In recent years, the investment spotlight has been firmly fixed on the US, especially its tech sector, drawing significant fund flows away from other regions. However, as global economic dynamics evolve, European small caps (smaller companies) are emerging as a compelling opportunity, poised for a resurgence after a period of underperformance relative to their large cap (larger company) counterparts.

Turning the tide

European small caps, typically more sensitive to macroeconomic factors, have faced several headwinds. The Russian invasion of Ukraine spurred a rise in energy prices, benefiting large-cap energy giants while small- and medium-sized enterprises (SMEs), particularly in energy-reliant economies like Germany, faced downgrades. Additionally, higher interest rates have disproportionately impacted European small caps, given their greater exposure to variable debt.

Yet, the tide appears to be turning. Uncertainty around President Trump’s tariff strategies created temporary disruption but is expected to stabilise. Some resolution to tariffs could lead to a more favourable economic environment, accompanied by potential interest rate reductions in both the US and Europe.

Europe’s economic outlook is improving, driven by a series of external pressures that have necessitated a robust response. The continent can no longer depend on Russia for energy or China for intellectual property security, leading to policy shifts. This transformation is gradually enhancing Europe’s economic prospects, particularly for European small caps, which stand to benefit from an upswing in global growth, decreasing energy prices, and a normalisation of inventory levels.

The attractiveness of European small caps lies in their potential to transition from a stagnant economic state to one with some momentum. Germany is positioned to lead this charge. The country is addressing its economic challenges, with plans to lower corporate taxes and incentivise capital investment, especially in sectors like electric vehicles (EVs). This strategic shift marks a departure from Germany’s historically conservative government spending policies, reflecting a broader European determination to enhance competitiveness and stimulate growth.

Valuation opportunities

Valuations for European small caps are at a near 20-year relative low versus large caps, despite their promising growth potential.1 This valuation gap presents a unique opportunity for investors, particularly as confidence in Europe’s economic resurgence builds. The flow of funds, previously directed toward the US, is beginning to reverse, with signs of increasing investment in European defence and infrastructure.

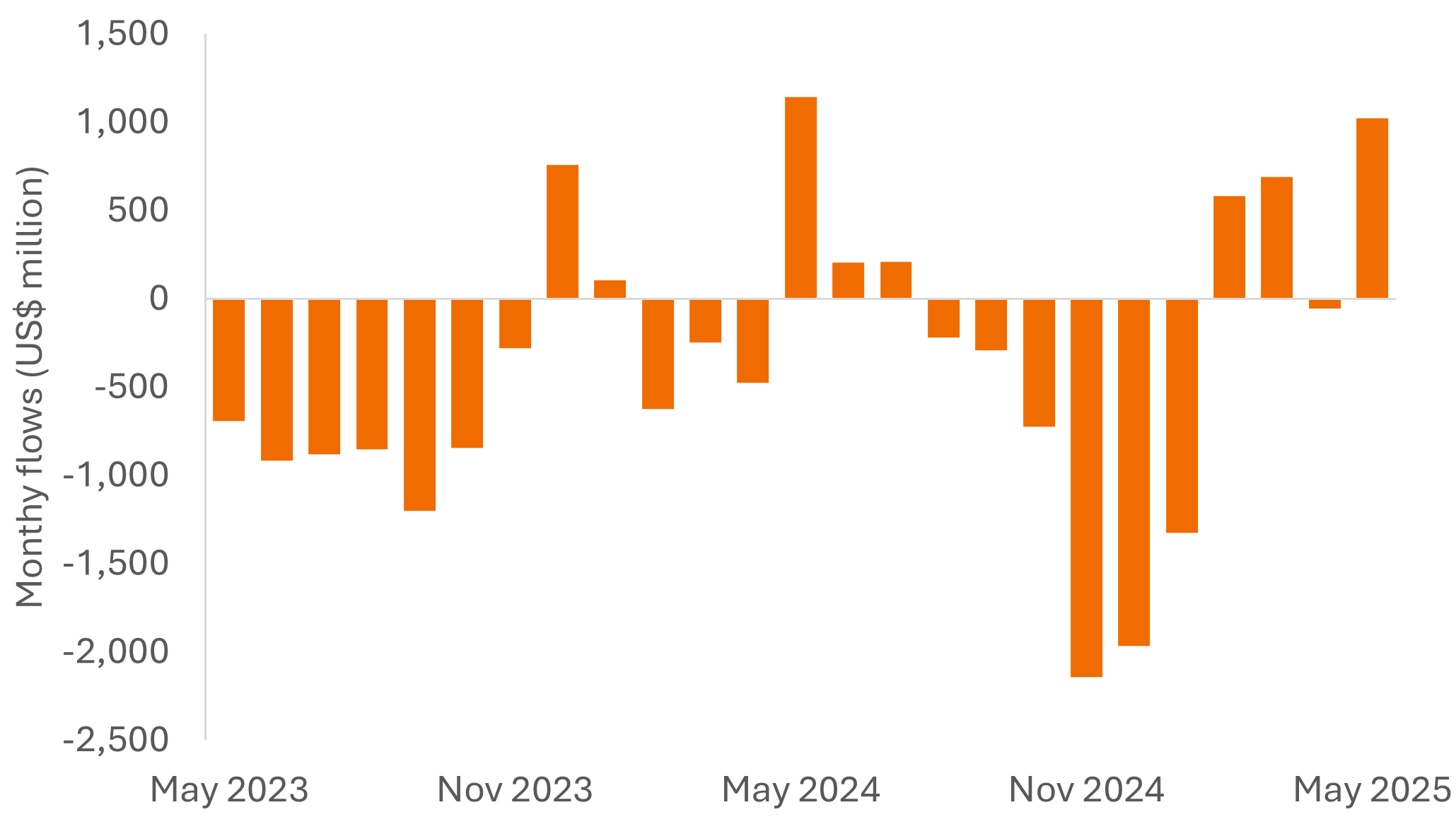

Flows into small/mid cap European equity funds

Source: UBS, market net monthly flows into small/mid cap European equity funds, May 2023 to May 2024.

Consumer sentiment, while still recovering, shows promising signs. Rising wages and falling energy prices could catalyse a shift in consumer behaviour, boosting spending and further supporting economic growth.

Despite the promising outlook, risks remain. Potential complacency regarding US tariffs or fiscal policies could pose challenges. Nevertheless, we believe the valuation of European small caps is attractive.

In our view, European small caps are positioned for a period of growth, supported by macroeconomic shifts and strategic policy responses.

1Source: Bloomberg, relative 12-month forward price/earnings (p/e) valuations for MSCI Europe ex UK Small Cap Index versus MSCI Europe ex UK Large Cap Index, at 30 June 2025. P/E is share price divided by earnings per share. Forward earnings are expected earnings over the coming 12 months according to consensus earnings estimates. There is no guarantee that past trends will continue or forecasts will be realised.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.