“There is, in our view, room for both extremes in 2025. Room for capital markets to fly, but also potential for greater risks…” That was our view at the start of 2025, where we saw markets with potential to make progress, but a level of uncertainty in investor behaviour that led us to believe that disruption was likely to become the norm.

As it happened, both outcomes proved to be true. The first half of 2025 saw heightened geopolitical uncertainty take root, as financial markets and economies grappled with the impact of tariffs, escalating tensions in the Middle East, the impact of ongoing conflict in Ukraine, and a worsening fiscal situation in the developed world.

But despite short, sharp setbacks, tech giants like Nvidia and Microsoft continued to push US markets to ever-higher levels as the year progressed. Across the Atlantic, European equities surged on optimism over lower interest rates, German fiscal stimulus measures and improved earnings momentum. A year of two halves, but has anything really changed?

The dichotomy of capital markets

As we look ahead to 2026, we see the current state of capital markets as a paradox. While there are prospects for capital markets to deliver further performance, we still see a multitude of challenges in a complex, debt-heavy landscape, characterised by AI advancements, geopolitical shifts, and economic uncertainties. This suggests a need to reassess traditional investment strategies and potentially consider how diversified alternatives can help investors to manage risk and achieve their return objectives.

Traditional diversifiers, such as equities and fixed income, have, in recent years, displayed increased correlation, reducing their effectiveness in managing risk. This means that the need for portfolio diversification is becoming more critical than ever. The potential for asset classes to move homogeneously under stress highlights the importance of having a “Plan B” that can adapt to an era where disruption is increasingly the norm, during periods when traditional assets do not perform as expected.

The role of diversified alternatives in 2026

We see this conflicted environment – uncertainty, but with a desire to maintain a ‘risk-on’ undertone – as supportive for alternative hedge fund strategies. Increased corporate activity levels, the need for liquidity provision, and for market participants to transfer risk, are all factors providing opportunity for specialised investment strategies to deliver returns independent of market direction. The landscape of alternative investments is broad, encompassing private assets (both equity and credit), as well as more esoteric hedge fund-like strategies. The key distinctions lie in their liquidity and return profile, particularly in times of market stress.

The increased issuance of convertible bonds and event-driven opportunities are examples of how alternatives can take advantage of market dynamics. The continued tailwind of refinancing maturing bonds, plus the attractiveness of lower coupons from convertibles relative to corporate bonds, leads us to expect activity to remain robust into 2026. This, in turn, can provide more opportunity for a convertible arbitrage strategy, given these bonds are typically issued at a discount to fair value.

Moreover, a more supportive regulatory environment, with changes in antitrust regulations, and faster deal clearance processes, is presenting new avenues for mergers and acquisition (M&A) activity, enhancing the potential for merger arbitrage strategies. With private equity currently armed with a lot of ‘dry powder’ – large cash reserves that they need to put to work to generate a return for their investors – and the initial public offering (IPO) market picking up, all the pieces are in place for a further increase in activity. Changes we have also been looking for in US banking regulation have started to come through to the benefit of derivative arbitrage strategies, as it should reduce balance sheet stress.

Prepare for the unpriced risk of market shocks

As always, sentiment plays a significant role in shaping investment strategies. Economic growth, particularly in regions like Europe, is likely to depend on factors such as infrastructure spending and deregulation in 2026, with Germany’s huge infrastructure and defence plan unlocking new capital channels and investment opportunities. However, this growth is tempered by concerns over increased debt and financing challenges, impacting currency strength and market stability.

The correlation between technological advancements, such as AI, and market valuations is highlighting the risks associated with today’s interconnected modern economy. Many portfolios, particularly passive investment strategies, are now heavily exposed to this concentration of dominant technology stocks.

While this environment argues the need to have some form of safety net, the market does not currently seem to be pricing in the risk of higher volatility. The positive consensus for markets in 2026 is nearly universal, bringing to mind investor Warren Buffett’s view on this kind of euphoria: “Be fearful when others are greedy, and be greedy when others are fearful.” On the plus side, this low volatility environment enables those within the diversified alternatives world who are less fearful to construct low cost, long volatility insurance-style exposures.

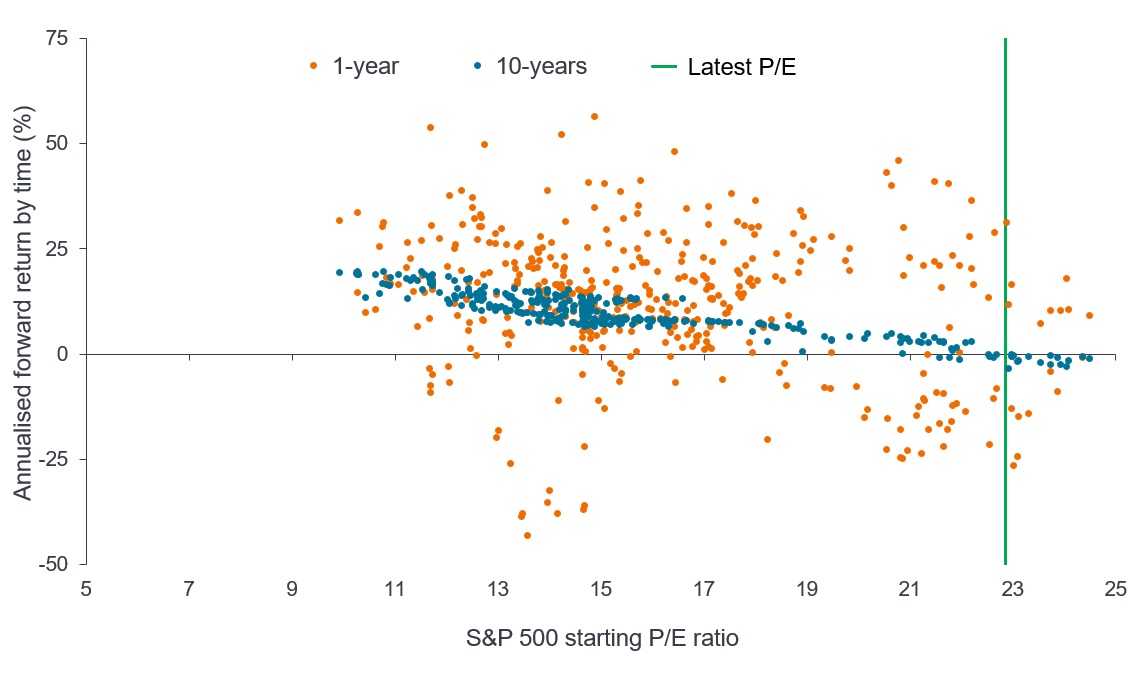

Valuations are high by historical standards, and – as Exhibit 1 shows – price has often held a strong correlation with future returns over the longer term. The prospect for valuations to stretch even further seem limited.

Exhibit 1: Equity markets might struggle to deliver long-term returns from here

Annualised forward returns on S&P500 from different starting P/E ratios

Source: DataStream, Janus Henderson Investors, as at 1 October 2025, in US dollars. Past performance does not predict future returns.

There are always hidden risks in market consensus. If the AI hype cycle were to show tangible signs of peaking, or if political interference in central bank policy lead investors to reassess their expectations, it could see sentiment reverse sharply, triggering broader market disruption. We see this as a broad concern for investors as we look ahead to 2026, and a potentially strong opportunity for diversified alternatives to show their value – particularly their ability to insulate or mitigate unexpected market shocks and markets that trend down, through ‘always on’ defensive strategies.

Building resilience is no longer optional

Old rules no longer apply when it comes to building portfolio resilience. At this point, we believe most portfolios lack sufficient exposure to the kinds of diversified alternatives strategies that can help to enhance the resilience and return potential of a balanced portfolio. By ensuring alternatives play a more significant role, we believe investors can better navigate the complexities of today’s market, particularly when markets are priced as they are.

The message is clear – in a world of increasing uncertainty, the opportunity set within the alpha-generating space is expanding, and diversified alternatives are more important than ever. As we stand at the intersection of technological innovation and economic uncertainty in a rapidly changing world, diversified alternatives can offer the flexibility needed to thrive, making them an essential component of any forward-thinking investment portfolio.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.