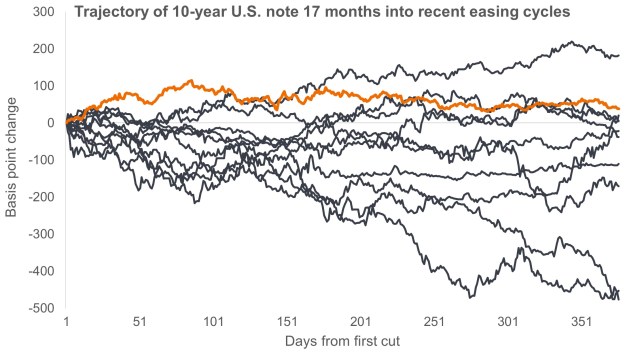

10-year U.S. Treasury yields charting a different course than what we’ve seen in recent easing cycles may indicate that this time could indeed be different.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Private credit has become a core allocation for investors. Hear insights from Janus Henderson and Victory Park Capital on the risk and opportunities in MENA and asset-backed finance.

Kenya’s external position has improved markedly, but beneath the surface emerges a more cautious story on fiscal reform and long term sustainability.

Hong Kong’s residential property market is in a recovery phase driven by supportive macro conditions, stronger household balance sheets, and renewed demand.

Ongoing reforms in Japan and South Korea could turn governance into a durable competitive advantage and catalyst for a re-rating of these markets.

The U.S. Supreme Court’s ruling on President Trump’s tariffs may be welcomed by markets, but investors must now decipher a host of adjacent issues.

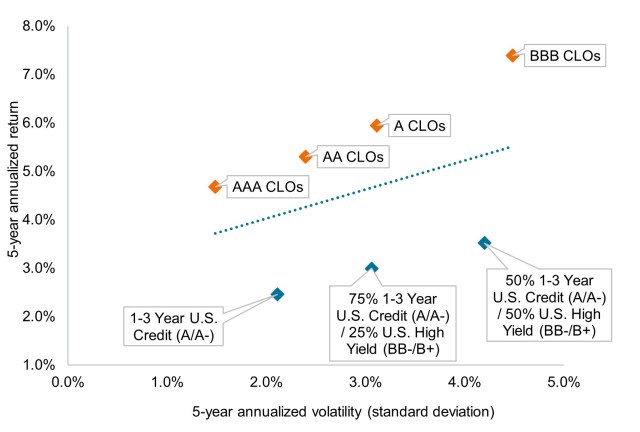

Over the past five years, collateralized loan obligations (CLOs) have delivered some of the best risk-adjusted returns available in fixed income markets.

To gain perspective on recent volatility, we believe investors need to understand the magnitude of the AI transformation and how it will invariably impact every corporate sector

Ali Dibadj joins Luke Newman and Robert Schramm-Fuchs to discuss Europe’s investment outlook, risks, and underappreciated opportunities.

Three essential elements to consider for an effective balanced strategy, plus trends to watch in equities and fixed income in 2026.

Why the market may be overpaying for growth, and how a shifting market structure creates both risks and opportunities for fundamental investors.