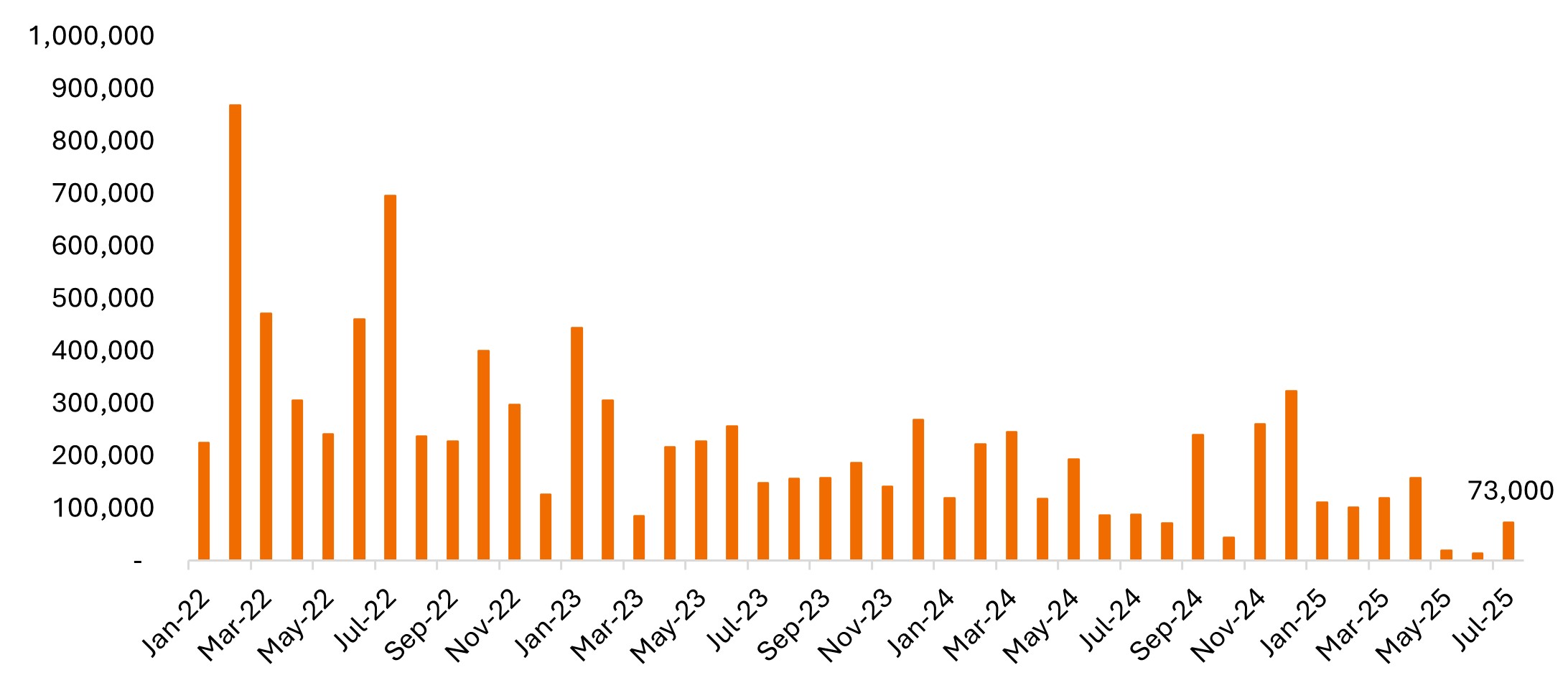

The Labor Department reported on Friday that the U.S. economy added only 73,000 jobs in July, a significant slowdown from previous months and well below economists’ forecasts of 115,000.1 The unemployment rate rose slightly to 4.2%, which was in line with expectations but up from 4.1% the month before.

In addition to July’s disappointing headline number, estimates for job growth in May and June were revised downward by a combined 258,000 jobs, revealing that the labor market was weaker than previously reported throughout late spring and early summer.

Nonfarm payrolls, change from a month earlier

Source: Labor Department. Seasonally adjusted. May 2025 change was revised to 19,000, down from 144,000. June 2025 was revised to 14,000, down from 147,000.

Source: Labor Department. Seasonally adjusted. May 2025 change was revised to 19,000, down from 144,000. June 2025 was revised to 14,000, down from 147,000.

Heightened odds for September easing

The employment miss meaningfully increases the odds of a September interest rate cut. The Fed has repeatedly emphasized its data-dependent approach, and at last week’s press conference, officials noted they were on the lookout for “downside risks to the labor market.” The weakness revealed in payroll revisions could shift the central bank’s focus within its dual mandate more toward maximum employment versus price stability.

Market expectations for a September cut have surged to 93%, up from just 42% before the jobs report. While the dissent from two Fed governors at last week’s Fed meeting was not surprising, it was a sign that the case for cutting rates had been gaining momentum. Another weak employment report with poor job gains and rising unemployment would only add to the likelihood of a September cut or could increase the odds of a 50 basis-point reduction, even with elevated inflation.

If it comes, we would view a cut as supportive of the economy; however, a September cut is not definitive. Payroll data can be volatile, and a bounce back in the next report could quickly change the narrative, as it did late last year. Also, Powell emphasized watching the unemployment rate, which encompasses both supply and demand components of labor, not just the change in payrolls. The unemployment rate, while rising, remains relatively low, with slower growth of labor supply offsetting the slower hiring. Additionally, a number of inflation data points will be released before the September meeting, which could influence the decision.

Enduring resilience

Despite initial indications of labor market softening, the broader economy remains resilient with slower but positive growth. Corporate balance sheets generally remain in a position of strength, with reduced debt levels post-pandemic and extremely low default rates even amid higher interest rates.

The positive corporate earnings picture is also intact. According to FactSet, with roughly 66% of S&P 500 companies reporting as of 1 August 2025, both the percentage of companies with positive earnings surprises and the magnitude of those surprises exceed 10-year averages.2

The consumer, too, remains healthy. Consumer debt service requirements relative to disposable income sit below normal levels, providing capacity for continued spending. Recent commentary from credit card providers and weekly spending indicators show consumer spending is solid.

These factors support our view that the employment picture reflects a nuanced shift rather than broad economic deterioration. Initial jobless claims and recent layoff data show that companies aren’t firing workers, but they’ve become hesitant to hire as continuing claims have not decreased. This pattern makes sense given uncertainty around trade, tax, immigration, and deregulation policies, as well as AI’s potential impact on productivity.

AI: The productivity wild card

AI infrastructure capital expenditure has been a major theme of late, with spending by major tech companies surging and setting new records, continuing to support market trends. Additionally, company management commentary increasingly reflects intensified discussions about AI’s impact on future headcounts. This suggests the labor market may not grow as rapidly as in past cycles due to potential AI-driven efficiencies.

More broadly, significant advancements in AI are expected to boost productivity. Rising productivity benefits corporate margins by enabling more output without proportional increases in labor or materials that could otherwise fuel inflation. From a macroeconomic perspective, improving productivity supports sustainable wage growth and consumer spending power.

Investment implications

Economic releases like Friday’s jobs data can be noisy and drive short-term volatility. Our focus remains on longer-term economic trends and several durable growth themes, including innovation in AI and healthcare, growth in the digital economy, and the electrification of the economy. We believe these areas continue to present solid opportunities for earnings growth and capital appreciation.

In fixed income, with the federal funds rate at 4.375% and the probability of cuts on the rise, taking interest rate risk on the front end of the yield curve can provide portfolio diversification and offer a cushion against potential volatility in equities or credit. Attractive starting yields are also on offer for investors seeking income in the current market, as well as those positioning for a changing interest rate environment.

Policy timing and the long view

We recognize near-term soft patches are possible as tariffs, stimulative tax and deregulation policies, and potential Fed easing unfold and work through the economy – and as the results of AI-driven capital spending start to show. With the latter point, we anticipate a need to shift perspective where the labor market is concerned as AI-driven productivity gains impact future headcount needs. Ultimately, though, we consider the economy to be on solid footing and remain focused on the long-run tailwinds that may be created through policy change and secular growth drivers.

1 Source: Factset, as at 31 July 2025.

2 Source: Factset, as at 1 August 2025.

Monetary Policy refers to the policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Quantitative Easing (QE) is a government monetary policy occasionally used to increase the money supply by buying government securities or other securities from the market.

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Volatility measures risk using the dispersion of returns for a given investment.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yield.

IMPORTANT INFORMATION

Artificial intelligence (“AI”) focused companies may face rapid product obsolescence, intense competition, and increased regulatory scrutiny. These companies often rely heavily on intellectual property and invest significantly in research and development, which may not yield successful outcomes. Their securities may be more volatile than those of companies offering more established technologies.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issuer, political and economic developments.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- An issuer of a bond (or money market instrument) may become unable or unwilling to pay interest or repay capital to the Fund. If this happens or the market perceives this may happen, the value of the bond will fall.

- When interest rates rise (or fall), the prices of different securities will be affected differently. In particular, bond values generally fall when interest rates rise (or are expected to rise). This risk is typically greater the longer the maturity of a bond investment.

- The Fund invests in high yield (non-investment grade) bonds and while these generally offer higher rates of interest than investment grade bonds, they are more speculative and more sensitive to adverse changes in market conditions.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund may use derivatives to help achieve its investment objective. This can result in leverage (higher levels of debt), which can magnify an investment outcome. Gains or losses to the Fund may therefore be greater than the cost of the derivative. Derivatives also introduce other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.