The investment environment remains highly complex, shaped by persistent macroeconomic and geopolitical uncertainties. Sovereign debt concerns, tariff risks, and AI-driven market dynamics continue to dominate headlines. The role and impact of fiscal and monetary policy remains crucial, particularly for the US Federal Reserve, with the US government pushing to accelerate interest rate cuts. These elements contribute to heightened market volatility and stock dispersion.

Against this backdrop, we see the role of absolute return strategies evolving. Not just as a lower-risk equity proxy, but used more for their diversification benefits, with investors increasingly using these strategies to help navigate market uncertainty.

Opportunities across regions and sectors

In 2026, we expect compelling opportunities to arise from increased stock dispersion and heightened volatility in global markets. This kind of environment is highly favourable for equity long/short strategies, as they can exploit both long and short positions, potentially generating performance both in good times and bad. A focus on company-specific factors like management quality, sustainability of profit margins, and valuation, enables skilled stock pickers to differentiate performance.

In the US, characterised by potential interest rate cuts and a cooling labour market, we see opportunities in sectors beyond the dominant technology firms. In Europe, the prospects in the defence and financial sectors appear promising, given increased government spending and deregulation initiatives. The UK market, with its broad international revenue exposure, offers diversified optionality across sectors.

Geopolitical shocks – the underappreciated risk

Possibly the most underappreciated risk for 2026 is that geopolitical tensions could escalate, spreading disruption across global markets. 2025 provided a taster of what that could look like, with short-sharp shocks around US tariff threats and concerns related to the big technology stocks. This risk is exacerbated by the interconnectedness of global economies, where unexpected tariffs or sanctions could disrupt trade flows, impacting earnings for companies. In this environment, maintaining a highly liquid, dynamic and diversified portfolio is crucial to managing risk effectively.

Indicators of a new market regime

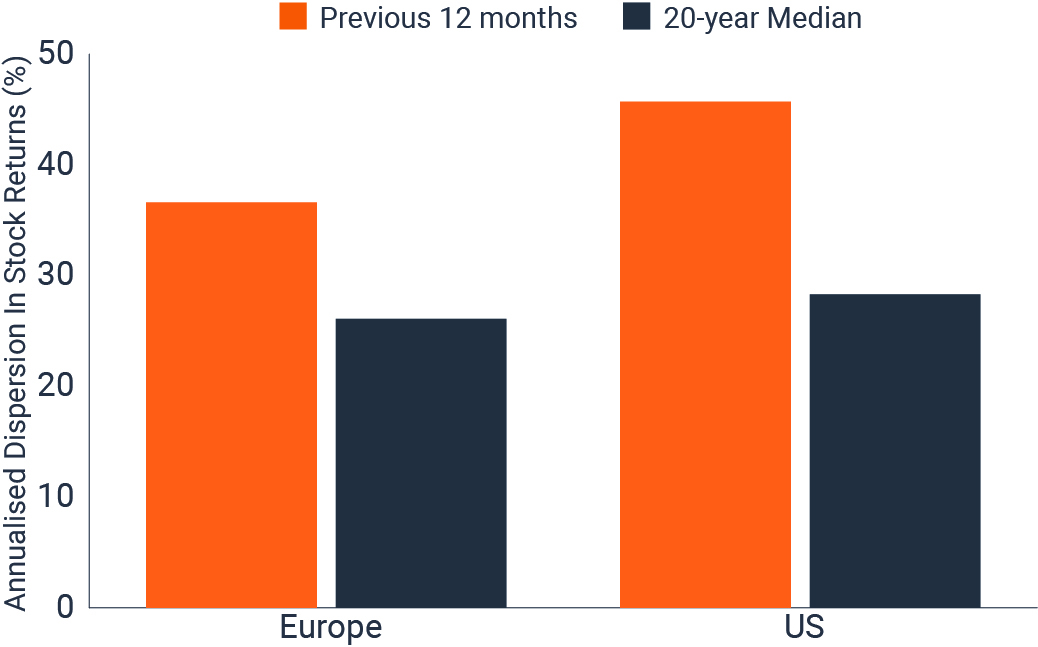

Gone are the days of rising tides lifting all boats, where just being active in the right market was sufficient to see the value of your portfolio rise. Stock dispersion remains elevated relative to history, emphasising the importance of stock selection.

Source: Morgan Stanley Alpha, FactSet, as at 26 August 2025. Dispersion in stocks measures the range of returns for a group of stocks. If the data points cluster around certain values, dispersion is low, whereas if they are more spread out, dispersion is high, creating potentially more opportunities for stockpickers. Median is the mid-point of a set of values. Past performance does not predict future returns

Active management and adaptability

In a landscape characterised by heightened volatility and stock dispersion, the ability to capitalise on both long and short opportunities is increasingly valuable. With fundamentals driving share prices more than broad market trends, engaging with experienced managers who can leverage these dynamics could be crucial for achieving differentiated performance and enhancing portfolio resilience in 2026.

Absolute return investing: A type of investment strategy that seeks to generate a positive return over time, regardless of market conditions or the direction of financial markets, typically with a low level of volatility. Please note positive (or absolute) returns are not guaranteed.

Long/short: A long position is a where a security is bought with the intention of holding over a long period in the expectation that it will rise in value. A short position is an investment technique that profits when a security falls in value, typically through borrowing then selling what are perceived to be overvalued assets with the intention of buying them back at a lower price and pocketing the difference. Fund managers typically use derivatives to simulate short positions.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.