| The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level. |

The Los Angeles commercial property market is facing multiple headwinds. We recently toured the city for the first time since January’s devastating wildfires, meeting with local property owners, investors and brokers, to gauge whether the city was showing any signs of recovery. The ‘City of Angels’ remains a cultural and economic powerhouse, but recent events have shone an even brighter light on its future path. Local leaders are asking questions as to whether the city can maintain its allure as an attractive place for residents and businesses, and whether, in the absence of major political reform, the city’s best days may already be behind it.

LA faces major economic and social problems

On the ground, sentiment could not have been more negative. The scale of the challenges is significant, with issues raised ranging from deteriorating business sentiment and a shrinking entertainment industry, to rampant homelessness, expensive housing, and a stringent tax and regulatory environment that prohibits much needed housing supply. Outmigration also continues to be a significant headwind to LA’s economic growth, making it one of the slowest-growing metros in the US. In the five years to 2024, LA County has lost almost 2.5% of its population, and hundreds of companies have moved their headquarters out of the city.

The devastating wildfires and impending tariff disruption seem to have only exacerbated existing concerns. The wildfires have depressed business activity, whilst tariff uncertainty threatens to freeze corporate decision making.

Costly wildfire devastation

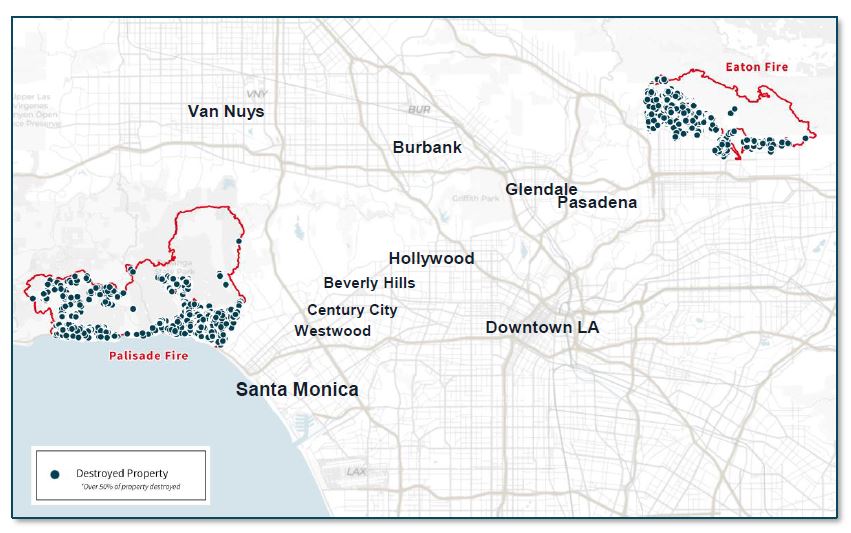

The LA fires in January 2025 were the most destructive in the city’s history. The economic toll has been staggering, with more than 18,000 structures destroyed causing an estimated US$250 billion of damages and economic loss, and property value loss to the tune of circa US$40 billion.1 The most obvious impact has been widespread displacement, with the cost and rebuilding process timeline shrouded in uncertainty.

What are the implications of the LA wildfires on real estate?

So far, the impact on the commercial and residential property market has been somewhat limited to the hardest-hit areas, with more than 95% of real estate losses in the fires stemming from single-family homes. 2 Most displaced families have rented larger homes or short-term Airbnbs in the city. This is where the rental market has been most unforgiving amidst the desperation to find shelter, and where suspicions of owners engaging in ‘price-gouging’ tactics have been most acute.

More broadly however, the impact to LA’s apartment sector has been muted. In the Pacific Palisades, household incomes averaged around US$200,000, and home values averaged US$3.8 million. The traditional apartment sector in contrast, is characterised by younger renters and dominated by one-bedroom and studio apartments. Apartment rents were up a mere 0.6% in Q1 2025 versus last year, well below the national average of 1.1%.3

Beyond the short-term impact on the residential market, there remains real fear that following the fires, many families and business leaders simply will not return. Many residents who lost homes have migrated their families and in some cases their employees to nearby beach towns, with lower cost housing, where children have been quickly enrolled into public schools. Some have left the state altogether, moving to Arizona or Texas. Time will tell whether these moves are permanent.

Figure 1: LA wildfire disaster is the costliest in US history

Source: JLL Research, Los Angeles Office Market, March 2025.

Optimism for the timing of the rebuild was also limited. Some experts were suggesting a timeline of more than five years to fully restore the worst hit areas. They cited severe damage done to infrastructure, logistical challenges for delivery of materials, a slow and arduous permit approvals process, high demand for contractors, limited labour availability, and escalating construction costs. A choppy insurance market is another headwind, with claim payouts in many cases not coming close to covering rebuild costs. Major providers such as State Farm and Allstate have also withdrawn from issuing new policies in high-risk zones.

LA’s sobering office market

Amidst an evolving landscape of weak economic growth and remote work, it is no secret that LA’s office sector is severely challenged. In a far cry from a once booming office market, several recent office transactions suggest office values have plummeted by 35-70% since early 2020.

This trip did nothing to suggest brighter days are ahead. While LA is not alone in contending with large corporate users shunning downtown central business districts (CBDs), the city urban ‘doom loop’ seems considerably worse than its gateway counterparts. Downtown LA in particular, is showing no signs of stemming the glut in vacant office space, with older obsolete office buildings losing tenants, and some falling into foreclosure given the magnitude of value destruction.

LA’s problems are especially acute for several reasons. The homelessness crisis, of which downtown LA is the epicentre, was raised several times to us as a key hurdle to an office recovery. LA City & County’s homeless population of over 70,000 is the second largest among US cities in 2024, according to USAFacts.org.

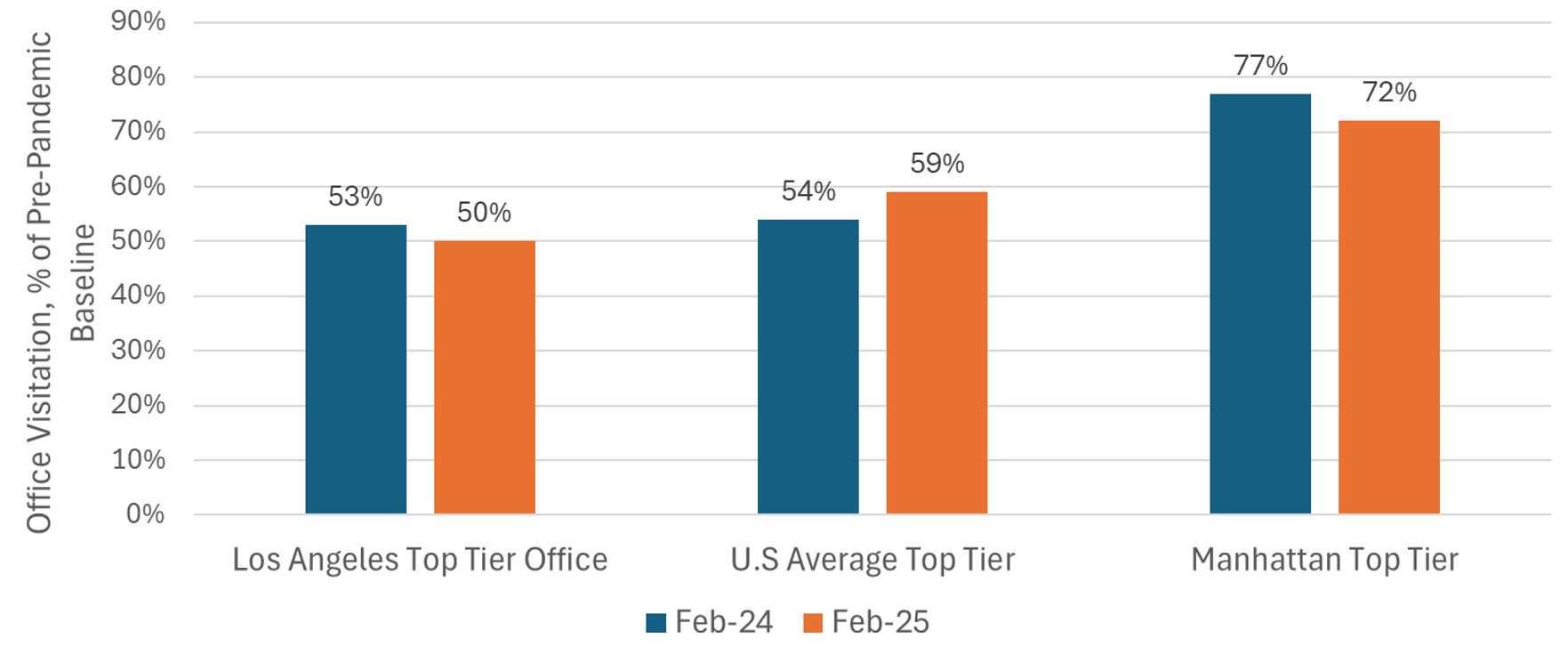

Office visitation in the city also remains well below the national average, stalling out over the past year at a pedestrian 50% of pre-COVID attendance. It’s sprawling geography and well-known epic rush-hour commutes are a major hurdle for RTO (return-to-office) mandates. Unlike other big cities, LA lacks credible alternatives to driving to work.

Figure 2: Los Angeles office visitation rates

Source: Placer.ai, Janus Henderson analysis, as at 16 May 2025.

With key drivers of the economy (namely the technology and media/entertainment sectors) still retrenching from the market and right-sizing their office footprints, it remains difficult for us to be constructive. Unlike San Francisco, where hopes of an impending office recovery have been pinned on an AI resurgence, drivers of Office demand growth in LA seem elusive. Other markets such as New York and Boston in contrast, are seeing slowing downsizing activity, and much more vibrant tenant activity, while Sunbelt office markets like Austin, Miami, Atlanta, Dallas and Charlotte continue to benefit from favourable demographic trends and corporate relocations.

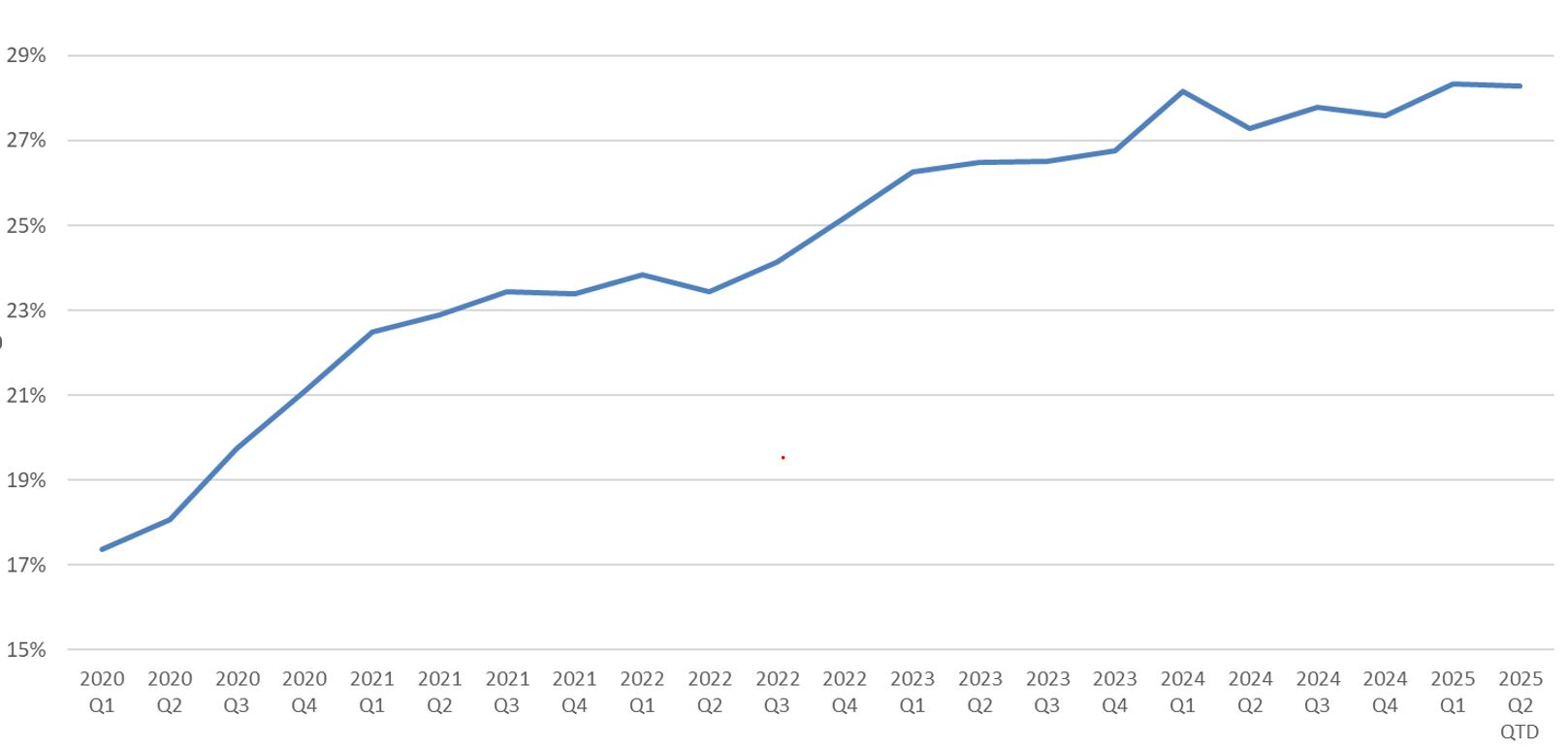

Figure 3: Los Angeles office availability rate

Source: CoStar, as at 16 May 2025.

In LA, the multitude of negative headwinds have contributed to an alarmingly high office availability rate (which includes space up for sub-lease) of 28%, up from 17% in early 2020 (Figure 3). Whilst parts of LA’s office market are holding in as companies move West to safer, more vibrant areas such as Culver City, Beverly Hills, and Bel Air, most are simply relocating, and cutting their office footprint significantly in the process.

Entertainment woes add to the less constructive outlook

The traditional entertainment industry, the heartbeat of life in LA, is also going through major upheaval. We toured several major production studios and sound stages in West Hollywood. Once upon a time, activity buzzed with film and production crews. Nowadays, people in the business describe a worrisome future. On-location feature film production is down 29% from one year ago, with TV production down 58% over the past three years. The number of recording days booked for music stages dropped from 127 in 2022 to just 11 so far this year.4

Global streaming spend cutbacks are one part of the story, but California is also losing filming share to lower cost markets with more attractive tax incentives, such as Georgia, Louisiana and New York. Some production has even relocated to Canada and the UK. Streamers like Amazon, Disney, Warner Bros, Discovery and Paramount are increasingly shooting on their own campuses. Spillover demand to rent LA’s sound stages, which were once full amid a boom in streaming content, no longer appears to exist. Stage occupancy, historically routinely above the 90% level, has now cratered to a new low of 63% in 2024.5

Will LA be back?

LA’s economy is indeed large, dynamic and diverse, but the entertainment industry is considered a cornerstone of the city’s growth prospects. Further struggles would be a major overhang on economic growth, particularly when added to the city’s long list of existing headwinds.

Our research trip reinforced our less constructive view of LA, with bold action needed to turn things around. Thinking of former Governor of California Arnold Schwarzenegger’s iconic quote in The Terminator, “I’ll be back” ─ a Hollywood comeback story might indeed be the key to turning around the fortunes of a city at a crossroads.

1California Department of Forestry and Fire Protection (CalFire); AccuWeather estimates as at 13 January 2025; JLL Los Angeles Office Market Report Q1 2025.

2 CoStar News as at 30 January 2025.

3 CoStar, Q12025 Los Angeles Multi Family Report.

4 Hollywood Reporter, 15 April 2025.

5 FilmLA Sound Stage Production Report, 3 April 2025.

Sunbelt: the region comprising the southern states in the US, extending from California in the west to Florida in the East.

Images sourced from Getty Images unless otherwise stated.

IMPORTANT INFORMATION

REITs or Real Estate Investment Trusts invest in real estate, through direct ownership of property assets, property shares or mortgages. As they are listed on a stock exchange, REITs are usually highly liquid and trade like shares.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally, REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.