Fiscal expansion

After dominating financial markets in the first half of 2025, the second half saw US trade tariffs seemingly reach a new equilibrium across many areas. One-off deals continue to appear and there remains a case with the Supreme Court on the overall legality of the approach, but the inflationary impact has been much more muted than many had expected. This allowed the Federal Reserve (Fed) to cut interest rates three times from September onwards in response to increasingly weak job growth. While the government shutdown resulted in delayed and/or cancelled data, making reading the state of the economy harder, the picture in the labour market appeared to remain one of slow employment growth but without rising unemployment. This has perhaps helped to support continued spending growth of around 5% and, alongside AI-related investment, kept the US economy growing solidly.

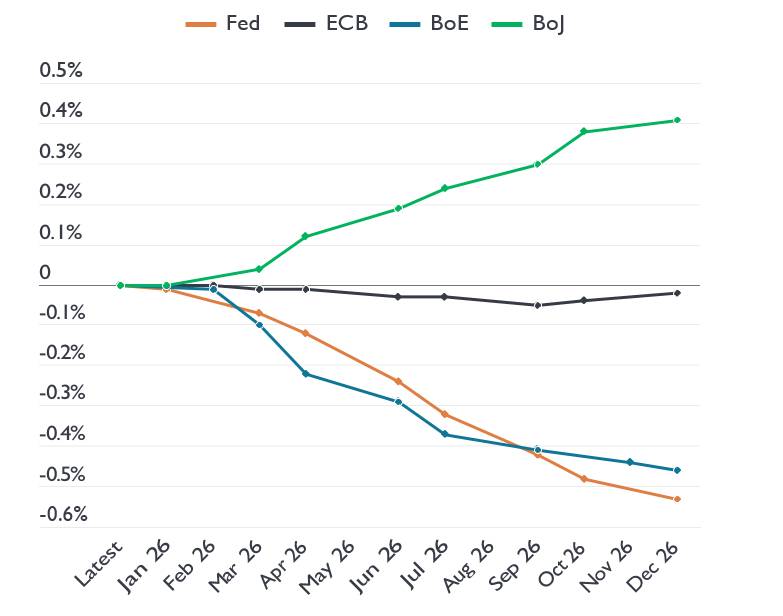

In contrast to the Fed, the European Central Bank (ECB) appears to have reached the end of its current easing cycle. If anything, markets switched to considering when the first hike may come. The outlook for the European economy is being buoyed by forthcoming German fiscal stimulus, with implementation starting in the final quarter of 2025. However, the ECB needs to balance the positives with the need for fiscal consolidation in Italy and France, although the topic continues to create political volatility in the latter. Labour market weakness in the UK and expectations for a sharp deceleration in inflation in 2026 led to the Bank of England (BoE) cutting interest rates four times over 2025.

Figure 1: Estimated change in central bank interest rates during 2026

Source: Bloomberg, market implied change in rates. There is no guarantee that past trends will continue or forecasts will be realised.

The picture in Asia was mixed as Chinese growth continued to show signs of domestic weakness. Exports have boosted the economy but attracted unwanted trade tensions. The situation domestically remains more difficult as house prices fell at a faster pace again and retail sales growth had almost stagnated by the end of the year. In contrast, Japan embarked on a fresh round of fiscal easing after the election of the country’s first female prime minister. Sanae Takaichi is looking to reduce the cost-of-living burden while stimulating the economy, helped by a Bank of Japan (BoJ) that is only tightening policy slowly in the face of sticky inflation.

2025: Another year of optimism

Despite periods of volatility, 2025 was ultimately a strong year for global equity markets, although the overall return varied significantly depending on which currency an investor was based in. The MSCI AC World Index rose 22% in US dollar terms, but this was reduced to 14% in sterling terms and 8% for euro-denominated investors.

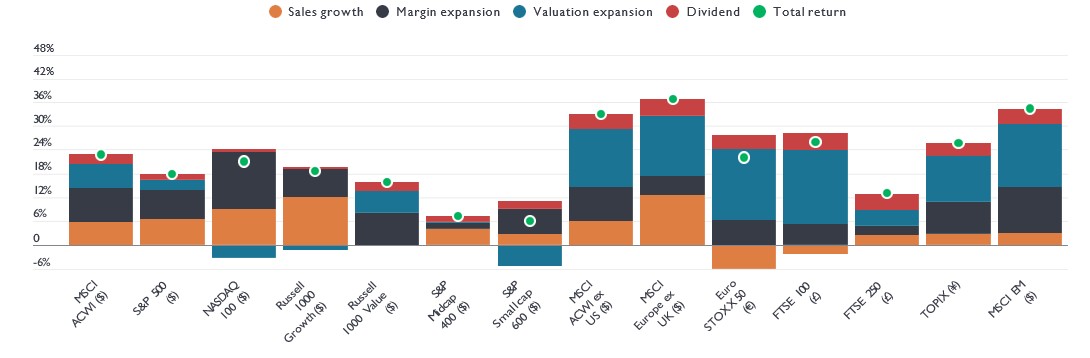

2025 also saw the drivers of equity performance vary across regions. In the US, the solid return from the S&P 500 index was driven mainly by growth in sales and higher margins, with much of this being contributed by the largest AI-related names. In contrast, other regions saw much greater contributions coming from the expansion of valuations as earnings growth was somewhat lacklustre in local currency terms (Figure 1).

Within fixed income markets, credit spreads (the extra yield that a corporate bond typically pays over a government bond of the same maturity) narrowed over the second half of 2025, reversing the widening in early April around “Liberation Day” to return to or reach new cycle lows. The moves in credit were somewhat reflected in sovereign bond yields. Over 2025, 10-year German bund yields rose 0.5% as the European economic situation proved resilient. 10-year UK gilt yields were little changed but the equivalent US Treasury yields declined 0.4% as the Fed ultimately proved to be more dovish than priced at the start of the year. Finally, it is worth noting the strong performance of gold which, after consolidating through the middle of the year, had a further surge higher in the final quarter of 2025. The commodity remains very sensitive to general uncertainty and a range of key risks, including geopolitics, Fed independence and re-allocation away from the US dollar among global currency reserves.

Figure 2: Contributions to total return in 2025

Source: Bloomberg as at 31 December 2025.. Sales growth reflects growth in sales; margin expansion reflects increased profitability; valuation expansion reflects a rise in the price/earnings ratio i.e. companies being valued at a higher multiple of earnings; dividend reflects the income paid out to shareholders; total return is the combined impact of income and any change in capital value for each index shown. Past performance does not predict future returns.

Outlook

While we continue to monitor the US labour market closely as job growth slows, we can find some signs of gradual improvement in other areas. Fiscal stimulus in Germany and the US could help to reaccelerate growth next year, while China may yet implement a further round of economic support to boost its flagging domestic economy. The benefits of prior interest rate cuts should also feed though in the coming months. Therefore, while recession risks remain above average, we can find reasons why we may instead see some re-acceleration.

Lower interest rates, moderate inflation and resilient economic growth would be supportive of risk assets. If the benefits of AI investment become more apparent and encourage further spending, we could yet see equity market valuations expand further. Either way, earnings growth could help deliver a solid year for stock markets globally, as well as supporting tight credit spreads. However, further gains in risk assets are likely to be accompanied by greater volatility, suggesting that diversification may be of greater importance than usual. Government bond yields may have fallen but still offer protection against the types of growth shocks that cannot be ignored in the current environment.

Default: The failure of a debtor (such as a bond issuer) to pay interest or to return an original amount loaned when due.

Diversification: A way of spreading risk by mixing different types of assets or asset classes in a portfolio on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Fiscal stimulus/policy: Fiscal measures are those related to government policy regarding setting tax rates and spending levels. Fiscal consolidation refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Dovish: This describes policymakers loosening policy, i.e. cutting interest rates to stimulate the economy.

Recession: A sustained decline in economic activity, usually perceived as two consecutive quarters of economic contraction.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.