Bond markets are increasingly operating as two separate markets. Shorter-dated bonds (e.g. two years to maturity) remain tightly linked to near-term monetary policy, while longer-dated bonds (10 years and beyond) have decoupled from policy rates.

The macro backdrop explains part of this divide. Global growth in 2025 surprised on the upside, defying repeated recession calls. Despite sharp declines in sentiment following the April tariff announcements, consumers remained resilient and labour markets softened only marginally. Investment tied to artificial intelligence and the energy transition continued apace.

Against this backdrop, interest rate cuts that began in mid-2024 across developed markets largely petered out in 2025, reflecting stubbornly elevated inflation. The UK exemplified this challenge, with inflation averaging well above expectations through 2025.

Under normal conditions, rate cuts should translate into falling bond yields and rising bond prices. Yet this did not occur. The most striking anomaly was in the United States, where 10-year Treasury (US government bond) yields failed to decline during a rate-cutting cycle for the first time in data going back to the 1960s.

This resistance to falling long-dated yields points to structural forces. Prominent explanations include persistently high government borrowing, reduced demand from “price-insensitive” buyers such as central banks (who buy bonds to support policy decisions rather than for an investment return), and lingering inflation concerns. Together, these have weakened the traditional supply-demand balance that once anchored long-term government bonds.

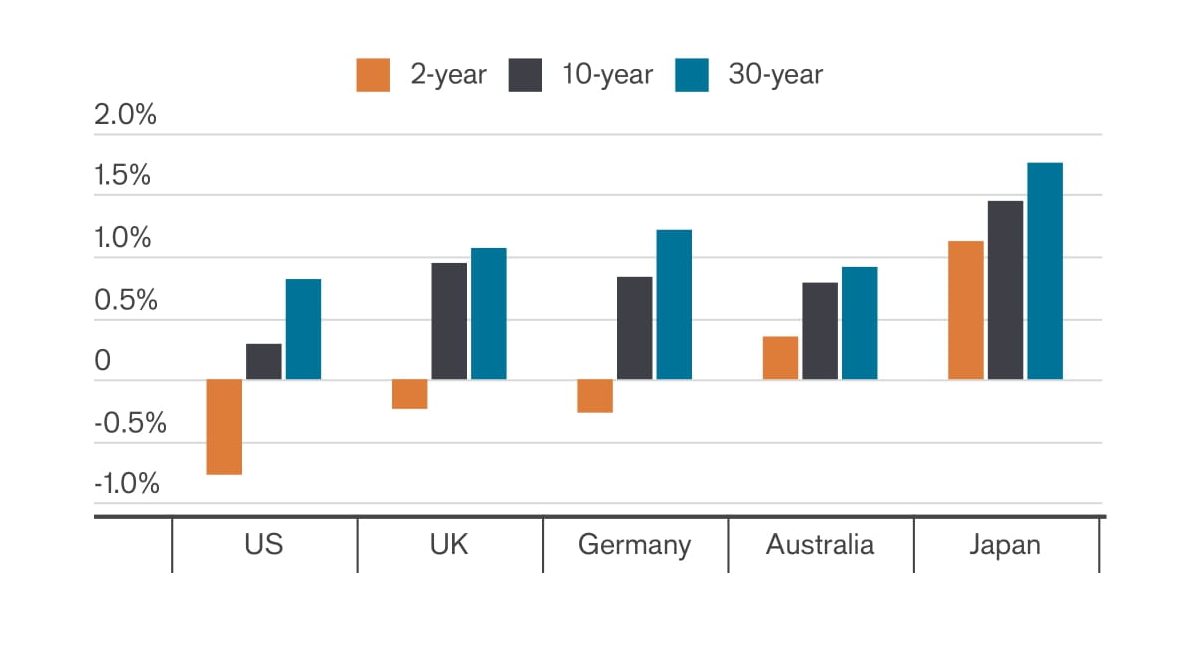

Source: Bloomberg, government bond yields for respective countries and maturities, 2-year, 10-year and 30-year bonds, difference between yield at 31 December 2023 and at 31 December 2025. Yields may vary over time and are not guaranteed.

A further shift has come from markets that historically acted as global yield anchors. Japan and Germany, long synonymous with low or negative yields, are transitioning to higher-yield regimes. In Japan, labour shortages and structural wage growth have ended decades of deflationary dynamics. In Europe, joint European Union debt issuance following Covid, Germany’s sizeable rise in government spending, and historically tight labour markets, have increased bond supply and put upward pressure on yields.

With these low-yield anchors drifting higher, supportive rate cuts have failed to pull long-dated global yields down. Instead, yields have remained range-bound. In fact, in late 2025, the market began to price in possible rate hikes in countries such as Australia and Canada.

Therefore, in a world of structurally higher bond supply, shifting demand dynamics and less dependable low-yield anchors, the bond market may increasingly act as two separate markets.

Inflation: The rate at which prices of goods and services are rising in the economy. Deflation is when prices fall.

Maturity: The maturity date of a bond is the date when the principal investment (and any final coupon) is paid to investors. Shorter-dated bonds generally mature within 5 years, medium-term bonds within 5 to 10 years, and longer-dated bonds after 10+ years

Structural: An economic condition arising when an industry or market changes how it functions or operates, typically with long-term implications.

Yield: The level of income on a security over a set period, typically expressed as a percentage rate.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

There is no guarantee that past trends will continue, or forecasts will be realised.

Marketing Communication.