The growth of private markets has raised questions about their impact on U.S. small-cap public stocks. Some worry that companies staying private longer reduces opportunities for small-cap investors.

The number of U.S. public listings has indeed fallen from roughly 6,500 25 years ago to about 3,000 today,1 partly because companies are now able to access substantial private capital earlier. Still, we believe concerns about private equity crowding out small-cap investors are often overstated and the opportunities to adapt are overlooked.

Recently overshadowed, but fundamentally healthy

Before addressing “staying private,” it’s important to put small-cap performance in context, because some concerns about the health of the small-cap market stem from recent underperformance relative to large caps.

Since the Russell 2000 Index was established in 1978 until about five years ago, small caps and large caps delivered remarkably similar returns: Both asset classes compounded at roughly 10% annually.

The recent split is what stands out. Over the past five years, small caps kept up solid performance at 9.6% annually, staying close to their long-term average. The anomaly was large caps surging to 15.6% returns annually.2 In large part, this came from significant multiple expansion in just a handful of mega-cap tech stocks, while small cap valuations actually contracted. Though large cap concentration may persist near-term, history suggests such extremes rarely last.

We see the small-cap market as fundamentally healthy. The disconnect between large caps and small caps reflects market sentiment rather than underlying business performance. In fact, investors may be surprised to learn that small-cap earnings growth has matched large-cap growth over the past 20 years.3

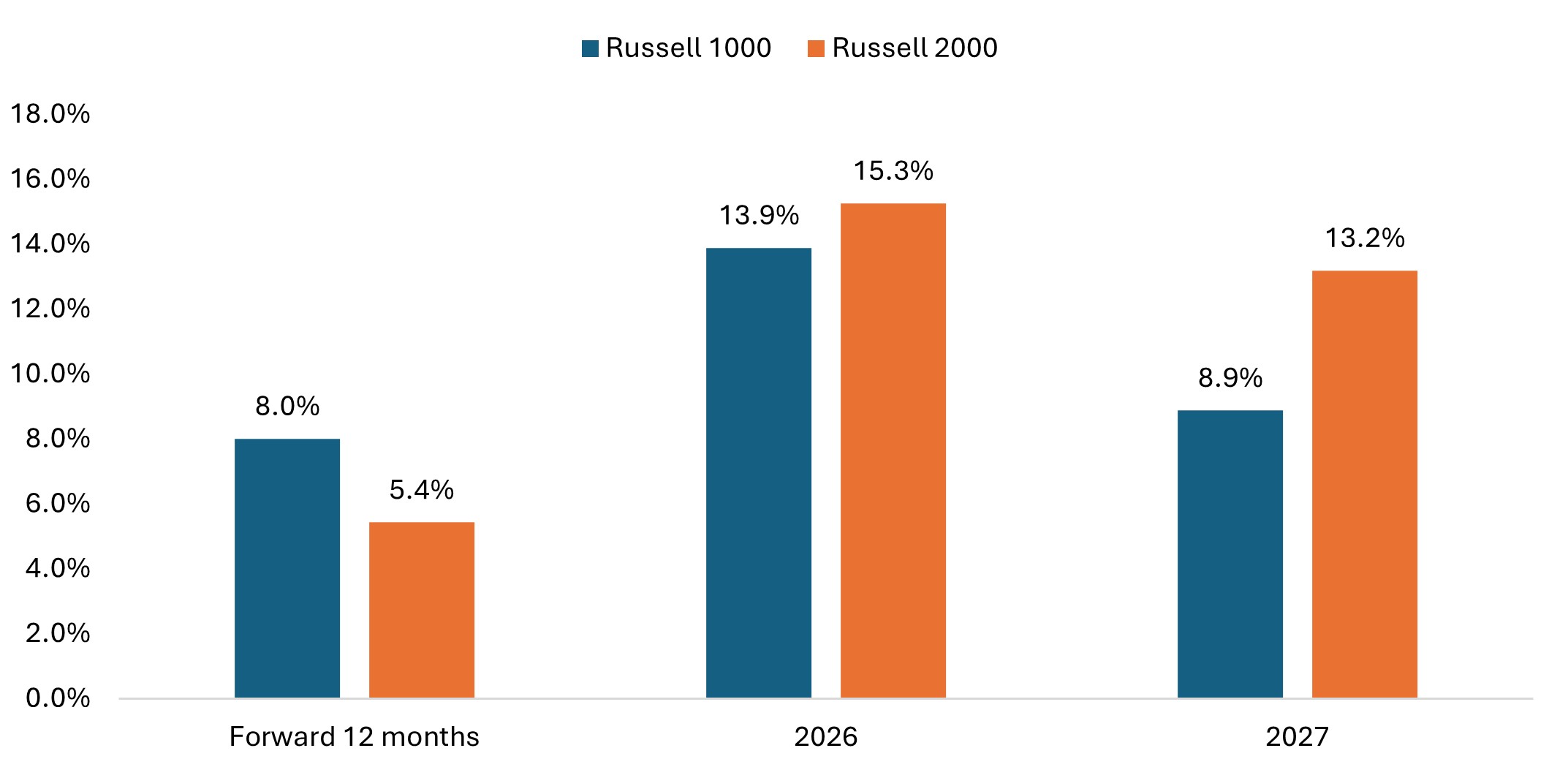

Today, relative valuations are attractive and the earnings recession weighing on smaller companies appears to be ending (Figure 1). Unlike large caps, small caps don’t need multiple expansion to deliver competitive returns – they simply need to establish earnings growth parity.

Figure 1: Russell 1000 vs. Russell 2000 EPS Growth Estimates

U.S. small cap earnings growth is projected to surpass large caps in 2026 and 2027.

Source: Bloomberg as at 10 July 2025. Adjusted EPS growth excluding negative earners. Past performance is no guarantee of future results. No forecasts can be guaranteed.

Private equity’s role: Nuanced, not dominant

Private equity plays a role in the decrease of the public small cap universe, but its impact is often oversimplified. The average private equity deal size is approximately $140-$180 million, placing most transactions in the micro-cap rather than small-cap public market range.

Regulations, especially post-Enron through the Sarbanes-Oxley Act, have contributed to fewer listings. But these rules also raised compliance standards that elevated remaining companies’ quality. It’s also worth noting that mergers and acquisitions (M&A) have played a big part in thinning the ranks of public companies.

In our view, quality and diversity matter more than quantity when building concentrated portfolios.

IPO recovery potential

Despite the recent impact, private market dynamics may be shifting. Many private equity investments made during the late 2010s to early 2020s were structured with significant low-cost leverage, with that debt typically coming due within five to seven years. As these loans mature, companies face decisions about their next steps.

During the low interest rate environment, private equity firms could sell portfolio companies to other private equity buyers at higher valuations, supported by increased leverage capacity. Today’s higher interest rate environment makes such transactions more challenging as debt costs have increased significantly.

That’s why going public could become a more attractive path for companies needing refinancing or private equity sponsors looking for an exit. We’re already seeing signs of life in the IPO market in 2025: Year-to-date IPOs as of June 25 are 83% higher than the same period in 2024.4 Potential deregulation could also make going public more appealing. A reopening IPO market typically benefits the entire small-cap asset class as quality companies tend to go public first and generate positive momentum across the space.

Even if some company IPOs continue to be delayed, the investable universe remains diverse, with ample opportunities for skilled managers.

Supporting the private-to-public bridge

When compelling companies approach public markets, two avenues exist to support their journey while securing better IPO allocations.

Cornerstone IPO positioning

Cornerstone IPO positioning allows larger institutional investors to commit capital before companies begin their traditional two-week roadshow process. This can help them secure larger allocations in quality deals by demonstrating their domain expertise and long-term investment approach to company management teams.

The arrangement benefits both parties: Companies gain credible institutional support with cornerstone investors’ names on the prospectus during the marketing process, while institutional investors secure meaningful positions without the disappointment of receiving miniscule allocations in popular “hot” deals.

A notable advantage of cornerstone positioning is the absence of lockup restrictions. Unlike traditional private investments, investors receive freely tradable stock with no holding requirements, though typically, managers will intend to hold these positions for multiple years given conviction in the underlying businesses.

Success in cornerstone positioning typically requires demonstrating relevant sector expertise through prior investments or research, giving companies confidence in the manager’s ability to be informed, long-term partners.

Private-to-public crossover investments

Investors may also selectively invest in late-stage private companies before they go public, allowing them to establish positions at valuations that are typically more attractive than what could be achieved post-IPO.

This approach serves dual purposes: Companies are supported through their journey to public listing, while investors gain early access to businesses they believe can compound returns over multiple years. This strategy helps investors build meaningful ownership stakes in quality companies at reasonable entry points while addressing the “staying private too long” concern.

Expanding the opportunity set

Cornerstone and crossover strategies provide additional avenues for expanding the investment opportunity set while ensuring access and meaningful positions in compelling growth stories from earlier stages.

A diverse public universe, combined with these proactive sourcing methods, means small cap investors can still uncover compelling growth and value creation.

1 Source: Center for Research in Security Prices (CRSP®), The University of Chicago Booth School of Business; Jefferies

2 Source: Bloomberg. From 29 December 1978 to 29 May 2020, Russell 2000 Index (small caps) annualized return was 9.8% and Russell 1000 Index (large caps) was 10.0%. From 29 May 2020 to 30 May 2025, Russell 2000 Index annualized return was 9.6% and Russell 1000 Index was 15.6%.

3 Furey Research Partners analysis as at 13 June 2025.

4 StockAnalysis.com as at 25 June 2025.

IMPORTANT INFORMATION

Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.

Smaller capitalization securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.