Strong fundamentals, improving market dynamics, and rising investor demand for diversification position real estate for a re-rating in 2026.

Insights

Our latest thinking on the themes shaping today’s investment landscape. Explore timely updates, quarterly features and in-depth analysis straight from our experts.

Sydney’s office market is facing muted future supply and a flight-to-quality.

REITs present a compelling diversification opportunity amid economic uncertainty and potential interest rate shifts.

Reasons for a constructive outlook for European REITs.

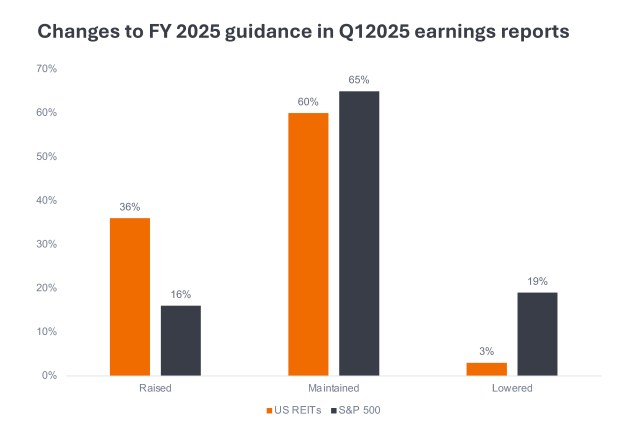

Listed REITs can offer lower volatility and better earnings visibility versus broader equities.

A research visit provides valuable insight into LA's real estate markets.

Key considerations for property equities investors amid the current market turmoil.

Residential REITs can offer attractive growth opportunities across a range of ‘living’ sub-sectors.

An update on the listed real estate sector amid market uncertainty.

The former Kai Tak airport redevelopment project reflects Hong Kong’s still weak residential sector.

Investment team's personal insights on being long-term investors in the listed real estate space.