NAVIGATING VOLATILITY

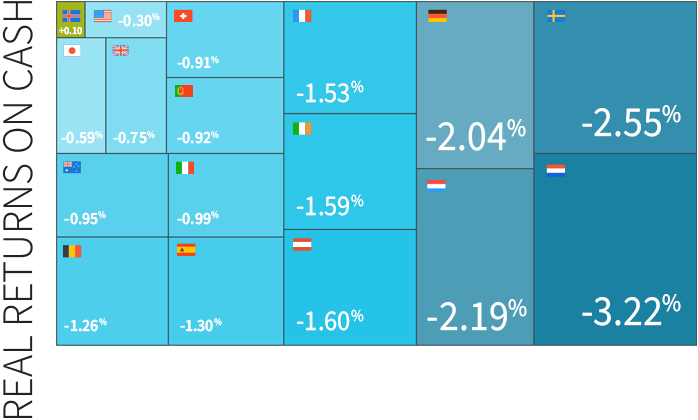

With the yields on cash and short-dated investments very low or negative in Europe, moving along the risk spectrum into an actively-managed, low volatility fixed income strategy can be a potential solution for investors seeking to make their defensive assets work harder over the medium term.

Source: Refinitiv Datastream, Janus Henderson calculations, % figures based on latest published centralbank policy rate minus latest published inflation rate. Current as at 07/01/2020. For illustrative purposes only, rates and individual experiences may vary.

The Janus Henderson Absolute Return Income Strategy

A fixed income strategy that aims to deliver steady positive risk-adjusted returns across various market conditions to make your cash work harder.

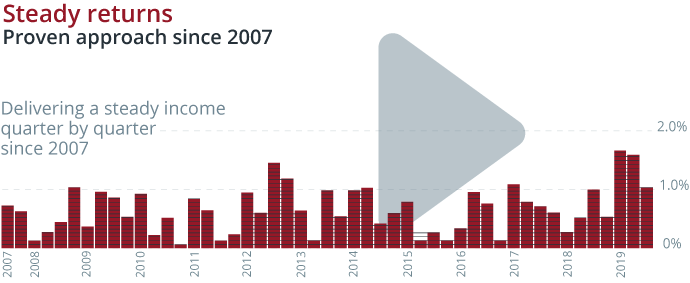

- Focus on generating a steady income stream through investing in shorter maturity investment grade securities

- Solid 12+ year track record since 2001, with experience managing the strategy through periods of extreme stress and volatility

- Conservative risk approach with low volatility target <1.5% p.a.

- Use of derivatives to implement defensive positioning and manage downside risk

*Bloomberg/Barclays

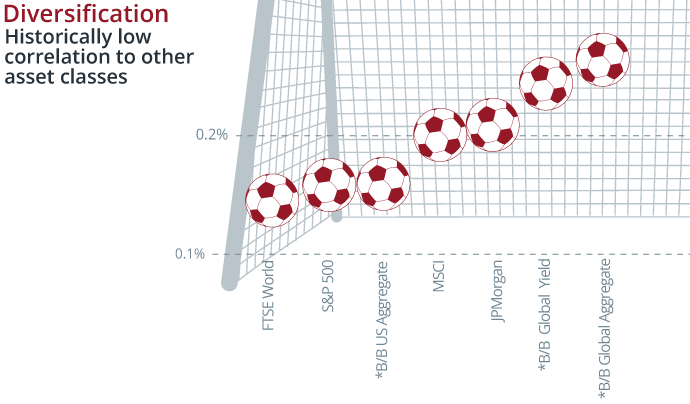

- Wider investment opportunity set ensures returns are globally diversified

- Low correlation historically to traditional equity and fixed income assets

Source: Janus Henderson Investors [AUM date] . See full details below.

This is for illustrative purposes only. Past performance is not a guide for past performance

Learn more

PLACEHOLDER TAG

Title of the video/article

Candy canes icing danish. Cheesecake cupcake cake marzipan. Cake muffin chupa chups cookie biscuit tootsie roll dragée. Powder sweet roll chocolate bar cookie tart cake soufflé gingerbread sesame snaps. Apple pie brownie tootsie roll. Candy brownie tootsie roll sweet roll tart pie.

Meet the experts

Co-Head of Global Bonds | Portfolio Manager

Industry since 1999. Joined Firm in 2015.

Portfolio Manager

Industry since 1994. Joined Firm in 2017.

Portfolio Manager

Industry since 2003. Joined Firm in 2015.

Discover our strategy by hearing directly from the Portfolio Managers.

Features of an active Absolute Return approach

Without benchmark constraints, the strategy is free to invest across global fixed income markets, giving the portfolio managers the latitude to:

- Fully express their high-conviction views

- Avoid areas of the market where they see greater downside risk

- Make what they believe to be the best investment decisions on behalf of investors

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them. Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. The information in this video does not qualify as an investment recommendation.

Related Insights

Our intellectual capital is readily available and central to our Knowledge.Shared approach.