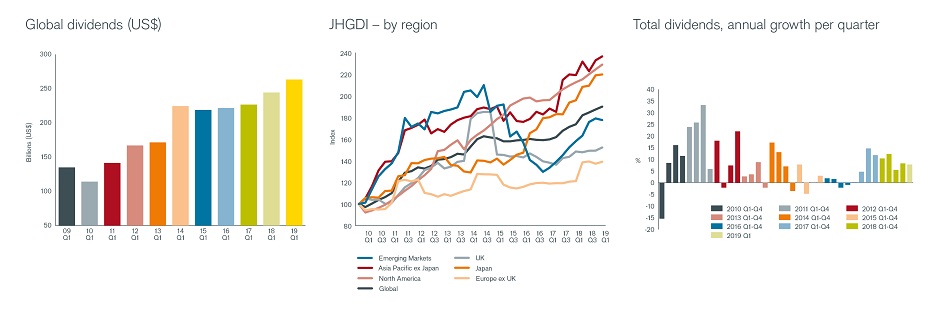

Global dividends shrugged off concerns about the world economy, rising 7.8% on a headline basis in the first quarter, and reaching a first-quarter record of US$263.3bn, according to the latest Janus Henderson Global Dividend Index. Underlying growth of 7.5% followed the same trend as large special dividends were offset by negative exchange-rate effects.

- Global dividends shrugged off concerns over global economic growth, rising 7.8% to a first-quarter record of US$263.3bn

- Underlying growth was 7.5% with the impact of large special dividend payments offset by exchange rate moves

- Janus Henderson Global Dividend Index rose to a record 190.1

- No change in 2019 forecast as higher special dividends are offset by the strength of the US dollar

- Janus Henderson expects a record US$1.43 trillion in payments this year, up 4.2% in headline terms, or 5.2% on an underlying basis

The Janus Henderson Global Dividend Index rose to a record 190.1, meaning that dividends are now almost twice the level they were a decade ago when the index started at the end of 2009.

All-time quarterly records were broken in the United States and Canada (which are less affected by seasonal payment changes). Growth in North America was the fastest in the world on an underlying basis, and its seasonally large weighting in the first quarter meant it made a significant contribution to overall global dividend growth. In the US dividends totalled a record US$122.5bn, up 8.3% on a headline basis, with underlying growth even better at 9.6%. US growth has exceeded the global average 70% of the time over the last five years, as company profits have benefitted from a robust economy and favourable tax changes. Almost nine tenths of US companies in our index raised their dividends, with the largest increases coming from the banking sector.

The first quarter sees relatively few dividends paid in Europe. Seasonal patterns mean Switzerland and Spain are overrepresented, while France and Germany make only a small contribution. Headline growth of 9.2% in Europe was boosted by special dividends; underlying growth of 5.3% was in line with 2018 performance. In the UK, underlying growth of 4.4% lagged the global average in Q1 but was in line with the UK’s long-run trend.

Asia Pacific ex Japan has seen the world’s strongest dividend growth since 2009, thanks to rising profits and expanding payout ratios. The Q1 total of US$18.1bn was up 14.7% year-on-year on a headline basis, breaking the record for first-quarter payouts, though this was mainly due to one-offs in a seasonally quiet quarter for dividends. Underlying growth was a more modest 3.8% with Hong Kong leading the way, while Australia lagged behind.

Income investors in Japan have enjoyed growth far ahead of the global average over the last five years as more Japanese companies have embraced a dividend-paying culture. Dividends are 70% higher than in 2014, compared to 25% for the rest of the world. This strong performance continued in the first quarter with underlying growth of 8.7%.

Emerging markets were weaker than their developed counterparts, as they were the first to feel the effects of tighter US monetary policy and global trade concerns, both in their exchange rates and in company profitability. Underlying growth was +2.2% due largely to strong performance from India.

At the sector level, pharmaceutical stocks were the largest-payers, contributing US$1 of every US$8 paid globally. The sector delivered an all-time record of US$30.1bn, though its underlying growth rate was lower than the global average. The much smaller leisure sector also delivered a record level of payments, boosted by a large special dividend from the UK’s Intercontinental Hotels. On an underlying basis, financial dividends grew fastest, thanks in particular to US banks and real estate companies, while oil dividends also bounced back, up by a tenth year-on-year thanks to higher oil prices.

For the full year, Janus Henderson expects global dividends to reach a record US$1.43 trillion, up 4.2% in headline terms, and 5.2% on an underlying basis. Higher special dividends than originally expected (Janus Henderson’s base case assumes each year that they revert to the longer-run average) are likely to be broadly offset by a more negative impact from exchange rates (based on the dollar’s current level).

Ben Lofthouse, head of global equity income at Janus Henderson said: “Dividend growth has made a strong start in 2019. This reflects a continuation of the robust growth witnessed in 2018, rather than necessarily setting the tone for another above trend year in 2019. Market expectations for corporate earnings have moderated in recent months as global economic momentum has slowed and forecasts may yet come down a bit further. Dividends are a lagging indicator of company health, so a reduction in their rate of increase is a normal consequence of slower earnings growth. Nevertheless, we do not yet feel the need to make changes to our dividend forecast for 2019. We have already allowed for a slowdown in growth this year, and would highlight that dividends are far less volatile than earnings. This is one of the major benefits for income investors – a diversified portfolio of equities provides a stable flow of dividends that will grow over the long term, even when earnings and financial markets are experiencing some volatility. Investors can therefore look forward to dividend growth of around 4-5% in 2019 and another record year for dividend payments”

-ends-

Press Enquiries

Janus Henderson Investors

Stephen Sobey

Head of Media Relations

T: 44 (0) 2078182523

E: Stephen.soley@janushenderson.com

Past performance is no guarantee of future results. International investing involves certain risks and increased volatility not associated with investing solely in the UK. These risks included currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavourable political or legal developments.

Notes to editors

Methodology

Each year Janus Henderson analyses dividends paid by the 1,200 largest firms by market capitalisation (as at 31/12 before the start of each year). Dividends are included in the model on the date they are paid. Dividends are calculated gross, using the share count prevailing on the pay-date (this is an approximation because companies in practice fix the exchange rate a little before the pay date), and converted to US$ using the prevailing exchange rate. Where a scrip dividend is offered, investors are assumed to opt 100% for cash. This will slightly overstate the cash paid out, but we believe this is the most proactive approach to treat scrip dividends. In most markets it makes no material difference, though in some, a particularly European market, the effect is greater. Spain is a particular case in point. The model takes no account of free floats since it is aiming to capture the dividend paying capacity of the world’s largest listed companies, without regard for their shareholder base. We have estimated dividends for stocks outside the top 1,200 using the average value of these payments compared to the large cap dividends over the five-year period (sourced from quoted yield data). This means they are estimated at a fixed proportion of 12.7% of total global dividends from the top 1,200, and therefore in our model grow at the same rate. This means we do not need to make unsubstantiated assumptions about the rate of growth of these smaller company dividends. All raw data was provided by Exchange Data International with analysis conducted by Janus Henderson Investors.

About Janus Henderson

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors achieve long-term financial goals through a broad range of investment solutions, including equities, fixed income, quantitative equities, multi-asset and alternative asset class strategies.

Janus Henderson has approximately US$357.3bn in assets under management (at 31 March 2019), more than 2,000 employees, and offices in 28 cities worldwide. Headquartered in London, the company is listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).

This press release is solely for the use of members of the media and should not be relied upon by personal investors, financial advisers or institutional investors.

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), AlphaGen Capital Limited (reg. no. 962757), (each incorporated and registered in England and Wales with registered office at 201 Bishopsgate, London EC2M 3AE) are authorised and regulated by the Financial Conduct Authority to provide investment products and services. Janus Henderson Investors Europe S.A. (reg no. B22848) is incorporated and registered in Luxembourg with registered office at 78, Avenue de la Liberté, L-1930 Luxembourg, Luxembourg and authorised by the Commission de Surveillance du Secteur Financier. Henderson Secretarial Services Limited (incorporated and registered in England and Wales, registered no. 1471624, registered office 201 Bishopsgate, London EC2M 3AE) is the name under which company secretarial services are provided. All these companies are wholly owned subsidiaries of Janus Henderson Group plc. (incorporated and registered in Jersey, registered no. 101484, registered office 47 Esplanade, St Helier, Jersey JE1 0BD). © 2018, Janus Henderson Investors. The name Janus Henderson Investors includes HGI Group Limited, Henderson Global Investors (Brand Management) Sarl and Janus International Holding LLC.