Has public real estate finally reached an inflection point?

Guy Barnard, Co-Head of Global Property Equities, reflects on a challenging year for property equities and explains the team’s more constructive outlook for 2024.

7 minute read

Key takeaways:

- Public REITs could be a key beneficiary of an inflection point in interest rates given the re-pricing already seen and the potential for attractive and growing dividends.

- Investors have overlooked a sector that is still seeing good tenant demand and earnings growth from property types benefiting from structural tailwinds.

- Public real estate may soon shift to ‘offense’ given a cost and access to capital advantage compared to private real estate.

We concluded our 2023 outlook by saying that, “there can be little real doubt that private real estate valuations are likely to have to adjust in 2023,” and that, “while 2023 will bring further challenges, we believe the starting point today (in listed real estate markets) is more reflective of the reality to come.”

Looking back

While 2023 certainly presented fresh challenges, the key driver of real estate investment trust (REIT) performance continued to be the moves in interest rate expectations and, specifically, real rates. This led to further volatility in the global REITs market in 2023 but ultimately little return, with the FTSE EPRA Nareit Developed Index in USD down around 1% as we write (27 November, 2023).1

While the public real estate market has continued to reflect the shifts in rate expectations in its daily pricing, a slower ongoing correction is being seen in private property markets.

Headlines vs reality

In 2023, we continued to highlight to investors that the many headlines surrounding ‘commercial real estate (CRE) in crisis’ were not entirely reflective of the reality that we see as active investors in the public REIT market. As is well-documented, the US office market is facing an extremely challenging backdrop for landlords, but forms only a small part of the REIT sector (4% of US public REITs) and one which we have avoided. Likewise, the challenges facing US regional banks, and the resulting reduction of debt availability, will present greater challenges in the private rather than the public real estate markets in which we invest. For the latter, leverage levels are historically low and companies have continued to demonstrate their ability to access both debt and equity on still accretive terms.

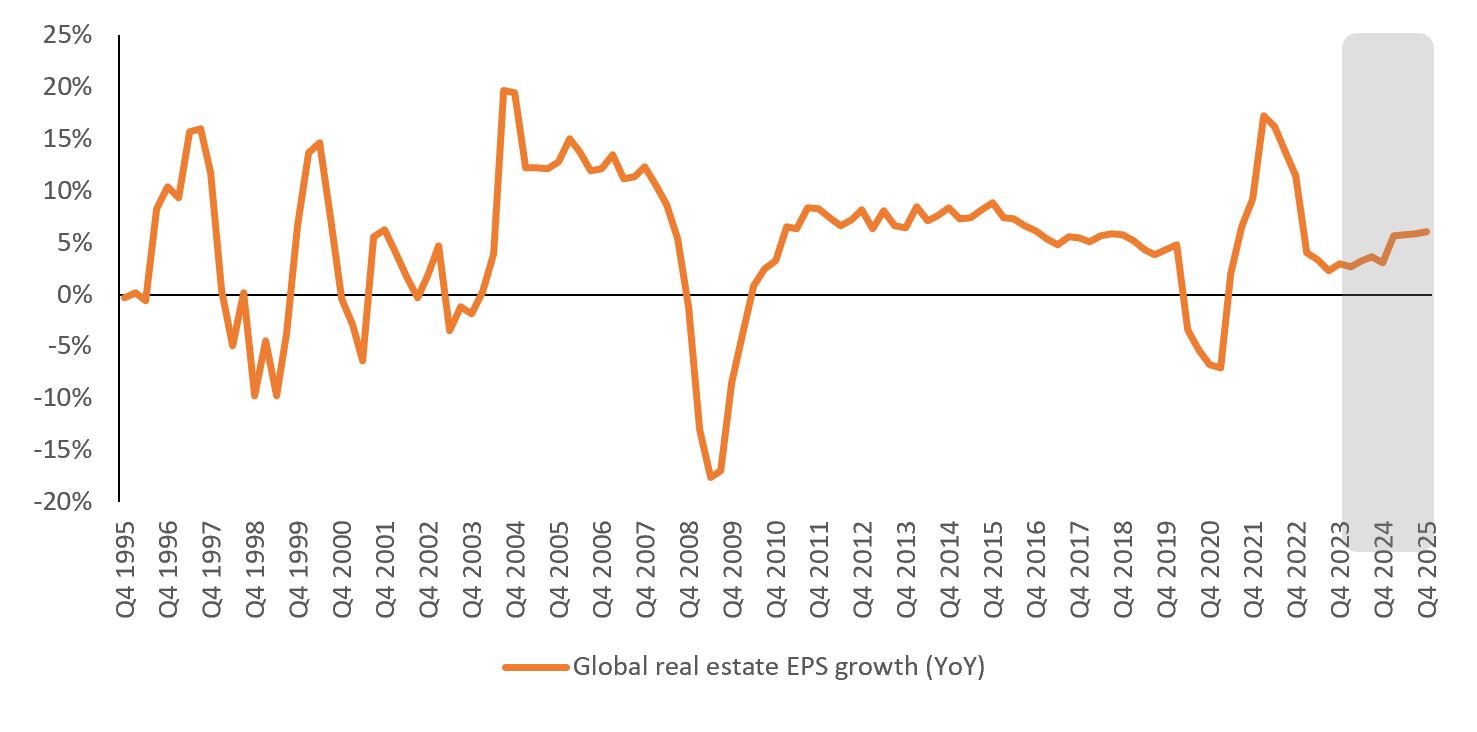

It is also important to remember that despite the significant de-rating seen in the REIT market in the last few years, the operational performance of the businesses we invest in has generally been strong, with 2023 estimated to be a year of mid-single digit earnings growth (Figure 1).2 The combination of continued growth in the face of share price declines means public REIT shares have become much “cheaper”. In fact, since the beginning of 2022 while global REIT share prices have declined by more than 25%, REIT cash flows per share have grown by c.13% (UBS data), resulting in an earnings multiple decline greater than any other equity sector.

Figure 1: Global public real estate earnings growth

Source: Refinitiv, IBES, UBS. Based on rolling 12-month forward earnings per share (EPS). Global real estate EPS growth is market cap weighted average of UBS factor model constituents (US, UK, Cont. Europe, AU, JP, HK, and Singapore, representing c70-80% of EPRA Developed Index. Grey shaded area highlights the IBES consensus estimates for EPS growth.

Most public REITs have continued to collect and grow rental income streams, benefiting from healthy tenant demand in many sectors and an increased focus on best-in-class assets. While demand is normalising in some sectors, and there are headwinds in a slowing economy, a focus on areas of structural growth and those companies that can be considered as quality compounders could potentially deliver further earnings growth in 2024.

Well-placed for further growth?

Looking ahead we view real estate as a sector that presents risks and offers opportunities for investors. Risks for those companies that took on too much debt in the good times and face difficult refinancing discussions as those loans mature. Risks for those exposed to areas of the real estate market that are facing structural obsolescence, high market vacancy levels, and no pricing power.

However, we see more opportunities in the public REIT market as we look forward. Strong balance sheets should enable many public companies to be opportunistic buyers of real estate, taking advantage of motivated sellers who may own good buildings but with weak balance sheets.

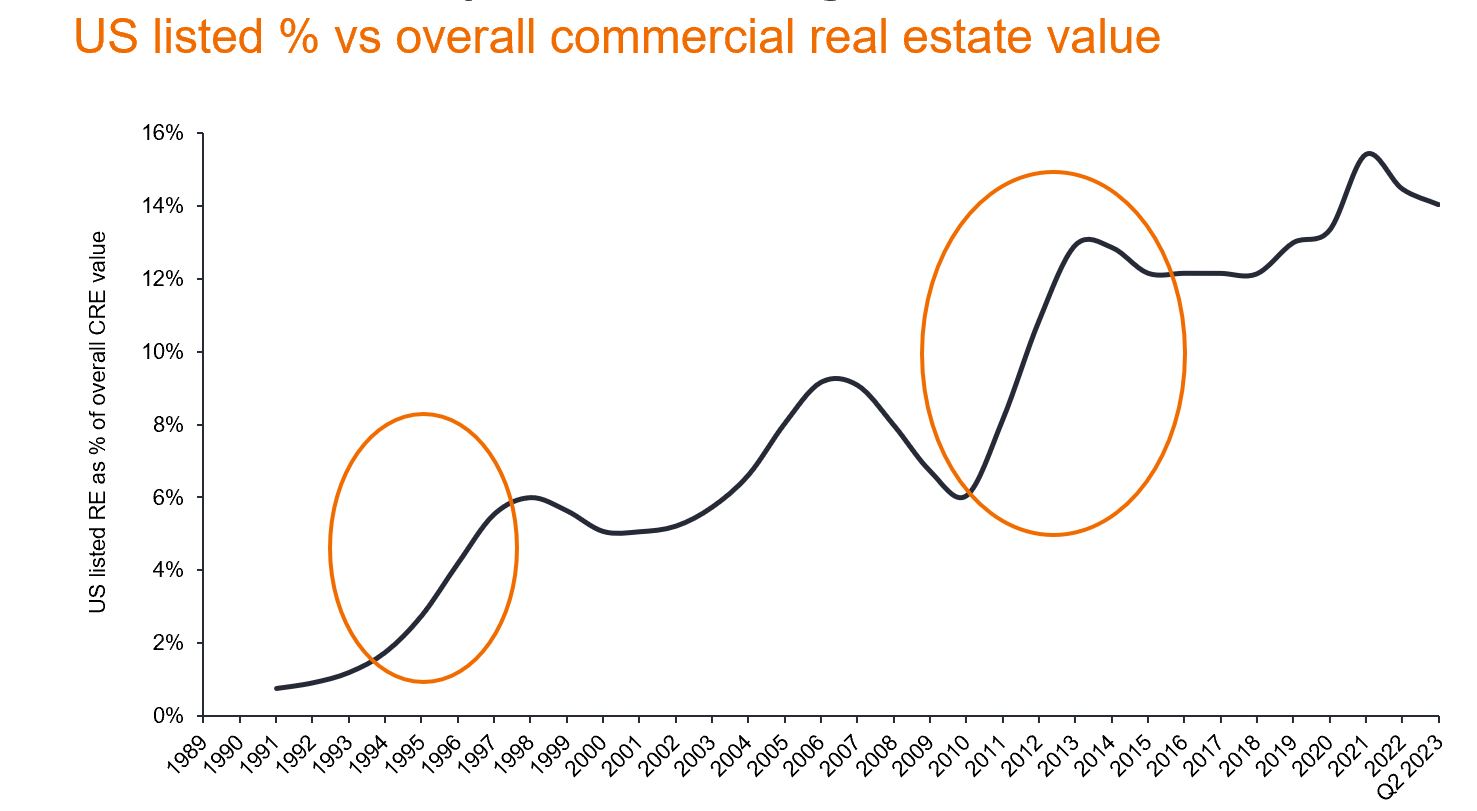

In our view, public REITs’ access to capital and at relatively lower costs compared to private real estate sets them on the path for faster growth in the years ahead – an advantage that should not be underestimated (Figure 2). This dynamic has occurred before, and has resulted in strong performance for public REITs.

Another factor benefiting public REITS is the greater exposure to alternative and faster growing areas the real estate market, such as data centres, logistics, storage, healthcare, and housing. Here, in-house operational platforms should help the REIT grow further and potentially outperform other real estate vehicles.

Figure 2: An opportunity for further growth in the public REIT market

Source: EPRA Nareit, UBS, Janus Henderson Investors analysis, as at 30 June 2023.

Are we at an inflection point?

As investors we are always looking for inflection points. The ability to benefit from a shift in view is an opportunity to generate returns. Looking to 2024, we may now be at an inflection point in the interest rate cycle, which has been such a dominant theme in markets for the last two years, with public REITs one of the hardest hit sectors. While it may be premature, recent market moves highlight that if the narrative around rates does shift, investors may want to again consider those sectors that have been shunned of late.

A two-stage recovery

That REITs are unloved, while sad for us as specialist managers, is not new news, with fund manager surveys showing that exposure to the sector is close to Global Financial Crisis lows. While we believe a stabilisation in interest rates is a crucial first step in real estate’s recovery, we also believe that a decline in rates is not a pre-requisite for public REITs to generate attractive returns from today’s levels because they are already trading at valuations that fully reflect the market’s concerns.

In the private property market, greater confidence in the cost of debt should lead to a pick up in real estate transactions as sellers’ pricing expectations become more realistic and closer to pricing that makes sense for buyers (i.e. lower). This is a scenario that we expect to see in the first half of 2024, which will drive greater price discovery and a resumption of more normal transaction volumes.

In the public REIT market, with shares already priced at or below more realistic values reflective of the new rate environment, recoveries typically begin six to nine months before direct values bottom, with excess pessimism removed as investors rebuild allocations to the sector – we believe we are in this period today.

Confidence in real estate asset valuations will enable investors to look beyond macro turbulence and refocus on the fundamentals: income and income growth, plus the ability for management teams to create value through development and asset management initiatives. While plateauing rates may limit the near-term capital growth story across real estate as a whole, not all real estate is equal across geographies, sectors and companies, and there will be areas of underappreciated growth for active managers like us to identify.

Third time’s a charm?

We therefore look to 2024 with greater confidence and conviction in public REITs’ prospects once again. In a real estate market of winners and losers, we believe the public REITs sector finds itself well-placed, owning more of the ‘right’ real estate, with easier access and significantly lower cost of capital to its advantage in most markets.

A shifting macro narrative may lead investors to revisit public REITs, reduce underweights, and positively re-rate the sector from its current low levels, as well as return the focus to the attractive and growing dividends on offer. Interest rate cuts if they do come, would likely offer further support.

We also highlight the potential for laggards to become leaders within equity markets. Taking some comfort from the fact that public REITs have never seen three years of consecutive negative returns it feels fair to ask whether ‘third time‘s a charm’?

1 Bloomberg, as at 27 November 2023. Past performance does not predict future returns.

2 UBS estimates as at November 2023. Forecasts may vary and are not guaranteed.

Balance sheet: a financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time, used to gauge the financial health of a company.

De-rating: the downward adjustment of a company’s financial ratios, such as the price-to-earnings (P/E) ratio, in response to business or market uncertainty.

EPS: earnings per share is the bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

FTSE EPRA Nareit Developed Index tracks the performance of real estate companies and real estate investment trusts (REITs) from developed market countries.

Leverage: the amount of debt that a REIT carries. The leverage ratio is measured as the ratio of debt to total assets.

Price discovery: the process of determining the price of an asset/security/commodity in the market through the interactions of buyers and sellers.

Real rate: interest rates adjusted for inflation, reflecting the real cost of funds to a borrower or real yield to an investor.

Volatility: the rate and extent at which the price of a portfolio, security or index, moves up and down.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs) may be subject to additional risks, including interest rate, management, tax, economic, environmental and concentration risks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- Shares of small and mid-size companies can be more volatile than shares of larger companies, and at times it may be difficult to value or to sell shares at desired times and prices, increasing the risk of losses.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund invests in real estate investment trusts (REITs) and other companies or funds engaged in property investment, which involve risks above those associated with investing directly in property. In particular, REITs may be subject to less strict regulation than the Fund itself and may experience greater volatility than their underlying assets.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund may incur a higher level of transaction costs as a result of investing in less actively traded or less developed markets compared to a fund that invests in more active/developed markets.

- Some or all of the ongoing charges may be taken from capital, which may erode capital or reduce potential for capital growth.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

- In addition to income, this share class may distribute realised and unrealised capital gains and original capital invested. Fees, charges and expenses are also deducted from capital. Both factors may result in capital erosion and reduced potential for capital growth. Investors should also note that distributions of this nature may be treated (and taxable) as income depending on local tax legislation.