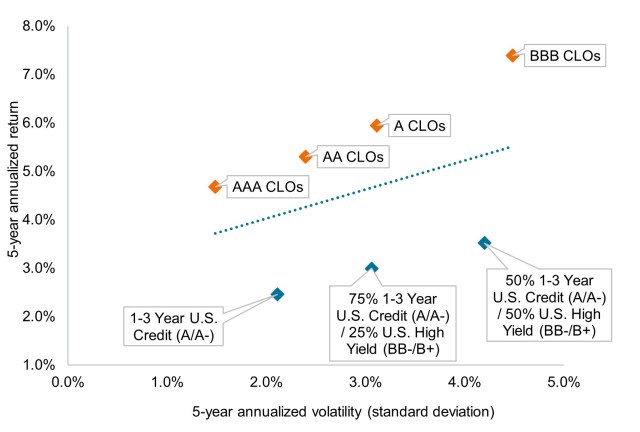

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

Three essential elements to consider for an effective balanced strategy, plus trends to watch in equities and fixed income in 2026.

Why the market may be overpaying for growth, and how a shifting market structure creates both risks and opportunities for fundamental investors.

Europe faces challenges, but rising reform momentum and structural tailwinds are reshaping its investment outlook.

Exploring the dispersion in the loan market.

How interest rates, AI trends, and evolving policy dynamics are influencing the outlook for the energy and financial sectors.

Wide dispersion in 2026 is creating a strong backdrop for selective global small cap investing.

After attending the sector’s flagship conference, we come away with strengthened conviction in the constructive backdrop shaping healthcare in 2026.

What the historic victory for the LDP party means for investors in Japanese stocks.