President Trump is not one to shy away from publicity and so it was little wonder that the first half of 2025 was defined by the new US administration, particularly its approach to trade policy.

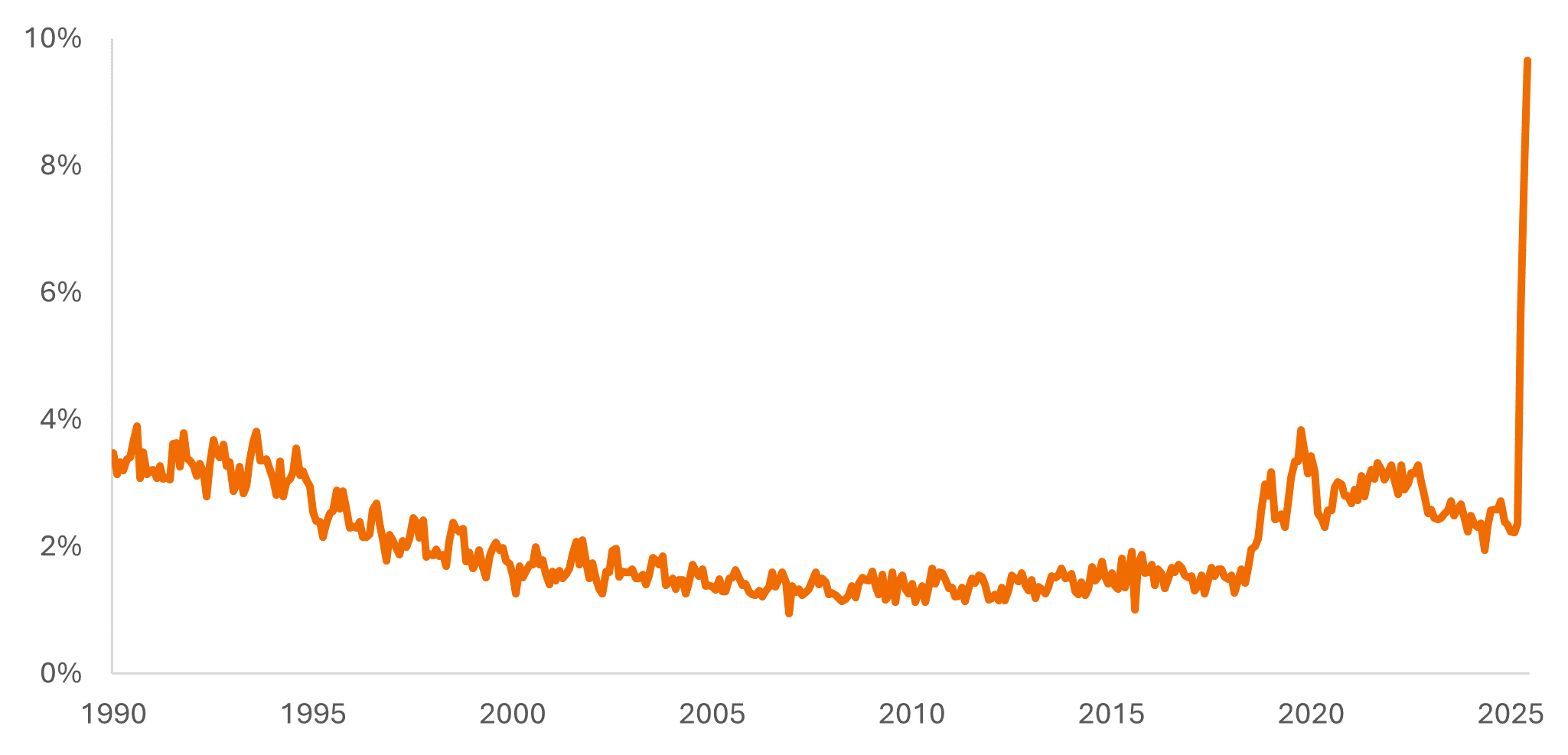

Markets had anticipated Trump would be true to his word and raise tariffs but the scale of the rises announced on 2 April, so-called “Liberation Day” shocked markets. Concerns grew that the tariffs risked slowing global growth and raising US inflation, even raising the spectre of a potential recession. Matters were not helped by China and the US playing hardball with each other, engaging in tit-for-tat tariff increases until some calm ensued. A pause in implementation until early July left a window of uncertainty but offered some hope that the final tariff rates would be milder than the opening levels.

Having sold off sharply on the initial tariff announcements, markets rebounded quickly during the “pause” period. Even an escalation of tensions in the Middle East, which temporarily drew the US into bombing nuclear facilities in Iran, was shrugged off by markets.

Economic backdrop

During the first half of 2024 inflation tended to moderate globally. In the UK, however, inflation rose in the second quarter as big increases in utility bills were pushed through and companies sought to pass on hikes in national insurance through the prices paid by customers. Labour markets remained robust, although there was some evidence of a slowdown in developed markets as the number of job vacancies softened. While the US reported a negative quarter for gross domestic product growth in Q1 2025, this was partly attributed to distortions from trade as companies front-loaded imports (a detractor from GDP) ahead of the tariff announcements and consumers pared back spending. Otherwise, global growth remained resilient.

US equities give ground to Europe

Equity markets returned towards their recent highs and made new highs in some areas. Strong earnings reports in the first quarter helped solidify positive momentum. European markets, in particular, benefited from news of greater fiscal stimulus in Germany, while the defence sectors rallied in advance of NATO members committing to a big rise in defence spending.

There was a notable weakening of the dollar during the period, with it falling against most major currencies and by 9% against the pound sterling. This meant US assets tended to underperform once dollar returns were translated into sterling. For example, the S&P500 Index, representing the largest 500 US companies, rose 6.2% in US dollar terms over the six months to 30 June 2025, but fell 2.9% when translated into sterling terms. European markets were strong, with the MSCI Europe ex UK Index rising 14.3%, while in the UK, the FTSE 100 Index rose 9.5% over the first half of 2025. The MSCI Emerging Markets Index rose 5.6%.

Bond markets

Cuts in interest rates by several central banks, including the European Central Bank and Bank of England, together with moderating inflation, helped yields on shorter-dated bonds to fall and their prices to rise over the six-month period. Performance of longer-dated bonds (10 years to maturity or longer) was more mixed as yields declined in the US and the UK but rose in Germany.

Government bonds must balance the prospects of slower growth, likely higher inflation in the US and greater government bond issuance across many major markets. The One Big Beautiful Bill Act in the US and measures proposed by Germany on infrastructure and defence spending will lead to more government borrowing. Matters are not helped by Trump being a vocal critic of the US Federal Reserve (Fed) Chair Jerome Powell, which adds additional uncertainty around interest rate policy in the US.

Credit spreads (the additional yield that corporates pay above a government bond of similar maturity) are back close to cycle lows. This leaves corporate debt more reliant on yields for returns, and vulnerable to spread widening if the economy were to sour noticeably. That said, yields remain attractive relative to recent history, and appetite for corporate bonds, for now, remains strong.

Outlook

Equity valuations (share prices divided by earnings per share, known as the price/earnings or p/e ratio) are high, both in the US and the rest of the world (in aggregate), although the UK remained relatively inexpensive. There are concerns that slower economic growth in the US may weigh on value stocks and smaller companies. Tariffs may cause pain for equities outside the US but this needs to be set against the potential upside benefits from government stimulus in Europe and China.

Ironically, a more unpredictable White House has tarnished perceptions of US exceptionalism. In some ways this has been a good thing, as it has encouraged investors to allocate more to other regions and provided a corrective to earlier exuberance.

Looking ahead into the second half of 2025, the delayed effects of higher tariffs may weigh on growth around the world, as well as push up US inflation. Recession risk is perhaps more elevated compared to usual as a result. This leaves the Fed in a difficult place, caught between rising inflation and a softer labour market. At some point, the White House will have to finalise tariff negotiations so the second half may bring some certainty on that front, although it remains to be seen whether markets will like the outcome.

All index return data is sourced from LSEG Datastream, in total return in sterling terms, unless indicated otherwise. Past performance does not predict future returns.

Fig 1: US effective import tariff rate soars

Source: Bloomberg, 31 January 1990 to 30 June 2025.

Gross domestic product: A measure of the size of the economy, reflecting the value of all finished goods and services produced by a country within a specific time period.

Tariff: A tax or duty paid on imports of goods.

US exceptionalism: The notion that the US has unique qualities that set it apart from other countries.

Value stocks: Companies that are deemed undervalued by the market, typically with low price/earnings ratios. They are often in sectors that are more sensitive to changes in economic growth.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

Volatility: The rate and extent at which the price of a portfolio, security or index moves up and down.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.