Dividends

LWI

Lowland Investment Company plc

Dividends

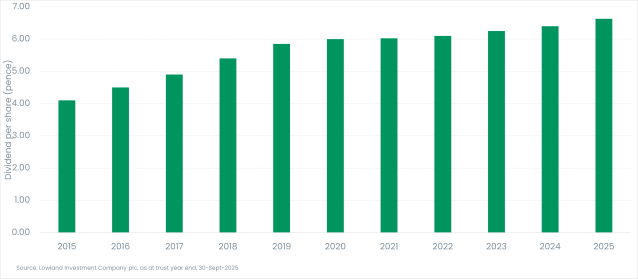

Lowland Investment Company aims to provide shareholders with better than average dividend growth. It is the Board’s intention to seek to continue to increase the dividend at a steady rate.

The Company aims to pay a progressive dividend, with each quarterly dividend equal to or greater than its previous equivalent.

Dividends are paid quarterly. The company generally pays dividends in January, April, July, and October.

Past performance does not predict future returns. The value of an investment and the income from it may go down as well as up and you may lose the amount originally invested.

Historic dividends (pence per share)

Dividend history

| Ex Dividend Date | Pay Date | Amount div p/ps |

|---|---|---|

| 29-Dec-25 | 30-Jan-26 | 1.70 |

| 25-Sep-25 | 31-Oct-25 | 1.65 |

| 26-Jun-25 | 31-Jul-25 | 1.65 |

| 03-Apr-25 | 30-Apr-25 | 1.62 |

| 24-Dec-24 | 31-Jan-25 | 1.62 |

| 26-Sep-24 | 31-Oct-24 | 1.60 |

| 27-Jun-24 | 31-Jul-24 | 1.60 |

| 11-Apr-24 | 30-Apr-24 | 1.60 |

| 28-Dec-23 | 31-Jan-24 | 1.60 |

| 28-Sep-23 | 31-Oct-23 | 1.60 |

| 29-Jun-23 | 31-Jul-23 | 1.52 |

| 30-Mar-23 | 28-Apr-23 | 1.52 |

Discrete performance (%)

|

Quarter End As of 31/12/2025 |

2024/2025 | 2023/2024 | 2022/2023 | 2021/2022 | 2020/2021 |

|---|---|---|---|---|---|

| Share price | 35.34 | 4.43 | 9.14 | -5.18 | 16.31 |

| Net asset value per share | 31.42 | 8.10 | 8.85 | -5.67 | 23.85 |

| FTSE All-Share TR Index | 24.02 | 9.47 | 7.92 | 0.34 | 18.32 |

Source: © 2026 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not predict future returns.