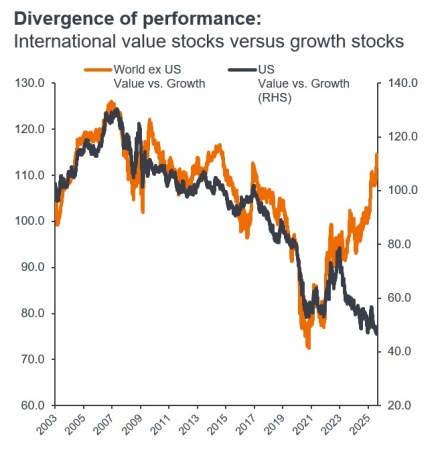

Source: Goldman Sachs Investment Research, Bloomberg, Janus Henderson Investors as at 31 August 2025. LHS chart total return indexed to 100 as at Jan 2003. Past performance does not predict future growth.

The perception of the performance of value vs growth stocks has appeared to be a one-sided debate for the past few years with some of the largest growth (often technology) stocks consistently outperforming the global market. Nonetheless, an analysis of international indices (global excluding US) versus domestic (US) stocks paints a very different picture.

Since 2009 there has been a trend of growth outperforming value, resulting in the narrative that “value isn’t working”. This may seem true for US equities where the rise of the Magnificent 7 and AI-driven tech giants skewed index performance heavily toward growth stocks. But since 2023, a divergence has emerged.

International markets, which have broader sector representation and more balanced style exposure is telling a different story — value is outperforming growth.

Diversification: A way of spreading risk by mixing different types of assets or asset classes in a portfolio on the assumption that these assets will behave differently in any given scenario. Assets with low correlation should provide the most diversification.

Growth stocks: Growth investors search for companies they believe have strong growth potential. Their earnings are expected to grow at an above-average rate compared to the rest of the market, and therefore there is an expectation that their share prices will increase in value.

Value stocks: Value investors search for companies that they believe are undervalued by the market, and therefore expect their share price to increase.

Magnificent 7: A reference to the seven major technology stocks—Apple, Microsoft, Nvidia, Amazon, Tesla, Alphabet, and Meta—that have dominated markets in recent years.

MSCI World ex USA Value vs Growth: The MSCI World ex USA Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across Developed Markets (DM) countries–excluding the United States. The MSCI World ex USA Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries.

MSCI USA Value vs Growth: The MSCI USA Value Index captures large and mid-cap US securities exhibiting overall value style characteristics. The MSCI USA Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics in the US.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.