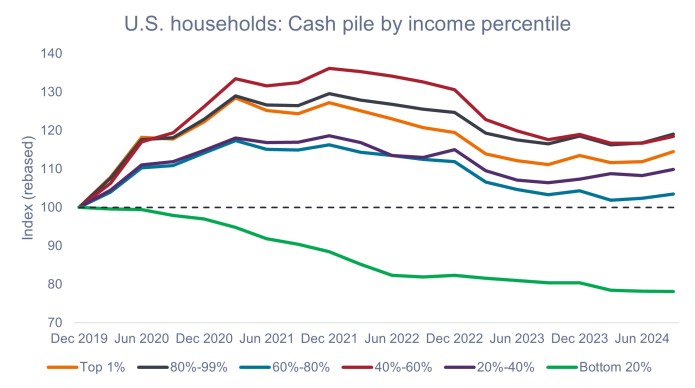

Source: JPM US Market Intelligence, Fed Z.1. The ‘consumer cash pile’ is defined as the combination of US households’ checkable deposits, savings deposits, and money market fund holdings. Index is adjusted for inflation using YE19 Consumer Price Index (CPI) as a base level.

In aggregate, the U.S. consumer – the bedrock of the U.S. economy – remains in good financial shape despite inflationary pressures and a softening labor market. Therefore, we believe the outlook for high-quality consumer credit and securitized fixed income remains upbeat. That said, as we witness a growing disparity in the financial strength of different market segments, it is important for investors to employ an active manager who may seek areas of strength and be selective about the types and quality of consumer credit they are exposed to.

– John Kerschner, Head of U.S. Securitized Products

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Securitized products, such as mortgage- and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.