Thus far in 2025, uncertainty has defined the narrative in financial markets amid the Trump administration’s tariff rollout and trade negotiations. While volatility has proliferated in equity markets, agency mortgage-backed securities (MBS) have quietly recorded their best start to a year since 2020, with the Bloomberg U.S. MBS Index up 3.35% year to date.2

We highlight three key reasons why we believe MBS continues to look attractive on both an absolute and relative basis.

1. Attractive valuations

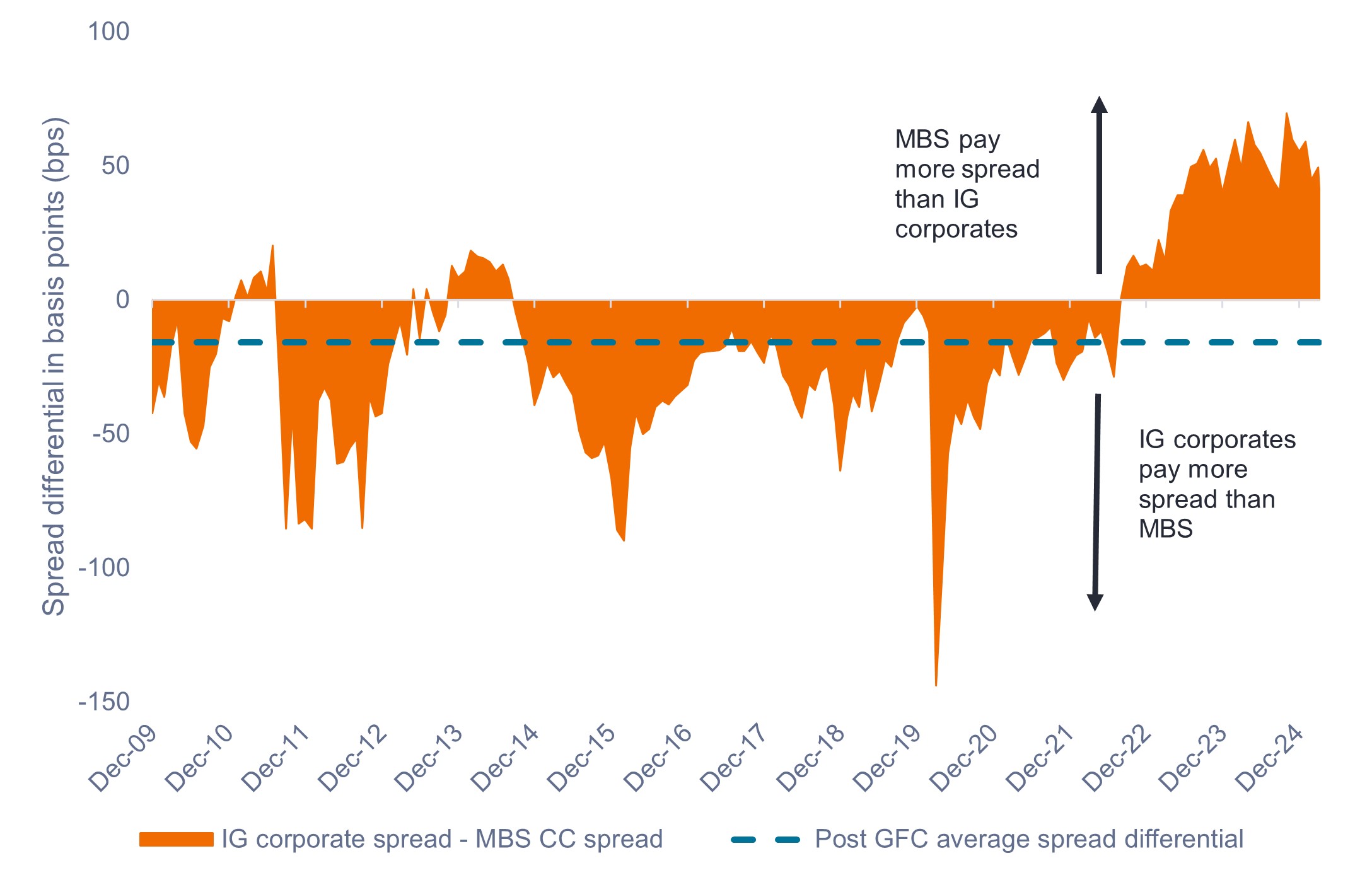

Current coupon (CC) spreads on government-backed agency MBS have historically traded tighter than investment-grade (IG) corporates. Since 2022, however, agency MBS have paid a premium over IG corporates, as shown in Exhibit 1.

This phenomenon is largely due to recent strong demand-supply dynamics in the corporate sector, which have kept spread levels tight. Conversely, the MBS market has faced a more challenging supply backdrop due to quantitative tightening (QT), coupled with softer demand from banking institutions amid rising interest rates.

With QT drawing to a close and the Federal Reserve (Fed) well positioned for future rate cuts, we believe the anomalous spread differential is likely to unwind. In our view, the current valuation environment presents investors with an attractive relative value trade and a potentially lucrative entry point into MBS.

Exhibit 1: IG corporate credit spread less MBS CC spread (2009 – 2025)

Agency MBS spreads are at their most attractive levels relative to IG corporates since the Global Financial Crisis.

Source: Bloomberg, Credit Suisse, Janus Henderson Investors, as of 8 April 2025. Past performance does not predict future returns.

2. Defensive characteristics of agency MBS

Ongoing geopolitical tensions and disruptions to global trade are rattling equity investors, resulting in heightened volatility and an uptick in recession risk. Equity selloffs are not uncommon, and we recommend investors maintain a sufficient allocation to defensive assets to dampen equity market volatility.

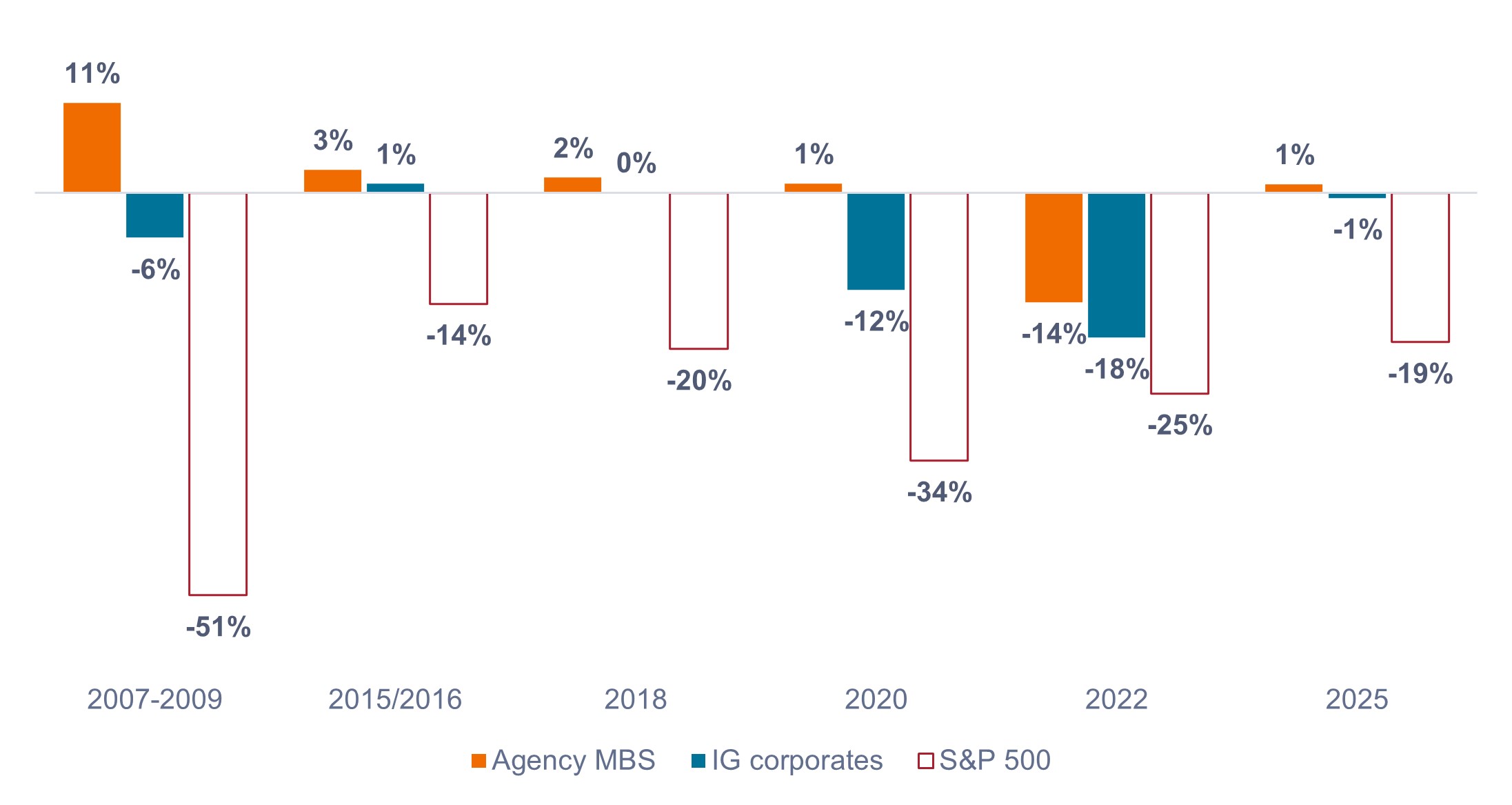

As shown in Exhibit 2, agency MBS have historically acted as a ballast when equity markets have sold off, making it a suitable defensive diversifier, in our view. Agency MBS are backed by government-sponsored entities, which mitigates credit risk and adds high-quality duration to investment portfolios.

We believe their historical resilience during market selloffs positions agency MBS as a prudent choice for broad portfolio diversification and an insurance hedge given macroeconomic uncertainty.

Exhibit 2: Agency MBS vs. IG corporate returns through equity market corrections / bear markets

Agency MBS have meaningfully outperformed IG corporates in each of the last six equity market drawdowns.

Source: Bloomberg, as of 30 April 2025. Asset class descriptions and indices used to represent asset classes: S&P 500 = S&P 500® Index, Agency MBS = Bloomberg U.S. Mortgage-Backed Securities Index, IG corporates = Bloomberg U.S. Corporate Bond Index. Returns represent the total return for selected fixed income sectors for the periods corresponding with the five most recent peak to trough corrections / bear markets on the S&P 500 Index. Past performance does not predict future returns.

3. Historically low prepayment risk

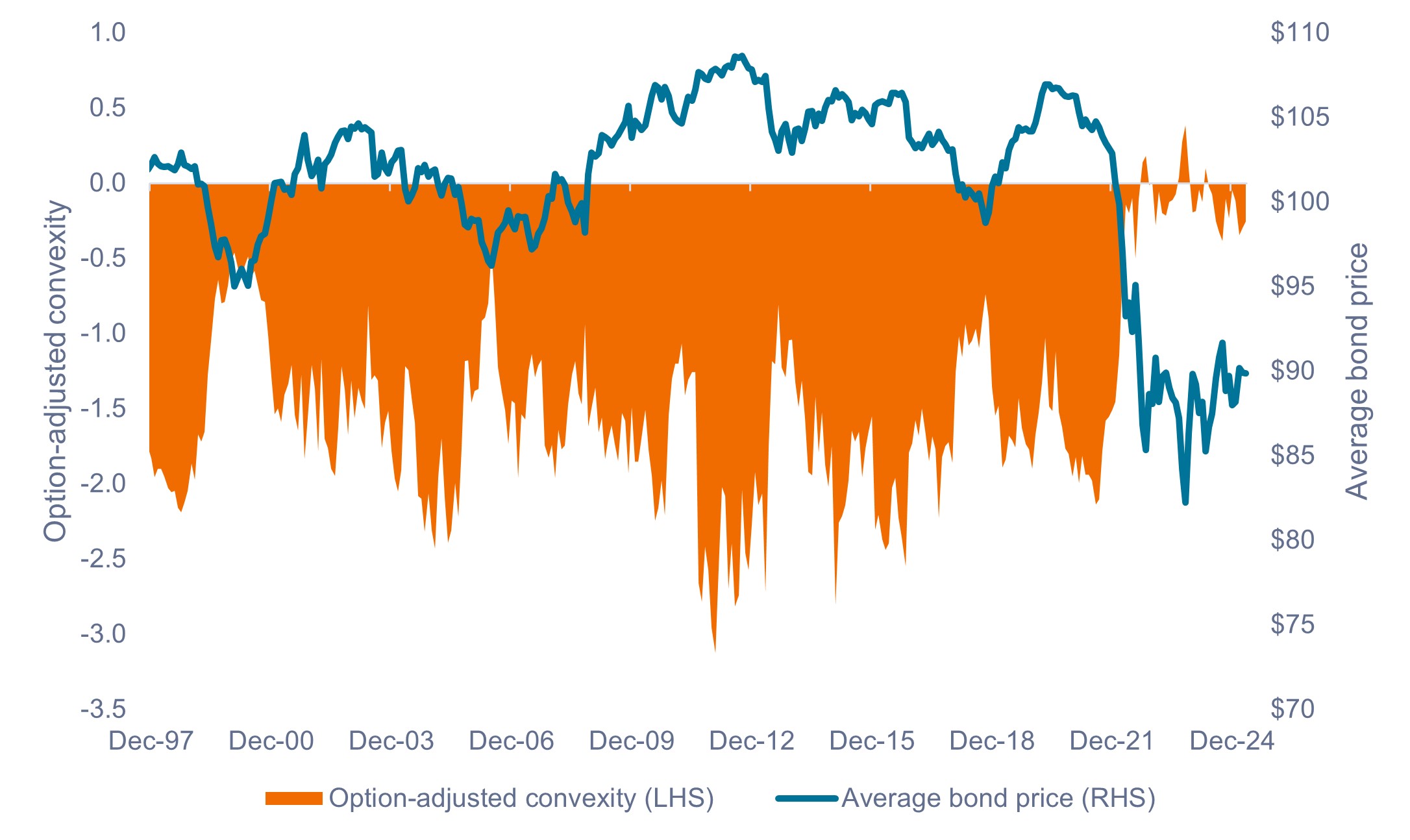

Prepayment risk is the primary fundamental risk for agency MBS, as homeowners may pay off or refinance their mortgage at any point. Refinancing typically increases when interest rates fall and homeowners switch to lower-rate mortgages.

Prepayments result in the duration of MBS falling when interest rates decline, a concept known as negative convexity. Negatively convex bonds such as agency MBS may not fully capture the price appreciation from declining interest rates compared to positively convex bonds, whose duration rises when rates fall. To compensate investors for this risk, MBS pay an additional spread above the yield on comparable U.S. Treasuries.

Due to an extremely low-rate environment in 2020 and 2021, over 70% of existing U.S. mortgages were originated at interest rates below 5%. With the current mortgage rate still well above 6%, there is no financial incentive for most borrowers to refinance. As a result, the agency MBS market finds itself in an unusual situation where prepayment risk and negative convexity are around all-time lows.

The low level of prepayment risk is also reflected in the average bond price, which has been around all-time low levels since April 2022, as shown in Exhibit 3. We believe investors should consider capitalizing on the unique opportunity to buy agency MBS at negligible levels of prepayment risk.

Exhibit 3: Bloomberg U.S. MBS Index convexity and average bond price (1997 – 2025)

Prepayment risk, negative convexity, and average bond prices have been at all-time low levels since April 2022.

Source: Bloomberg, as of 30 April 2025. Past performance does not predict future returns.

Summary

In our view, the attractive relative value proposition, extremely low prepayment risk presently, and historical resilience during market selloffs support a tactical overweight to agency MBS for investors seeking to add defensive duration to portfolios and lock in higher yields.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Mortgage-backed securities (MBS) may be more sensitive to interest rate changes. They are subject to extension risk, where borrowers extend the duration of their mortgages as interest rates rise, and prepayment risk, where borrowers pay off their mortgages earlier as interest rates fall. These risks may reduce returns.

2 Through 30 April 2025.

Bloomberg U.S. Mortgage-Backed Securities (MBS) Index measures the performance of U.S. fixed-rate agency mortgage backed pass-through securities.

Convexity demonstrates how the duration of a bond changes as the interest rate changes.

Credit Spread is the difference in yield between securities with similar maturity but different credit quality. Widening spreads generally indicate deteriorating creditworthiness of corporate borrowers, and narrowing indicate improving.

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative tightening (QT) is a monetary policy where central banks reduce the amount of money in circulation by selling assets or allowing them to mature without reinvestment, effectively shrinking their balance sheet.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.