DEFINING CHARACTERISTICS OF OUR STRATEGY

- Built upon a 30-year strategy history of sustainable investing and innovative thought leadership

- High-conviction portfolio of companies selected for their potential to deliver compounding growth and their ability to contribute to the development of a more sustainable global economy

- Committed to provide clients with high standards of engagement, transparency and measurement

WHAT WE BELIEVE

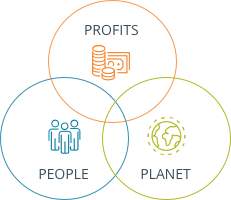

We believe there is a strong link between sustainable development, innovation and long-term compounding growth.

Read More

Our investment framework leads us to invest in companies that we believe contribute to the development of a more sustainable global economy, through their revenue alignment with ten environmental and social themes. At the same time, it helps us stay on the right side of disruption by seeking to avoid companies we consider to be involved in activities that are harmful to the environment and society.

We believe this approach will provide clients with a persistent return source, deliver future compound growth and help mitigate downside risk.

The guiding principle of our investment philosophy evolves around: Is the world a better place because of this company?”

Hamish Chamberlayne, CFA

Head of Global Sustainable Equity |Portfolio Manager

Investment Considerations

Read Less

INVESTMENT OBJECTIVE

The Fund aims to provide capital growth over the long term (5 years or more) by investing in US companies that the Investment Manager believes contribute to positive environmental or social change by reference to the sustainability themes. The Investment Manager has identified nine environmental and social sustainability themes that it believes will help drive a sustainable global economy by addressing current global challenges such as population growth, ageing population, resource constraints and climate change. The Investment Manager will invest in companies whose products and/or services are aligned with the sustainability themes.

More

The Fund invests at least 70% of its net assets in a concentrated portfolio of shares (also known as equities) of US companies, provided that such companies are not excluded by virtue of the applicable exclusions and meet the Fund’s sustainability standard. Whether a company provides sustainable products and/or services, and therefore whether it is a sustainable company for this Fund, will be determined by a robust evidence-based standard, which requires the majority of each company’s current revenues (at least 50%) to be aligned to a single sustainability theme.

The Fund may also invest up to 30% of its assets in other assets including: (a) companies that have less than 50% revenues aligned to the sustainability themes or have revenues which the Investment Manager considers as enhancing quality of life and which are not considered to conflict with the sustainability themes: (b) companies that derive at least 50% of prospective revenue from products and services that contribute to positive environmental or social change; (c) Collective Investment Schemes (including those managed by Janus Henderson); and (d) cash.

The Investment Manager may use derivatives (complex financial instruments) to reduce risk or to manage the Fund more efficiently.

The Fund is actively managed with reference to the S&P 500 Index, which is broadly representative of the companies in which it may invest, as this can provide a useful comparator for assessing the Fund's performance. The Investment Manager has discretion to choose investments for the Fund with weightings different to the index or not in the index.

As an additional means of assessing the performance of the Fund, the IA North America sector average, which is based on a peer group of broadly similar funds, may also provide a useful comparator.

Less

The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.

Potential investors must read the prospectus, and where relevant, the key investor information document before investing.

This website is a Marketing Communication and does not qualify as an investment recommendation.

Investors wishing to invest in this fund can do so via a third party provider or by contacting a professional financial adviser.

KEY DOCUMENTS

Investment

Principles