout the investment process

LATEST INSIGHTS

At Janus Henderson, we believe in the sharing of expert insight for better investment and business decisions. We call this ethos Knowledge Shared.

ANNOUNCEMENTS

- Lowland 2023 financial results.

- 17.2% increase in Net Asset Value ('NAV') for year

- 2.5% increase in dividend for the year

- Final dividend of 1.6p

- All resolutions were passed at the AGM on 24 January on a show of hands, including approval of the final dividend.

- The latest announcements for this Company can be found on the London Stock Exchange website.

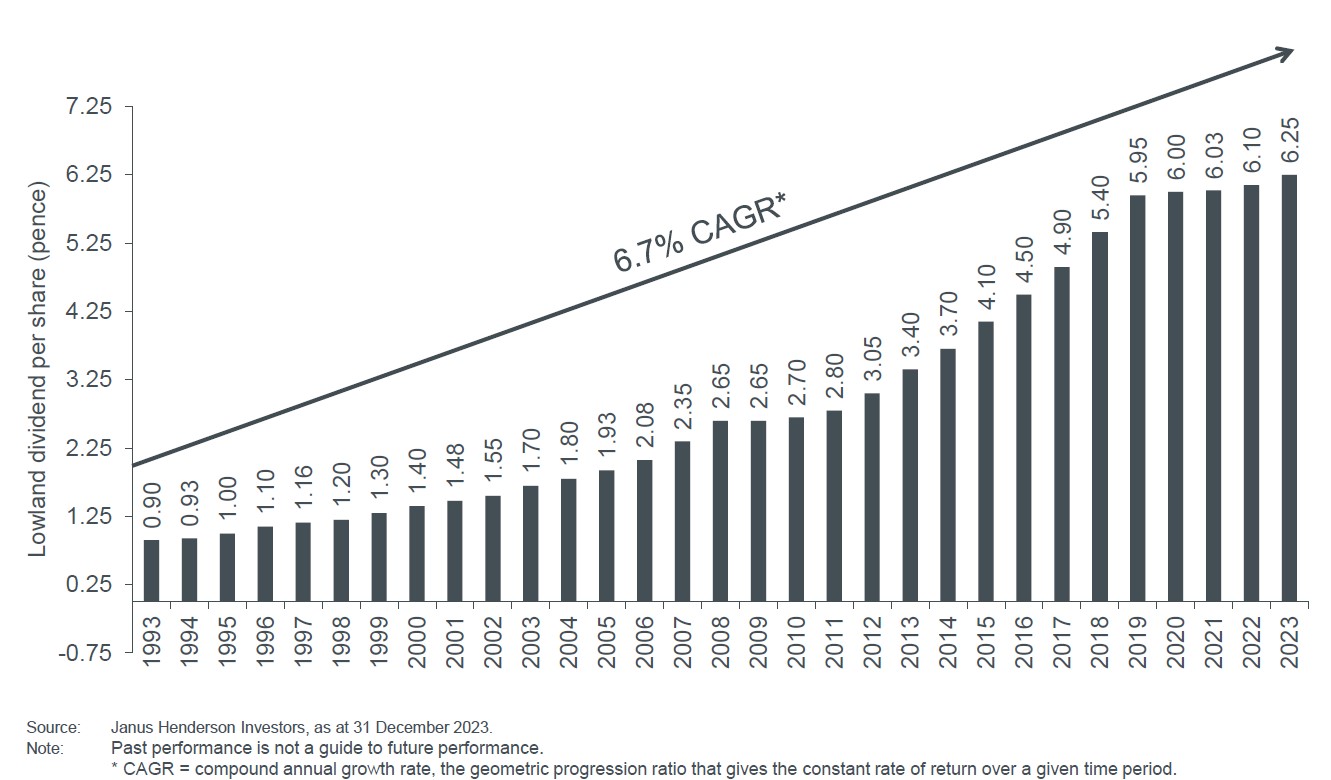

DIVIDEND HISTORY

- Pays its dividends quarterly, with each quarterly dividend being maintained or increased since they were introduced in 2013

- The dividend on an annual basis has been maintained or increased since the Company was founded

- Barring adverse circumstances, each quarterly dividend aims to be no less than the previous equivalent