AI has been the dominant economic driver

For the last two years in our outlook, we have talked about the importance of artificial intelligence for the economy and the markets. At the end of 2023 we pointed out that while the US Federal Reserve’s (Fed) Chair might be the economy’s pilot, it was AI – the emerging “co-pilot” – that was really going to drive the economy. At the end of 2024 we expected technology to cement its reputation as the vampire sector – sucking growth from other sectors of the economy. And in 2025 this all became evident, with the Fed taking a backseat to AI in markets. While AI spending is still a small share of GDP, it was responsible for the vast majority of US economic growth in the first six months of 2025.1

What tailwinds do we see for tech stocks in 2026?

As we enter 2026, we see a constructive backdrop for equities with a new Fed Chair in May likely providing support. Should headwinds of government spending cuts and tariffs in 2025 reverse, they will become tailwinds to the economy, driving incremental demand across broader sectors, beyond AI. With the Trump administration and change afoot, a smooth path is never certain but industrials, autos, and housing-related demand for technology have shown signs of bottoming. The delineation of AI demand as separate to the rest of the economy will fade as the focus shifts to its potential for improving overall productivity. We expect that this will drive further technology share gains in the economy.

AI is transformative – and transformation takes time

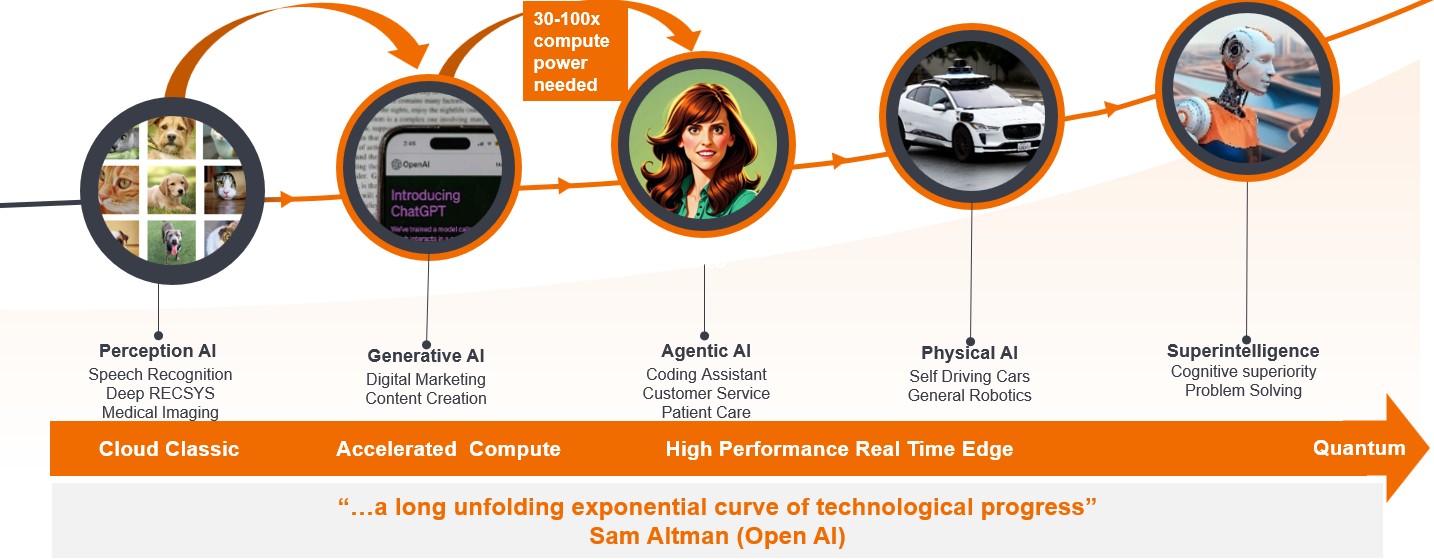

AI is a long-term wave – not just a theme. A technology wave (AI is the fourth wave after the mainframe, PC internet, and mobile cloud) is defined by the fact it touches every aspect of the economy. It requires investment in every layer of the technology stack from the silicon (semiconductors), to platforms, devices, and models with every company becoming an AI user in some way. These waves take multiple years to evolve and for AI, the pace of build out of capacity is being gated by deglobalisation, permitting, power availability, construction limitations as well as availability within the compute supply chain.

There is a circular problem in that the gating factor on demand for compute power has been the capacity available to train and develop new models. As we shift from generative AI to agentic AI, more reasoning capability and memory are needed to provide greater context. This requires significantly more compute power for increased token generation (units of data processed by AI models). We see areas such as physical AI developing quickly with a broadening of testing of autonomous driving and robotics worldwide. In short, as we look towards 2026 and 2027, we believe demand for compute power will continue to outstrip supply.

Figure 1: AI evolution expands use cases

Revenue opportunities emerging

Source: Janus Henderson Investors.

Why do we think skepticism about AI valuations is healthy?

The debate on the spending magnitude on AI has come much earlier than we would have expected given the impressive revenue ramps seen at start-ups, such as OpenAI and Anthropic, with revenue growth at a pace that we have not seen in our team’s combined 100+ years of investing in the technology sector.

Recent signs of investing circularity, combined with the outperformance of perennially unprofitable tech names this year, have brought healthy skepticism to the sector. We are monitoring this closely and recognise that there are pockets of hype appearing, for example in quantum computing. This aligns with our core belief that valuation discipline and assessing true unappreciated growth are essential for a rewarding long-term investment in tech stocks.

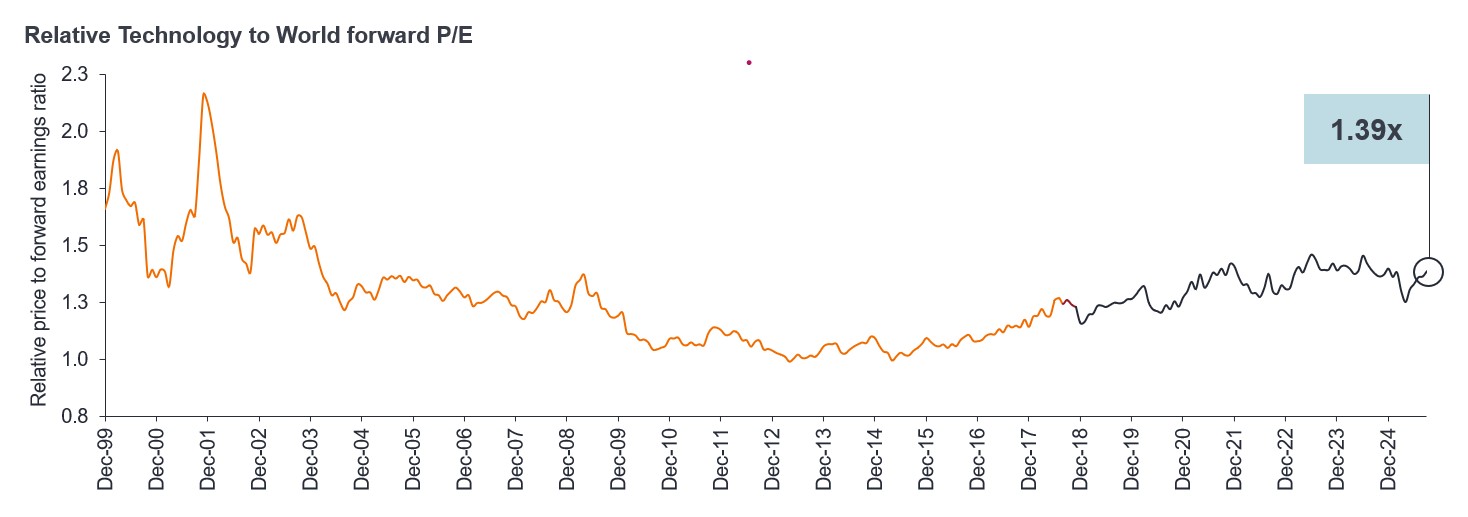

Tech sector valuations remain within the range of the last five years, significantly below that of the internet bubble. We see opportunity as we expect positive earnings revisions and growth above that of the broader equity market in 2026.

Figure 2: Tech stock valuations are a long way from 1999/2000 highs

Source: Bernstein, as at 30 September 2025. Forward P/E = Price to forward earnings. (Orange line) MSCI ACWI Information Technology Sector, price-to-forward earnings relative to MSCI ACWI Index from December 1999 to November 2018 pre GICS sector changes in MSCI Global indices, (Red line) represents the change to (Grey line) MSCI ACWI Information Technology + ACWI Communication Services relative to MSCI ACWI Index to 3 September 2025 post GICS sector changes in MSCI Global indices. Past performance does not predict future returns.

Active management has multiple key roles in tech investing

We still see underappreciated growth and disparity in valuations within the Magnificent 7 stocks; the Mag 7 are certainly not a monolith. When innovation and disruption are accelerating at such a pace, market leadership can change. This heightens the importance of identifying the leaders of tomorrow versus being passively tied to the winners of a prior era.

This is why active management is crucial in tech investing – to ensure portfolio diversification as well as balance exposure to the best of the mega caps, while also broadening into names where we see emerging leadership and underappreciated earnings growth. Be it tied to next generation AI infrastructure layers or in areas such as fintech, automation, agentic ecommerce (internet 3.0), or enabling the electrification of the economy.

Stock selectivity key while technology continues to take share

We believe that the magnitude and duration of AI is still underappreciated. Our experience of investing in past technology waves has taught us that the build of capacity and the emergence of new applications will not be linear – investors must be prepared for the ensuing volatility. We are no longer at the beginning of the AI transformation but there is still a long way to go. Stock selectivity, active management, and valuation discipline will be key to navigating the hype from the reality of this transformative technology wave in 2026 and beyond.

1 Fortune.com; “Without data centers, GDP growth was 0.1% in the first half of 2025, Harvard economist says”; 7 October 2025.

Agentic AI: An AI system that uses sophisticated reasoning and iterative planning to autonomously solve complex, multi-step problems. Vast amounts of data from multiple data sources and third-party applications are used to independently analyse challenges, develop strategies and execute tasks.

Diversification: A way of spreading risk by mixing different types of assets or asset classes in a portfolio on the assumption that these assets will behave differently in any given scenario.

Generative AI: Refers to deep-learning models that train on large volumes of raw data to generate ‘new content’ including text, images, audio and video.

Magnificent 7: Refers to the seven major technology stocks Apple, Microsoft, Nvidia, Amazon, Tesla, Alphabet, and Meta that have dominated markets in recent years.

Mega cap: Typically refers to US companies with a market capitalisation (market cap) above $200 billion. Market cap is the total market value of a company’s issued shares and is used to determine a company’s size.

Physical AI: The integration of sophisticated AI algorithms into tangible, interactive systems, enabling autonomous machines with cognitive reasoning and spatial knowledge to learn from their interactions and respond in real time. Examples include autonomous vehicles, surgical and humanoid robots.

Price-to-forward earnings: A ratio calculated by dividing the current share price by projected earnings for the next 12 months to value a company’s shares.

Quantum computing: A multidisciplinary field including computer science, physics, and mathematics that utilises quantum mechanics to solve complex problems faster than on classical computers.

Valuation: The process of determining the fair value of an asset, investment, or firm. Among others, future earnings and other company attributes are used to arrive at a valuation.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.

Important information

Please read the following important information regarding funds related to this article.

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- When the Fund, or a share/unit class, seeks to mitigate exchange rate movements of a currency relative to the base currency (hedge), the hedging strategy itself may positively or negatively impact the value of the Fund due to differences in short-term interest rates between the currencies.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.

Specific risks

- Shares/Units can lose value rapidly, and typically involve higher risks than bonds or money market instruments. The value of your investment may fall as a result.

- If a Fund has a high exposure to a particular country or geographical region it carries a higher level of risk than a Fund which is more broadly diversified.

- The Fund is focused towards particular industries or investment themes and may be heavily impacted by factors such as changes in government regulation, increased price competition, technological advancements and other adverse events.

- This Fund may have a particularly concentrated portfolio relative to its investment universe or other funds in its sector. An adverse event impacting even a small number of holdings could create significant volatility or losses for the Fund.

- The Fund may use derivatives with the aim of reducing risk or managing the portfolio more efficiently. However this introduces other risks, in particular, that a derivative counterparty may not meet its contractual obligations.

- If the Fund holds assets in currencies other than the base currency of the Fund, or you invest in a share/unit class of a different currency to the Fund (unless hedged, i.e. mitigated by taking an offsetting position in a related security), the value of your investment may be impacted by changes in exchange rates.

- Securities within the Fund could become hard to value or to sell at a desired time and price, especially in extreme market conditions when asset prices may be falling, increasing the risk of investment losses.

- The Fund could lose money if a counterparty with which the Fund trades becomes unwilling or unable to meet its obligations, or as a result of failure or delay in operational processes or the failure of a third party provider.