After a relatively strong period of performance in 2025, European equities stand well positioned to make further progress in 2026, benefiting from a global macroeconomic rebound, calmer trade relations, and large-scale strategic reforms, particularly in Germany. As Europe navigates what is turning into a transformative period, this could represent a tailwind for companies in the region in the years ahead. But what themes do we expect to dominate?

Europe’s trade prospects

Nearly half of Europe’s GDP is export oriented, meaning that the region’s economic prospects are inextricably linked to global trends, with the US and China as its largest trading partners. Any signs of economic impetus in these countries suggest a favourable environment for European exports.

Right now, we are seeing improving prospects for the US economy, driven by a mix of monetary easing, fiscal stimulus measures, and deregulation. With import tariff uncertainties receding into the background, the recent trade agreement between the US and Europe marks a positive milestone, potentially invigorating cross-border business activities, with the automobile sector a particular focus. Meanwhile, China is seeing consumer spending and inflation surprising on the upside. This could suggest a turning point in overall macroeconomic prospects so far marred by slow growth, rising unemployment and deflation.

European reforms as a catalyst for growth

At the European level, we expect a series of reforms and stimulus measures over the course of 2026 to lay the groundwork for future growth. Key initiatives include the potential relaxation of bank capital requirements, the securitisation market reform, and omnibus bills aimed at streamlining regulatory processes. These reforms, linked to former ECB President Mario Draghi’s report on EU competitiveness, are designed to enhance the region’s financial stability, prospects and investment appeal, fostering a more dynamic and resilient economic environment.

Germany, often referred to as Europe’s economic locomotive, has led reforms on the domestic side, building expectations for a period of robust growth. The German government has embarked on a path of fiscal stimulus and deregulation, which is expected to drive economic activity through 2026 and beyond. This development not only bolsters Germany’s domestic market but also has positive spill-over effects for European companies outside Germany that are positioned to deliver the goods and services needed.

Europe is home to a broad range of strong businesses

Banks and defence have been strong themes within the European equities market in 2025 and we see further prospects for both sectors in 2026. European banks would be key beneficiaries of reforms related to securitisation market reform and bank capital requirements, and a steeper yield curve environment has been a sustained driver of profitability. We still see the sector trading significantly cheaper than its own (chequered) history.

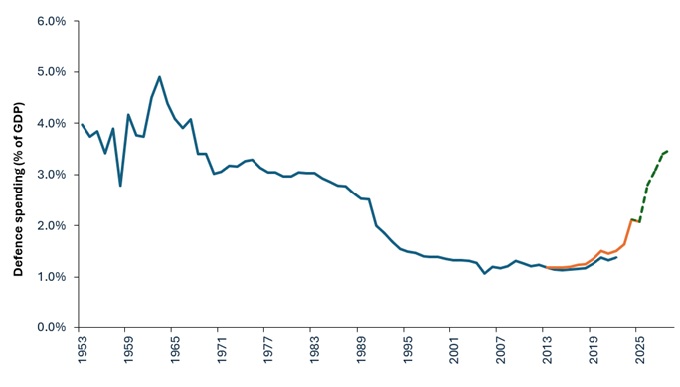

Similarly, despite a fairly exceptional rally for defence stocks in this cycle, the long-term prospects for the defence industry have been transformed by what is a generational shift in how Europe perceives the need for its own defence capabilities (Exhibit 1).

The path to enduring peace in Ukraine remains fragile and uncertain, leaving multiple outcomes on the table, in terms of the prospects for European and global equities. Structural support remains for the long-term prospects for European defence or related stocks, given the need for Europe to modernise and expand its capabilities, reducing reliance on the US. And there is a lot of ground to make up. Europe’s armies are woefully under-equipped and under-supplied. Rearmament efforts are likely to continue at the same or even accelerated speed given US retrenchment from Europe, and US President Trump’s view that European security problems are for Europe to solve on its own.

More broadly the longer term, the welcome prospect of reduced geopolitical risk opens the door to many sectors. Europe would be expected to take a leading role in the reconstruction process in Ukraine, with all the related industries that could participate.

Exhibit 1: Rearmament of the West

Source: NATO, SIPRI, UBS, at 9 July 2025. The blue line refers to SIPRI data, the black line is NATO data. Both use slightly different definitions. There is no guarantee that past trends will continue, or forecasts will be realised.

We also see momentum building across several other themes. An ever-accelerating investment into AI infrastructure has put the spotlight back on semiconductor equipment firms and data centre-exposed electrical equipment companies. More generally electrification and grid investment are shaping up as sustained structural growth stories. The start of a monetary easing cycle in the US also bodes well for those European companies with cyclical US exposures.

Keep in mind that risks remain

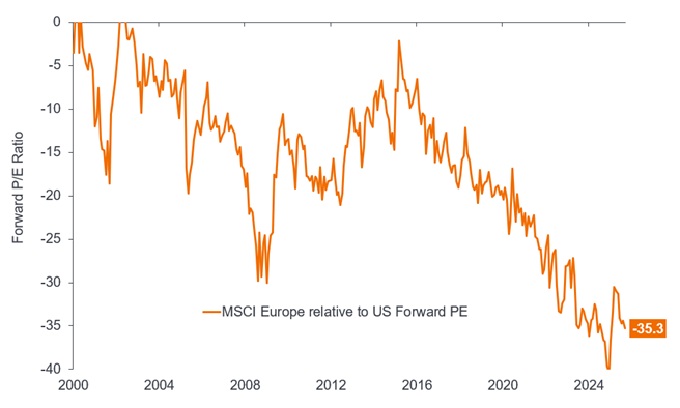

We do not believe that the prospect for European reforms is really factored into current valuations for stocks in the region, particularly on a relative basis versus the US (Exhibit 2). Should the momentum driving change get bogged down by political indecision and/or ponderous bureaucratic processes, there are still multiple pathways for European equities to make progress.

Exhibit 2: European stocks are priced at an historic discount relative to US equities

Source: Bloomberg consensus forecasts, Janus Henderson Investors Analysis, at 30 September 2025. Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

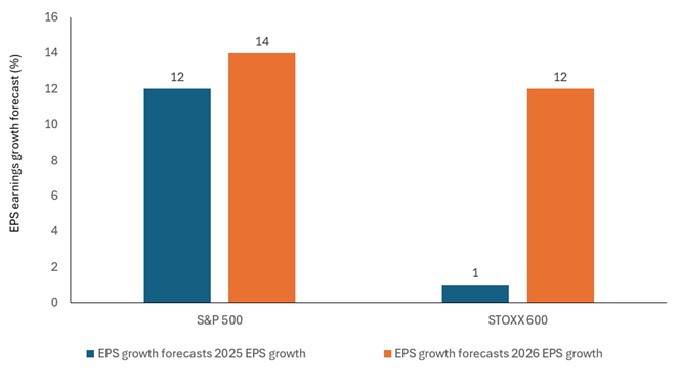

Optimism rooted in corporate earnings, rather than geopolitics

One factor that encapsulates our views on the prospects for European equities is the consensus on European corporate estimates, where we see a significant jump, year on year, between 2025 and 2026. The earnings figures for 2025 looked artificially poor because the strength of the euro has reduced the value of foreign earnings when converted back to euros. This has been a particular headwind for industrials, consumer discretionary and healthcare firms – areas we would expect to be typically more exposed to factors that affect exports. Should the expected uptick in earnings come through, this could represent a significant tailwind for valuations in Europe.

Exhibit 3: Earnings growth expectations have increased sharply for European companies

Source: Datastream, Bloomberg, BNP Paribas Exane estimates, as at 30 September 2025. Past performance does not predict future returns. There is no guarantee that past trends will continue, or forecasts will be realised.

Earnings per share (EPS): The bottom-line measure of a company’s profitability, defined as net income (profit after tax) divided by the number of outstanding shares.

Fiscal policy: Describes government policy relating to setting tax rates and spending levels. Fiscal austerity refers to raising taxes and/or cutting spending in an attempt to reduce government debt. Fiscal expansion (or ‘stimulus’) refers to an increase in government spending and/or a reduction in taxes.

Macroeconomics: The branch of economics that considers large-scale factors related to the economy, such as inflation, unemployment, or productivity.

Monetary policy: The policies of a central bank aimed at influencing the level of inflation and growth in an economy. Monetary policy tools include setting interest rates and controlling the supply of money. Monetary stimulus refers to a central bank increasing the supply of money and lowering borrowing costs. Monetary tightening refers to central bank activity aimed at curbing inflation and slowing down growth in the economy by raising interest rates and reducing the supply of money.

Securitisation: The process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities together which constitutes a market for buying or selling. The interest and principal payments from the assets are passed through to the purchasers of the securities.

S&P 500 Index: A stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the US.

STOXX 600 Index: A stock market index that represents a broad measure of the European equity market, with 600 components across 17 countries and 11 industries.

Tariff: A tax or duty imposed by a government on goods imported from other countries.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate. For equities, a common measure is the dividend yield, which divides recent dividend payments for each share by the share price. For a bond, this is calculated as the coupon payment divided by the current bond price.

Yield curve: A graph that plots the yields of similar quality bonds against their maturities, commonly used as an indicator of investors’ expectations about a country’s economic direction. In normal conditions, a normal/upward sloping yield curve is expected, whereas yields for shorter-maturity bonds are lower than yields for bonds with a longer maturity. The shape of the yield curve can vary significantly, depending on where investors expect yields to trend in future.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.