BBB CLOs combine income, structural resilience and diversification benefits, offering an alternative way to reshape credit exposure for a late‑cycle environment of tight credit spreads.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

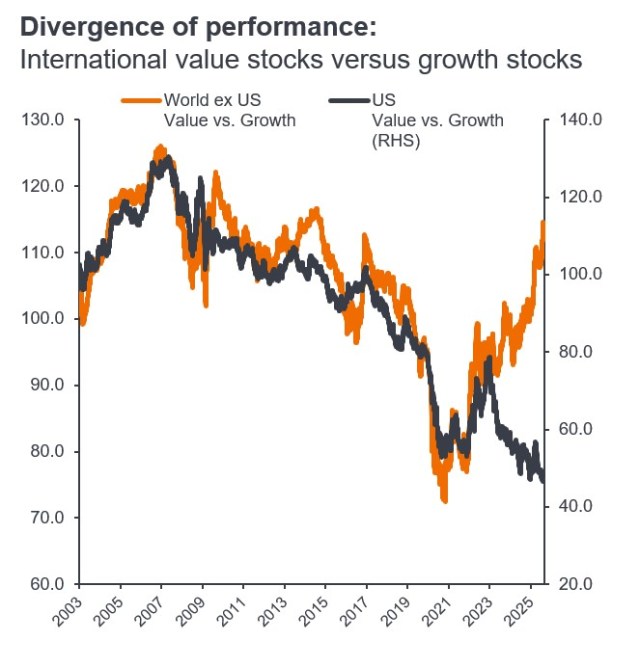

Investors concerned about high concentration in US stocks should look elsewhere to achieve better portfolio diversification.

What are non-agency residential mortgage-backed securities (RMBS), and how might they play a role in investors’ portfolios?

Investors with a narrower focus are missing out on the benefits of diversification.

The first in a three-part video series explores the role securitized assets played in the Global Financial Crisis.

The final installment in a three-part video series considers how non-mortgage related securitized sectors fared through the GFC and what investors can learn from this period in history.

We explore the different types of investor and their motivations for investing in CLO ETFs.

Why bond investors need a new playbook to maximize a fixed income allocation’s potential.

The European ABS sector offers access to different consumer-driven and ‘real economy’ risks, diversifying from corporate credit. Here we unravel the sector's distinguishing features.

European securitisations are ‘risky’ given concentration and ‘opaque’, which transpires as myths when considering the clear diversity in its biggest sector, CLOs.

Ranking the best-performing U.S. fixed income sectors of 2024.