As fixed income investors consider building more efficient portfolios that are suited to their individual goals, we believe that combining certain complementary sectors may result in better risk-adjusted returns.

Corporate bonds are typically a key component of most fixed income strategies. But the corporate market is not necessarily a one-stop solution for all fixed income needs. In our view, pairing one’s existing corporate exposure with an allocation to asset-backed securities (ABS) may lead to improved investment outcomes, for the following reasons:

1. Pairing ABS with corporates may improve a portfolio’s overall credit quality

The average credit quality of the U.S. investment-grade (IG) corporate market has fallen over the last 25 years, resulting in a riskier index from a credit default standpoint.

As shown in Exhibit 1, the percentage of BBB rated bonds in the Bloomberg U.S. Corporate Bond Index more than doubled from January 2000 through April 2021, before tapering off to a (still high) 46% in August 2025.

In contrast, 98% of the Bloomberg U.S. ABS Index is rated A or higher, with 88% of securities in the index being AAA rated. The credit quality of the ABS index is also, in our view, much less likely to deteriorate due to the credit enhancements embedded in ABS structures.

We believe that pairing ABS with IG corporates may improve the overall credit quality of portfolios, as well as smooth out variations in credit quality within the corporate market.

Exhibit 1: Share of BBB rated bonds in the Bloomberg U.S. Corporate Bond Index (2000-2025)

The average credit quality of the IG corporate market is not what it once was.

Source: Bloomberg, as of 31 August 2025.

2. Pairing ABS with corporates may reduce interest rate sensitivity and volatility

IG corporates typically exhibit longer duration (coupled with more variability in duration) than ABS, as illustrated in Exhibit 2.

Longer-duration bonds are more sensitive to changes in interest rates – a characteristic that went largely unnoticed amid the zero-interest rate regime in the decade following the Global Financial Crisis. But more recently, and especially since 2022, interest rates, bond yields, and rate volatility have all risen – with the outcome being that bond investors have had to contend with higher portfolio volatility.

Corporate issuers can issue bonds of longer or shorter duration depending on the interest rate regime and their business needs. In comparison, the duration of the U.S. ABS index has historically been lower, and more predictable, due to the more stable duration profile of the underlying consumer loans.

We believe the addition of ABS to a portfolio may be a suitable antidote to the recent challenge of higher volatility within fixed income, as their shorter duration profile makes the sector less interest-rate sensitive.

Exhibit 2: Duration: IG corporates vs. ABS (2000-2025)

At the portfolio level, lower-duration ABS may help to moderate sensitivity to changes in interest rates.

Source: Bloomberg, as of 31 August 2025.

3. Pairing ABS with corporates may help to lower overall correlation to equities

One of fixed income’s primary portfolio functions is to dampen volatility when equity markets sell off. Therefore, an asset class’s correlation to equities is a key factor when constructing portfolios.

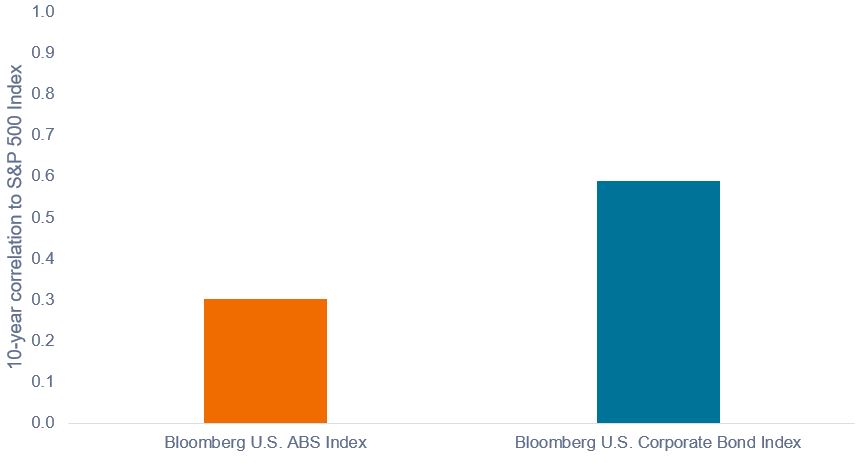

As shown in Exhibit 3, ABS have exhibited roughly half of the correlation to the S&P 500® Index versus IG corporates over the past 10 years.

Pairing ABS with IG corporates has historically led to improved portfolio diversification, with the result being that fixed income allocations could do a better job of dampening volatility when equities sell off.

Exhibit 3: Correlation to U.S. equities: IG corporates vs. ABS (2015-2025)

The addition of ABS to corporate bond allocations may reduce overall correlation to equities.

Source: Bloomberg, as of 31 August 2025. Monthly correlation for the 10-year period ended 31 August 2025.

In summary

In our view, there is a compelling case for the inclusion of ABS in fixed income portfolios. ABS cover a broad universe of subsectors that each have their own fundamental and technical characteristics, and which may perform uniquely through the market cycle.

Yet, there is no single benchmark that is fully representative of the ABS investment universe, while the Bloomberg U.S. and Global Aggregate Bond Indexes have de minimis exposure to the ABS market, at 0.5% and 0.2%, respectively.

Therefore, we believe investors considering an investment in ABS need to be intentional about their exposure to the asset class and seek out experienced active managers with a proven track record of investing in securitized markets.

The Bloomberg Global Aggregate Bond Index is a broad-based measure of the global investment grade fixed-rate debt markets.

The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg U.S. Asset-Backed Securities (ABS) Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. The index only includes ABS securities.

The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers.

Correlation measures the degree to which two variables move in relation to each other. A value of 1.0 implies movement in parallel, -1.0 implies movement in opposite directions, and 0.0 implies no relationship.

Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest).

Duration measures a bond price’s sensitivity to changes in interest rates. The longer a bond’s duration, the higher its sensitivity to changes in interest rates and vice versa.

Investment-grade securities: A security typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings when compared with bonds thought to have a higher risk of default, such as high-yield bonds.

The S&P 500® Index or Standard & Poor’s 500 Index is a market-capitalization weighted index of 500 leading publicly traded companies in the U.S.

A yield curve plots the yields (interest rate) of bonds with equal credit quality but differing maturity dates. Typically bonds with longer maturities have higher yields.

IMPORTANT INFORMATION

Actively managed portfolios may fail to produce the intended results. No investment strategy can ensure a profit or eliminate the risk of loss.

Diversification is a common investment strategy that entails buying different types of investments to reduce the risk of market volatility.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Securitized products, such as mortgage-backed securities and asset-backed securities, are more sensitive to interest rate changes, have extension and prepayment risk, and are subject to more credit, valuation and liquidity risk than other fixed-income securities.