European equities stand well positioned to make further progress in 2026, benefiting from a global macroeconomic rebound, calmer trade relations, and large-scale strategic reforms, particularly in Germany. But what themes do we expect to dominate?

Trade prospects and reforms

Nearly half of Europe’s gross domestic product (GDP) is export oriented, meaning that the region’s prospects are inextricably linked to global trends. Right now, we are seeing support for the US economy from monetary easing (e.g. interest rate cuts), fiscal stimulus measures, and deregulation. With import tariff uncertainties receding, the recent trade agreement between the US and Europe marks a positive milestone. Meanwhile, China is seeing consumer spending and inflation surprising on the upside.

Domestically, we expect reforms and stimulus measures in Europe to lay the groundwork for future growth. Key initiatives include the potential relaxation of bank capital requirements, securitisation market reform, and bills aimed at streamlining regulations. Germany is embarking on a significant plan that combines fiscal stimulus measures and deregulation, expected to drive economic activity through 2026 and beyond.

Europe is home to a broad range of strong businesses

Banks and defence have been strong themes within the European equities market in 2025 and we see further prospects for both sectors. Long-term structural support remains for European defence stocks, given the need for Europe to modernise and expand its capabilities. Any path to enduring peace in Ukraine opens the door across sectors, with Europe expected to take a leading role in the reconstruction process in Ukraine.

We also see momentum building across other themes. Accelerating investment into AI infrastructure has put the spotlight on semiconductor equipment firms and electrical equipment companies. Electrification and grid investment are shaping up as sustained structural growth stories. Monetary easing in the US also bodes well for European companies with cyclical US exposures.

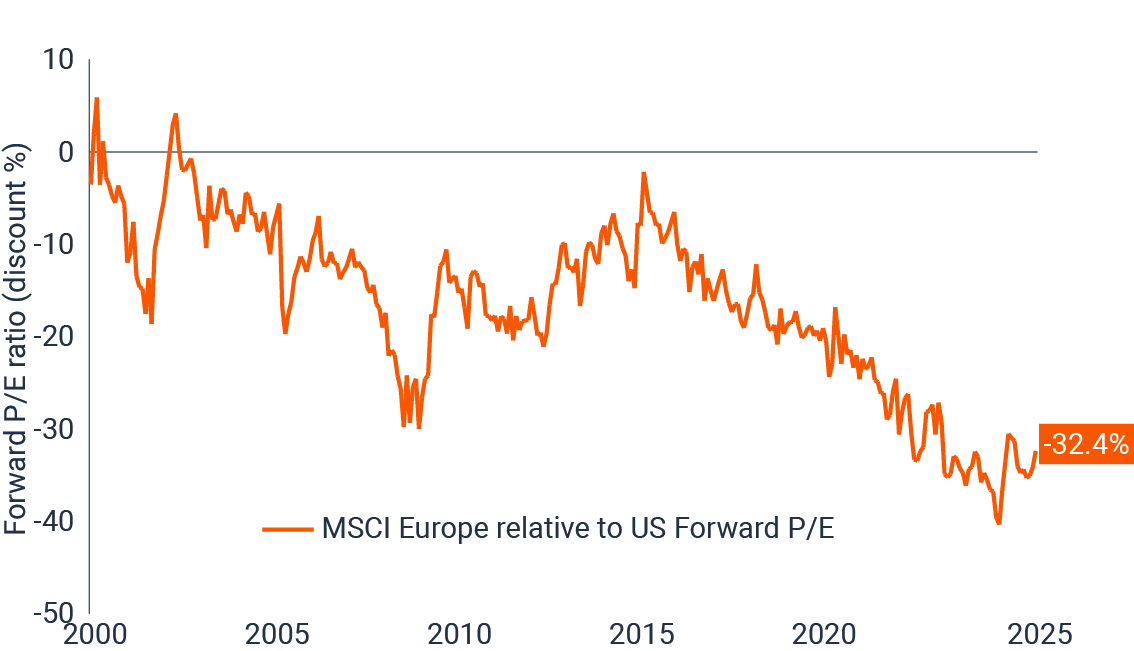

We do not believe that the prospect for European reforms is really factored into current valuations, particularly on a relative basis versus the US (Exhibit 1). Should the momentum get bogged down by political indecision and/or ponderous bureaucracy, there are still multiple pathways for European equities to make progress.

Source: Bloomberg consensus forecasts, Janus Henderson Investors Analysis, at 31 December. P/E is share price divided by earnings per share. Forward earnings are expected earnings over the coming 12 months according to consensus earnings estimates. The discount indicates European equities (MSCI Europe Index) are cheaper relative to US equities (S&P 500 Index) in terms of P/E valuation. At 31 December 2025, European equities traded at a forward P/E of 15.2 (i.e. 15.2 times earnings) versus the US at 22.5 (a discount of 32.4%). Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

Optimism rooted in corporate earnings

Source: Bloomberg consensus forecasts, Janus Henderson Investors Analysis, at 31 December. P/E is share price divided by earnings per share. Forward earnings are expected earnings over the coming 12 months according to consensus earnings estimates. The discount indicates European equities (MSCI Europe Index) are cheaper relative to US equities (S&P 500 Index) in terms of P/E valuation. At 31 December 2025, European equities traded at a forward P/E of 15.2 (i.e. 15.2 times earnings) versus the US at 22.5 (a discount of 32.4%). Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.